Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is poised for enormous upside momentum as an knowledgeable hints at a purchase sign for the altcoin. On February 11, 2025, a outstanding crypto knowledgeable made a publish on X (beforehand Twitter), stating that ETH seems bullish. They additional famous that the TD Sequential indicator flashes a purchase sign on each day by day and weekly time frames.

Based mostly on current value motion and historic patterns, if ETH holds above the breakout space, there’s a robust risk it might soar by 10% to succeed in the $3,000 stage within the close to future.

This shift in sentiment and up to date breakout occurred after the general cryptocurrency market started experiencing upside momentum, attracting vital consideration from merchants and traders.

Ether Bullish On-Chain Metrics

In line with the on-chain analytics agency Coinglass, ETH open curiosity (OI) has jumped by 6.50%, indicating rising participation and the formation of recent positions, which helps a bullish outlook. Nonetheless, Coinglass information additionally reveals that intraday merchants are at present betting strongly on lengthy positions.

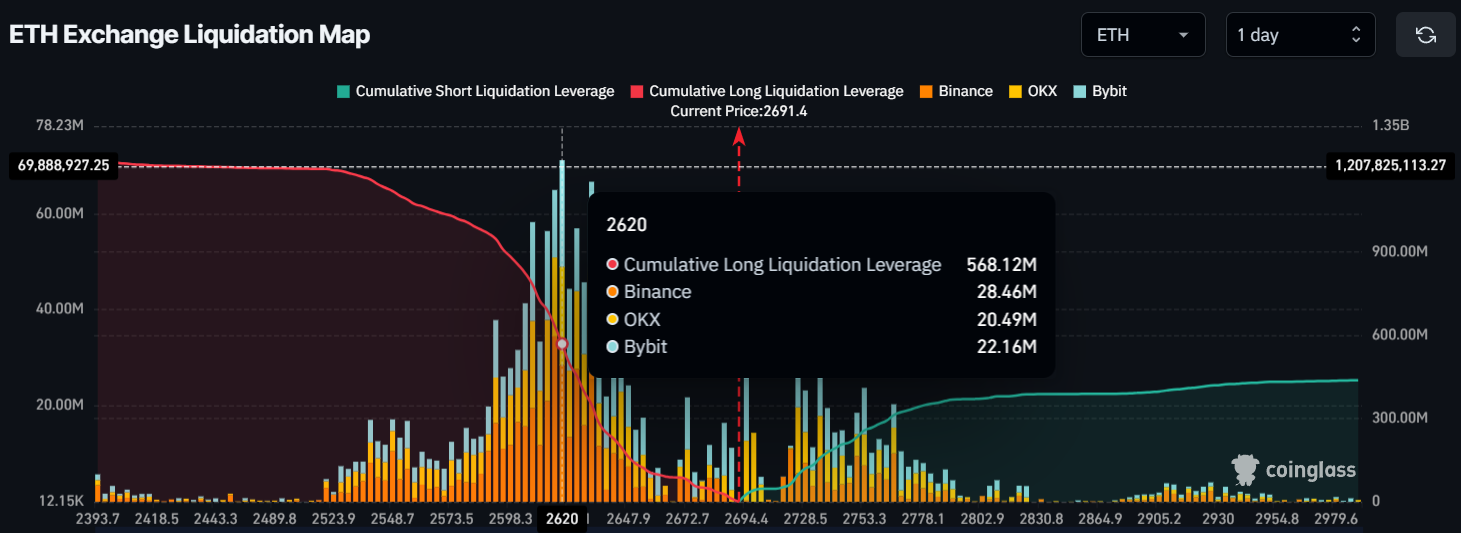

At press time, the key liquidation ranges are close to $2,620 on the decrease facet and $2,725 on the higher facet, with merchants being over-leveraged at these ranges.

If market sentiment stays unchanged and the value rises to the $2,725 stage, almost $100 million price of quick positions can be liquidated. Conversely, if sentiment shifts and the value drops to the $2,620 stage, almost $570 million price of lengthy positions can be liquidated.

This liquidation information reveals that merchants are strongly betting on the lengthy facet, at present holding greater than 5 occasions the worth in lengthy positions in comparison with quick positions.

Ethereum (ETH) Present Outlook

With rising curiosity and bullish value motion, Ether is at present buying and selling close to the $2,685 stage, having surged over 4% prior to now 24 hours. Nonetheless, throughout the identical interval, its buying and selling quantity has elevated by 5%, indicating a modest rise in participation from merchants and traders in comparison with the day past.