It is a section from the Empire publication. To learn full editions, subscribe.

They are saying crypto quickly ages you. Look no additional for proof than the ETH chart.

Extra particularly, the ETH chart compared to Intel inventory. Their trajectories share an uncanny resemblance.

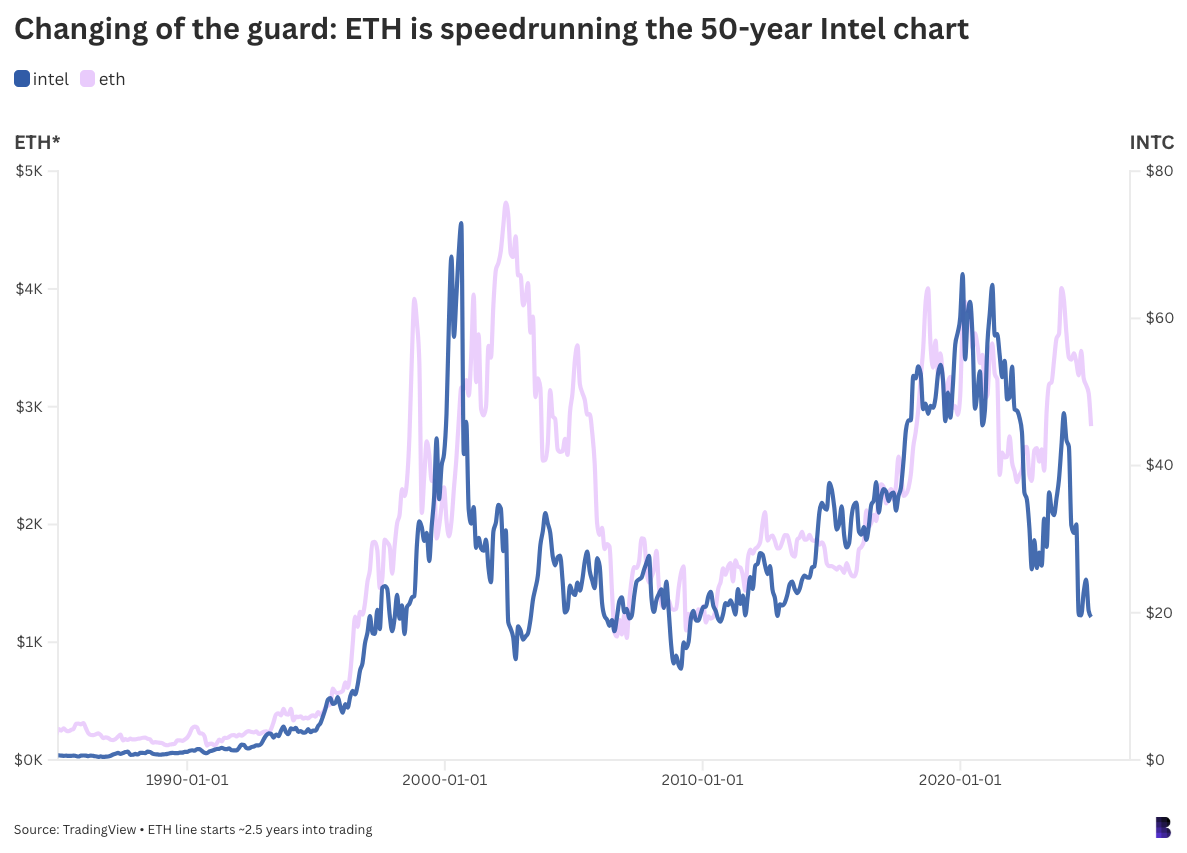

The chart under plots the worth of ETH in pink in opposition to Intel inventory in blue however with caveats:

- INTC is ready over the previous 50 years (it went public in 1971) on weekly intervals.

- ETH is ready over the previous seven years on every day intervals.

- ETH is superior by round two and a half years — so it begins in Jan 2018 fairly than August 2015.

As you may see, ETH has performed virtually precisely what Intel inventory has achieved, simply seven instances as shortly.

It’s not all dangerous information: Intel inventory has just lately tanked more durable than ETH

Evaluating cryptocurrencies and shares doesn’t make a number of sense. Ethereum shouldn’t be a enterprise in the identical manner that Intel is.

Ethereum is a decentralized community that sells blockspace to apps and different protocols that service customers not directly — removed from a chipmaker with factories, workers, board members and CEOs.

