Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is exhibiting indicators of a possible value decline after latest bearish value motion. Along with the worth motion, whales and trade specialists appear to be shedding curiosity within the altcoin, as revealed by the on-chain analytics corporations IntoTheBlock and CryptoQuant.

Will ETH Worth Decline?

Lately, ETH skilled a value surge of over 15% and hit the $4,100 mark for the primary time since March 2024, the place it confronted promoting stress and a notable value decline. Traditionally, ETH has reached this stage 5 occasions, and every time, it has encountered a value decline and important promoting stress.

Ethereum (ETH) Rising Trade Reserve

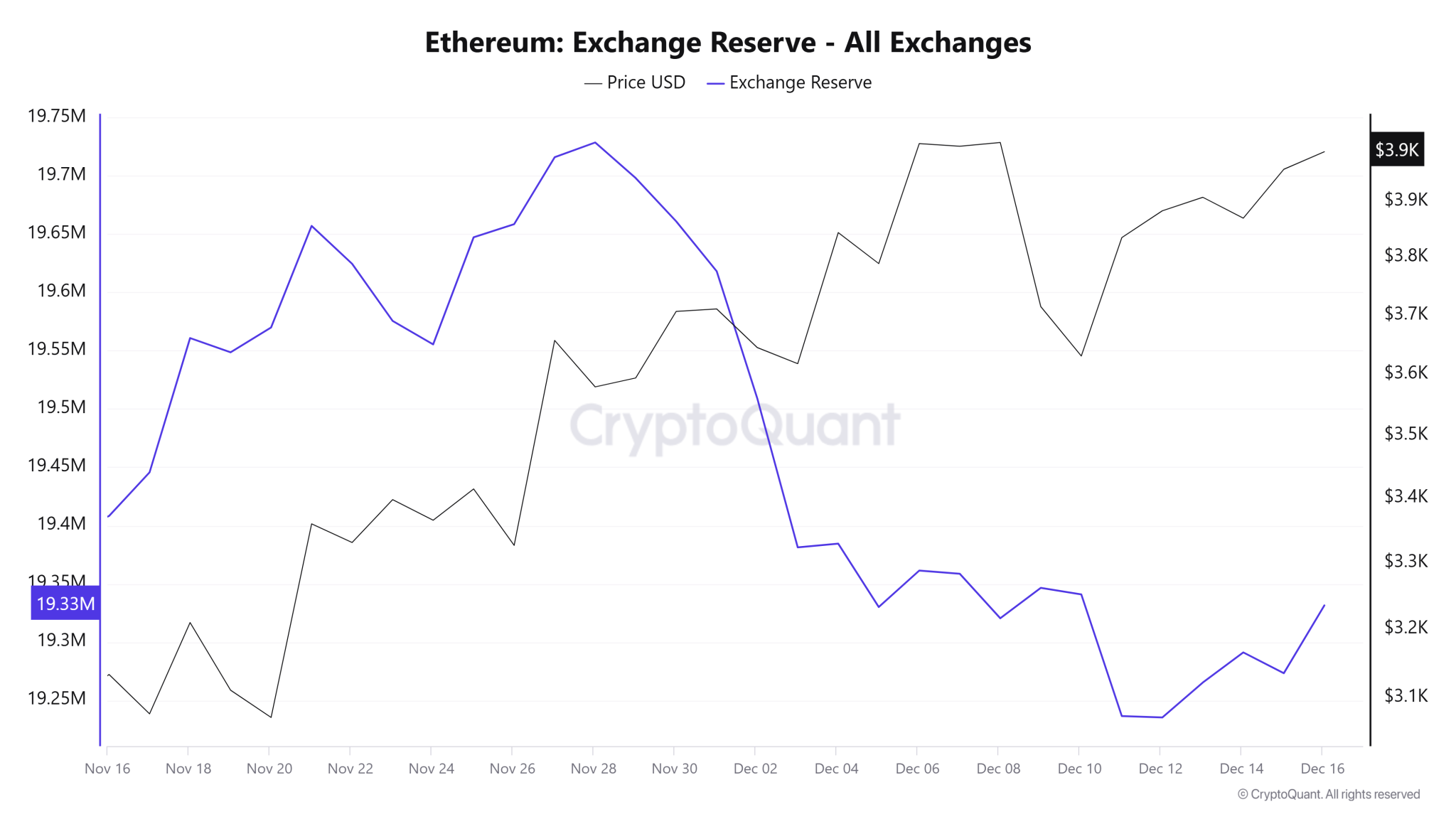

This time, taking a look at previous developments whales and long-term holders seem to proceed depositing their ETH to exchanges, as revealed by CryptoQuant’s ETH trade reserve metrics.

Knowledge exhibits that trade reserves have elevated by practically 100k ETH price $400 million which may sign elevated promoting stress as the worth nears a six-month excessive.

Supply: CryptoQuant

Rising Unstaking Exercise

Along with the rising trade reserves, whales have begun withdrawing tokens from staking, suggesting they’re progressively taking earnings because of the latest value surge or indicating a lack of curiosity in holding ETH long-term.

That is evidenced by the latest exercise of Justin Solar, the founding father of Tron. On December 16, 2024, the whale transaction tracker Spotonchain shared a put up on X (previously Twitter) stating that Solar’s linked pockets deal with requested to withdraw 52,905 ETH, price $209 million, from the staking protocol Lido Finance.

Ethereum (ETH) Technical Evaluation and Key Ranges

In line with skilled technical evaluation, ETH seems to be forming a bearish double-top value motion sample on the sturdy resistance stage of $4,100. Along with the double-top sample, ETH’s Relative Power Index (RSI) is falling, indicating a bearish divergence, which additional suggests a value decline and elevated promoting stress.

Supply: Buying and selling View

Primarily based on the latest value motion, there’s a sturdy chance that ETH may decline by 12% to achieve the $3,500 stage sooner or later.

Present Worth Decline

At press time, ETH is buying and selling close to the $3,970 stage and has skilled a modest value decline of 0.80% prior to now 24 hours. Throughout the identical interval, its buying and selling quantity has soared by 60%, indicating heightened participation from crypto fanatics amid the latest value surge.