Ethereum skilled a surge this week, briefly breaking above a key resistance area. Nonetheless, it lacked adequate momentum, showing to be a false breakout.

If ETH faces a extra profound rejection at present ranges, decrease costs might observe.

Technical Evaluation

By Shayan

The Day by day Chart

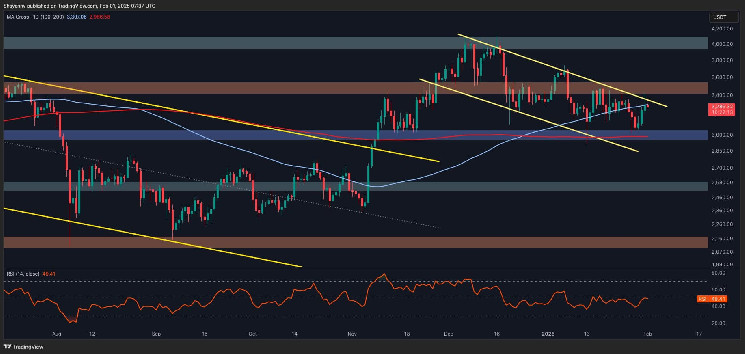

Ethereum noticed a powerful push from patrons on the $3K assist vary, driving the worth barely above a considerable resistance area. This key area contains:

- The 100-day transferring common at $3.3K

- The bullish flag’s higher boundary at $3.4K

Regardless of clearing these ranges, ETH encountered vital promoting strain at $3.5K, highlighting inadequate shopping for energy. This false breakout raises issues a few potential rejection.

Persevering with the bullish pattern will probably be potential if the asset efficiently breaks above these key thresholds and in the end reclaims the $3.5K juncture. In any other case, a rejection might result in heightened volatility and a possible value drop.

The 4-Hour Chart

On the decrease timeframe, ETH gained momentum after bouncing from the 0.5-0.618 Fibonacci retracement zone, efficiently breaking above a descending wedge sample. Such a breakout typically indicators a possible bullish continuation, shifting sentiment in favor of patrons.

Nonetheless, upon reaching the essential $3,5K resistance, Ethereum encountered vital promoting strain, triggering a retracement towards the beforehand damaged trendline of the wedge.

The upcoming value motion will probably be essential; if Ethereum finds assist at this trendline and completes a pullback, the bullish construction might stay intact, main to a different push towards $3.5K. Conversely, if demand stays weak and patrons fail to step in, the market might face a deeper correction, probably concentrating on the $3K assist degree once more.

Onchain Evaluation

By Shayan

The Binance liquidation heatmap provides worthwhile insights into areas the place substantial liquidation occasions are more likely to happen. As liquidity tends to behave as a value magnet, these ranges typically turn into focal factors for market actions, with merchants looking for to capitalize on liquidity sweeps.

Latest market consolidation has resulted within the formation of a major cluster of liquidation ranges simply above the important thing $3.5K resistance. These ranges correspond to short-position liquidation ranges, making them a gorgeous goal for bulls and institutional patrons. Given this setup, Ethereum’s value could possibly be drawn towards this liquidity pocket, rising the likelihood of a breakout above $3.5K within the mid-term.

Regardless of the present lack of robust bullish momentum, the $3.5K degree stays an important battleground. A decisive transfer above this resistance to set off brief liquidations might act as a catalyst for additional upside, probably propelling Ethereum towards the psychological $4K mark within the coming classes.