The Ethereum (ETH) market has skilled some current good fortunes rising by over 5% previously 24 hours. Regardless of this worth acquire, the distinguished altcoin stays in a downtrend as indicated by its 11.17% loss previously week. Nevertheless, distinguished analytics platform Glassnode has found an essential worth degree that might supply some short-term help.

Traders Increase Accumulation By 300,000 ETH At This Worth Area – What May It Imply?

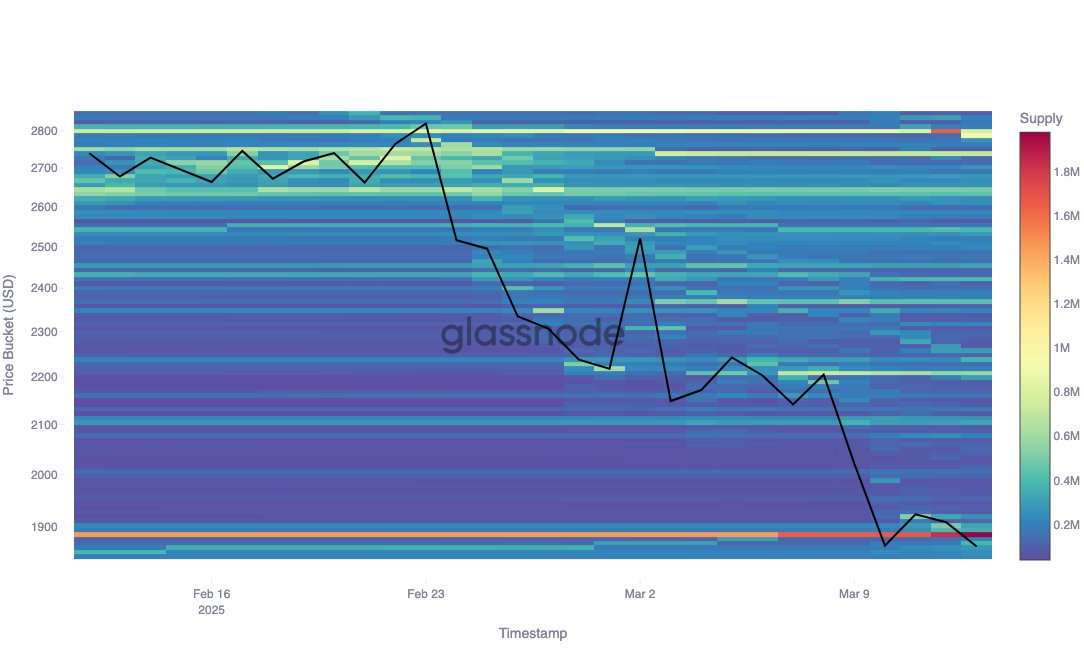

In an X publish on March 14, Glassnode offered an intriguing evaluation of the ETH market highlighting a possible sturdy help degree. Based mostly on the Value Foundation Distribution (CBD) metric, these analysts consider ETH is more likely to hit a serious help zone on the $1,886 worth degree within the case of an additional worth decline.

Within the crypto market, CBD represents an important on-chain metric that tracks the worth ranges at which tokens had been final offered or purchased. When a big variety of cash is acquired inside a particular worth vary, that zone usually serves as a help or resistance degree.

In response to Glassnode, Ethereum’s CBD information exhibits that buyers’ provide at $1,886 has grown from 1.6 million ETH to 1.9 million ETH indicating the acquisition of an extra 300,000 ETH when worth final reached this degree. This growth postulates that a good portion of buyers view $1,886 as an important worth level and are more likely to enhance their holdings on this area to forestall any additional decline thus making a viable help zone.

Glassnode notes that this postulation aligns with insights from its customized capitulation metric design to seize worth capitulation occasions leveraging the usage of weighted promote volumes and non-linear financial ache skilled by buyers. Nevertheless, it’s value noting that the $1,886 worth degree can solely supply short-term help suggesting a possible worth capitulation within the presence of overwhelming promoting stress.

Ethereum Worth Overview

On the time of writing, Ethereum trades at $1,924 following a 5% acquire on the final day as beforehand acknowledged. In the meantime, the market’s day by day buying and selling quantity is down by 29.29% and valued at $12.91 billion. Apparently, the Relative Power Index metric suggests Ethereum may quickly enter the oversold area and doubtlessly expertise a worth reversal.

Nevertheless, ETH bulls are confronted with a number of resistance zones at $2,249, $2,539, and $2,829 if they’re to drag off any important rebound and halt the present downtrend. Alternatively, any decisive worth fall under $1,886 may result in decrease ranges Corresponding to $1,650 and $1,132.

Featured picture from iStock, chart from Tradingview