Nonetheless, I can’t assist however draw similarities between Ethereum and Intel, not less than when it comes to narrative arcs.

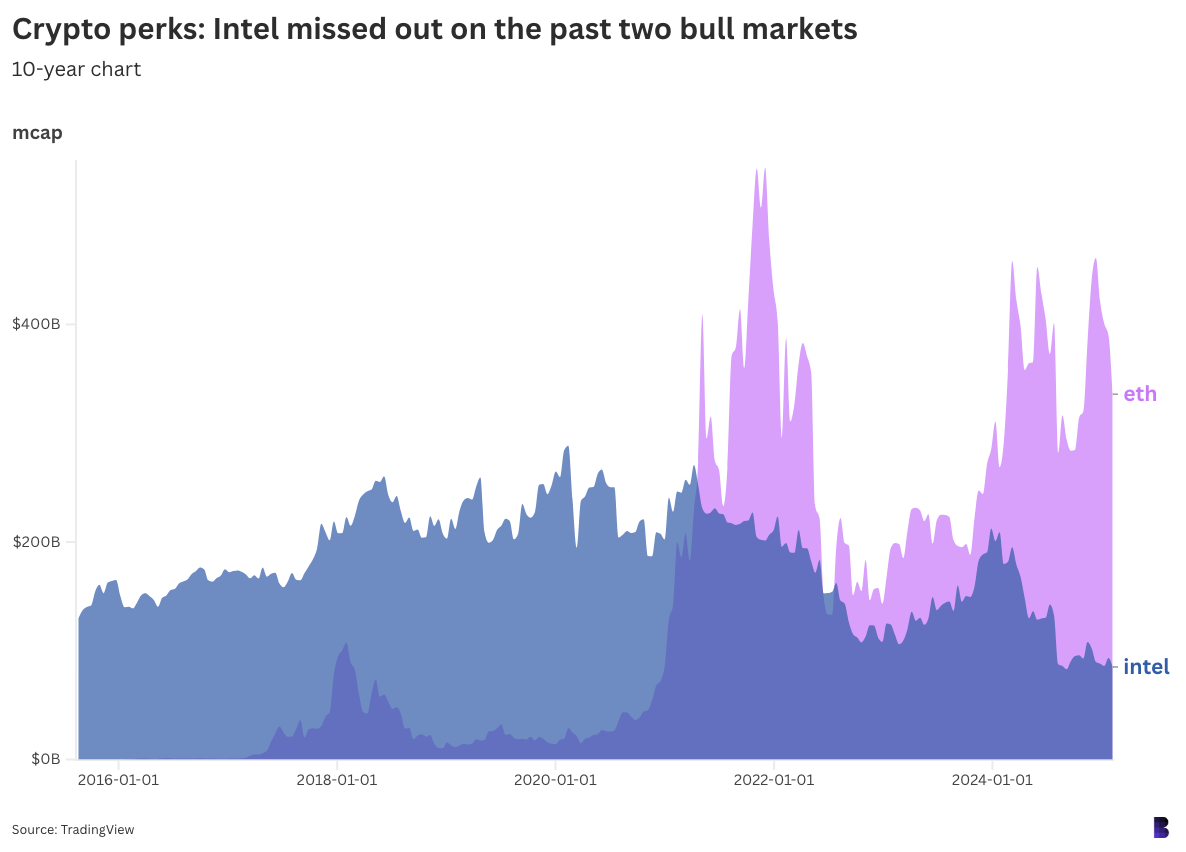

ETH’s market cap is now about 4 instances that of Intel inventory

High mind Vitalik Buterin and the non-profit Ethereum Basis (EF) he leads are nonetheless underneath hearth for supposedly misaligning themselves with the fashionable crypto neighborhood — prioritizing infrastructure over thrilling new apps that correctly accrue worth to ETH.

That disconnect has contributed to massively elevated market and mindshare for rival Solana and a ETH/BTC ratio at four-year lows.

Intel’s board in the meantime ousted its CEO Pat Gelsinger in December over considerations that he’d didn’t capitalize on the AI growth and will now not stage a comeback in opposition to Nvidia.

Intel had lengthy been probably the most worthwhile US chipmaker till Nvidia flipped its inventory in mid-2020. Many tip SOL to doubtlessly flip ETH someplace down the road.

If the eerie correlation with Intel inventory persists (and that’s a giant if), maybe it may occur sooner fairly than later.