Ethereum (ETH) is giving buyers a critical case of whiplash. After a 13.40% drop previously week, and with the buying and selling quantity within the final 24 hours standing at $17.64 billion, the market is clearly on edge.

Analysts are watching value patterns, technical indicators, and liquidation developments to determine Ethereum’s subsequent potential transfer. By the way in which, ETH trades at $1,893.17 as of press time.

Combined Alerts: Falling Wedge vs. Bearish Outlook

In accordance with Daan Crypto Trades, Ethereum has been consolidating following a considerable market downturn. He factors to a falling wedge sample as a attainable signal of a development reversal.

This technical construction is often thought-about bullish, suggesting that if ETH can break above the resistance zone, a value restoration could possibly be imminent. For this to occur, ETH should break and maintain above a key resistance zone earlier than even fascinated by a transfer in the direction of the $2,000+ area.

$ETH Has been consolidating for the reason that massive dump.

It has shaped this falling wedge sample which could possibly be an honest construction for an area development reversal.

However for that to happen I would need to see the breakout and maintain above the white zone. If it may well do this, we are able to begin searching for… pic.twitter.com/cbDokpEv0t

— Daan Crypto Trades (@DaanCrypto) March 14, 2025

The ETH/BTC ratio stays close to multi-year lows, regardless of displaying slight resilience. This bounce alone isn’t robust sufficient to substantiate a development reversal. Sustained energy and a break of key resistance ranges are essential for a major shift in momentum.

Associated: Ethereum Retraces to $1612.81 Help After Quick-Lived Spike

Conflicting Views: $800 on the Desk?

Including to the uncertainty, Ali Martinez affords a bearish perspective, highlighting that Ethereum is breaking out, but when momentum falters, ETH might see a transfer down towards $800.

#Ethereum $ETH is breaking out, and if momentum holds, it could possibly be on monitor for a transfer towards $800! pic.twitter.com/rCtDDAKq8r

— Ali (@ali_charts) March 13, 2025

Leverage and Liquidations: A Recipe for Volatility

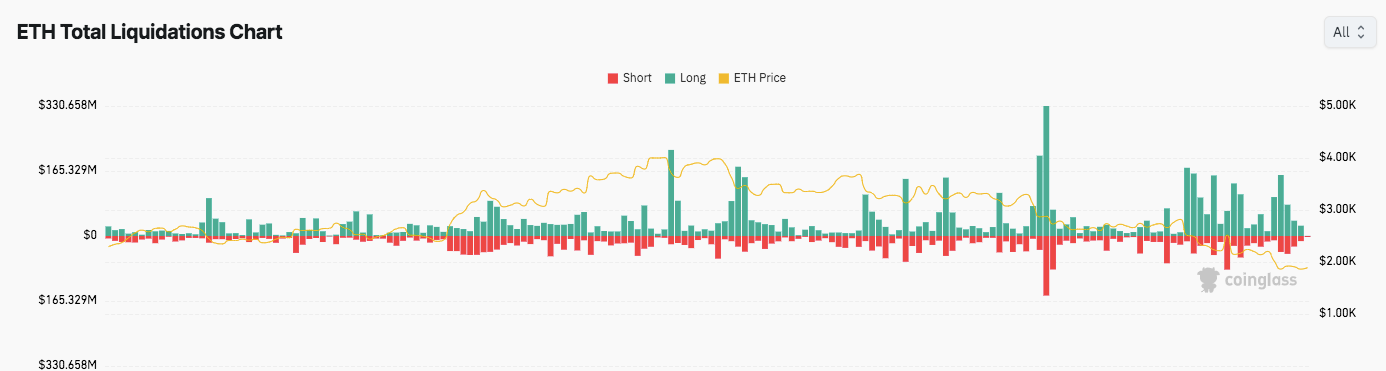

The Ethereum Whole Liquidations Chart highlights the impression of leverage buying and selling on value actions. Vital liquidation spikes happen round essential value zones between $2,000 and $3,000. When ETH costs surge, lengthy liquidations enhance, whereas value declines set off brief liquidations.

Supply: Coinglass

The best liquidation ranges surpass $330 million, revealing aggressive leveraged positions getting worn out. A big lengthy liquidation spike coincided with a pointy value drop, reinforcing the high-risk nature of leveraged buying and selling. In different phrases, excessive leverage can result in huge losses – quick.

Technical Indicators: RSI and MACD Evaluation

ETH/USD every day value chart, Supply: TradingView

From a technical standpoint, ETH’s Relative Power Index (RSI) is round 33.29, nearing oversold territory. An RSI under 30 sometimes alerts that an asset is undervalued, probably setting the stage for a value rebound.

Associated: Ethereum Mining Different Ravencoin Surges Nearly 70% In 1 Week

Nevertheless, the MACD stays destructive, with each the MACD line and sign line under zero. This confirms bearish momentum, however a crossover might point out a development reversal. So, the RSI hints at a attainable bounce, however the MACD continues to be flashing warning indicators.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.