Ethereum has just lately skilled a surge in shopping for exercise, discovering strong assist on the important $3.5K degree, triggering a bullish rebound.

Regardless of this restoration, the $4K resistance stays a major barrier that ETH consumers intention to beat within the mid-term.

Technical Evaluation

By Shayan

The Day by day Chart

Ethereum’s worth motion has been characterised by a notable rebound after encountering assist on the decisive $3.5K degree. This area served as a pivotal accumulation zone, fostering elevated shopping for strain and a subsequent upward surge. As the value climbs, the $4K resistance emerges as a important psychological and technical barrier, requiring a decisive breakout to determine a sustained upward trajectory.

Presently, Ethereum is consolidating inside the $3.5K-$4K vary, indicating a possible breakout in both path. A profitable breach of the $4K threshold may set the stage for a contemporary rally and affirm bullish sentiment. Conversely, a rejection at this degree could result in additional consolidation or retracement inside the present vary.

The 4-Hour Chart

On the decrease timeframe, Ethereum’s decline discovered strong assist inside the important thing 0.5 ($3.2K)–0.618 ($3K) Fibonacci retracement ranges. This assist zone attracted substantial shopping for curiosity, halting the downtrend and sparking a bullish restoration.

The next accumulation part has transitioned right into a bullish spike, with Ethereum now eyeing the important $4K resistance. This degree, coinciding with a earlier important swing excessive, is predicted to be a robust promoting strain zone.

Ethereum’s worth motion on the $4K degree will decide its future trajectory. A profitable breakout above this resistance may result in a sturdy rally, whereas a failure may end in extended consolidation or a possible retest of decrease assist ranges close to $3.5K.

Onchain Evaluation

By Shayan

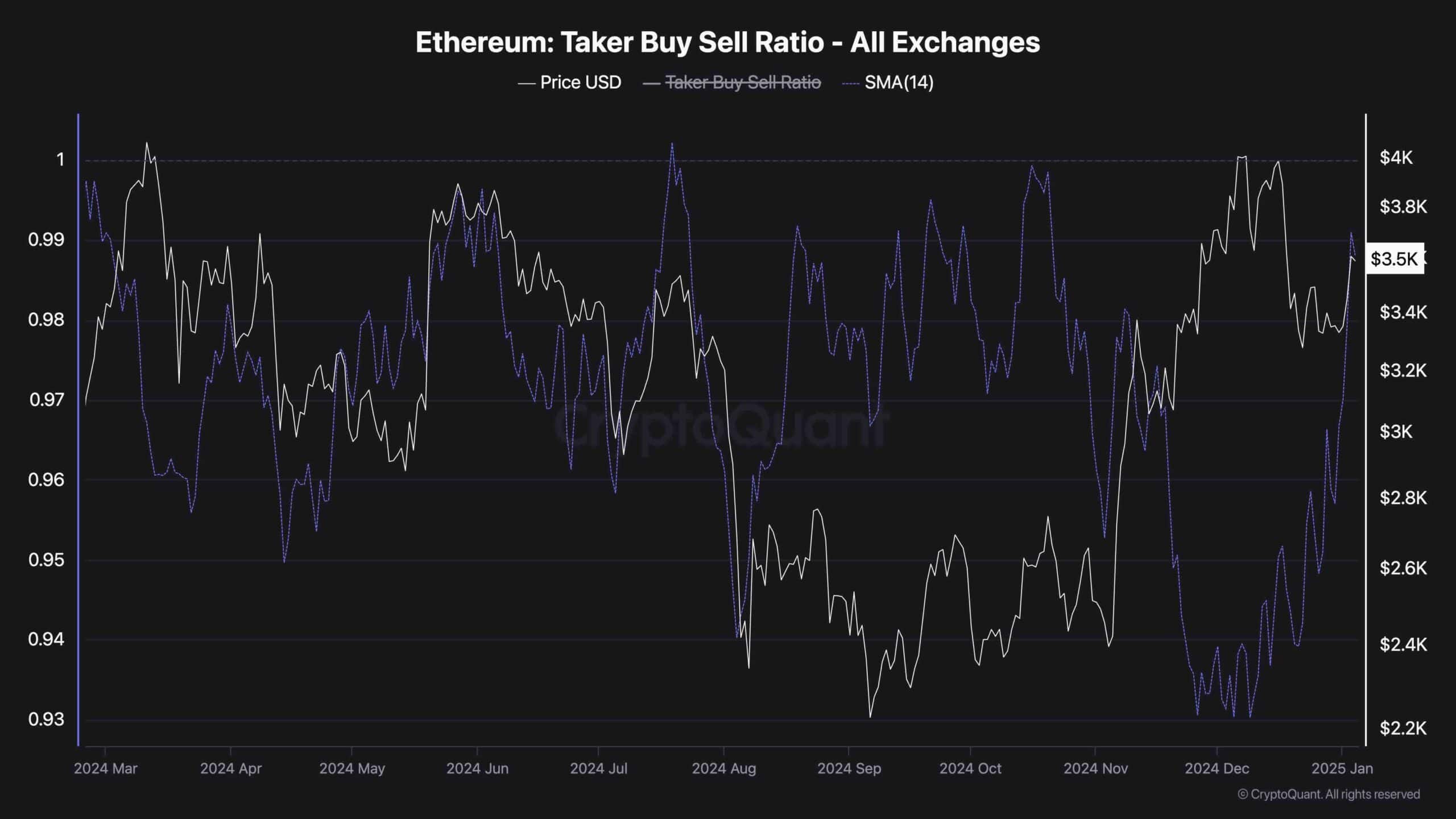

The Taker Purchase Promote Ratio, a pivotal metric for assessing sentiment within the futures market, offers insights into whether or not consumers or sellers are extra aggressive in executing market orders. Following Ethereum’s bullish rebound close to the $3K assist, this metric has exhibited a notable uptick, indicating a surge in market purchase orders inside the futures market.

This development means that futures market individuals are more and more optimistic about Ethereum’s short-term worth trajectory, anticipating the asset to push towards the $4K resistance.

Takers’ Purchase/Promote Ratio exceeding 1 means consumers are overwhelmingly dominant, usually aligning with the onset of a bullish development. The present knowledge underscores this sentiment shift, reflecting heightened confidence amongst merchants and an expectation of continued upward momentum.