Main altcoin Ethereum has confronted a collection of headwinds over the previous few days. With heightened market volatility and important liquidations, ETH stays underneath bearish strain.

Nevertheless, a bullish divergence has emerged on its day by day chart, suggesting that the coin is likely to be poised for a rebound and a potential rally again above $3,000.

Ethereum Merchants Wager on the Upside as Shopping for Stress Will increase

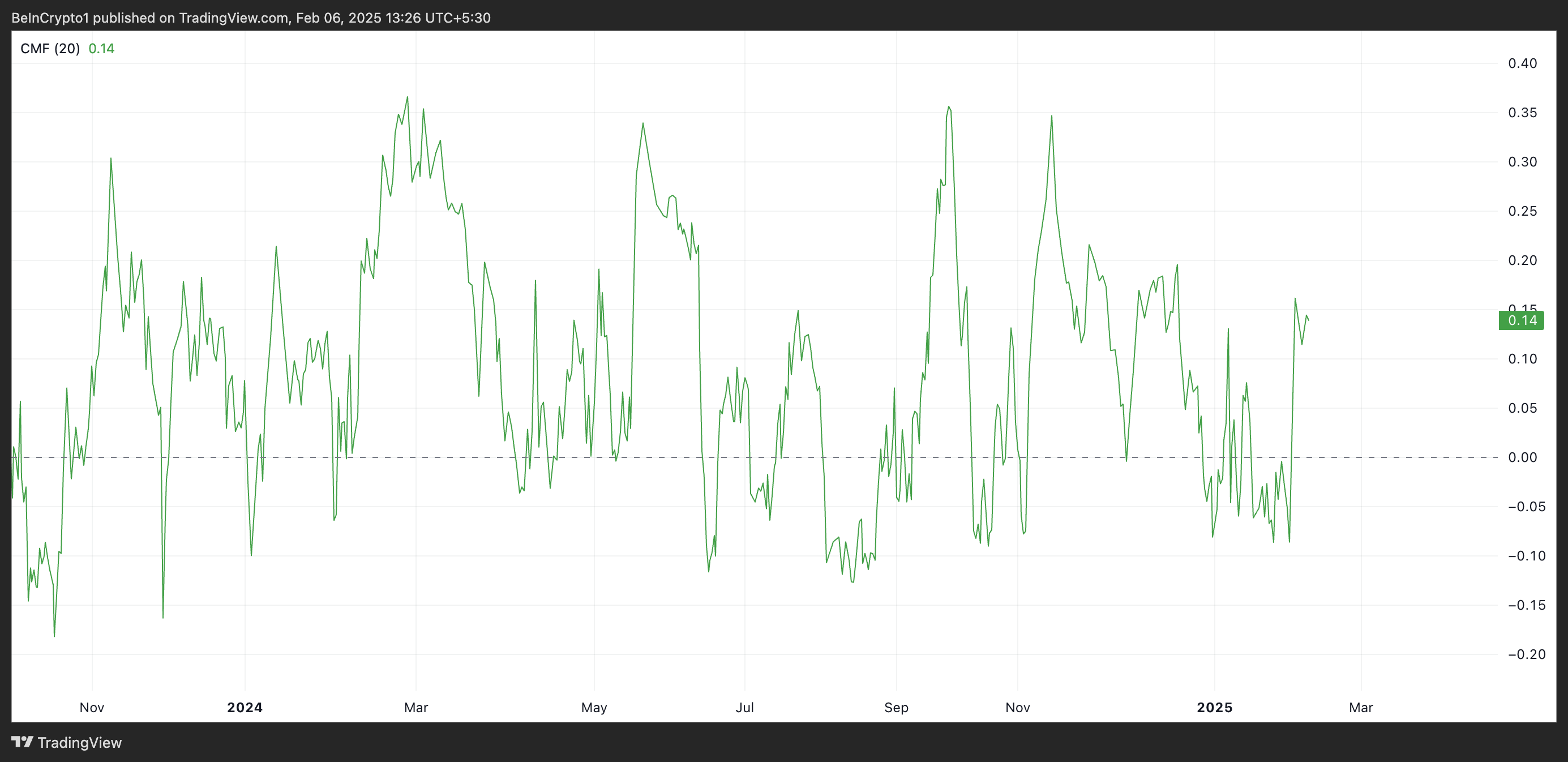

BeInCrypto’s evaluation of the ETH/USD one-day chart reveals that regardless of ETH’s worth decline up to now few days, its Chaikin Cash Circulation (CMF) has maintained an upward development, forming a bullish divergence. At press time, ETH’s CMF rests above the zero line at 0.14.

ETH CMF. Supply: TradingView

This indicator measures the energy of shopping for and promoting strain by analyzing worth and quantity over a particular interval. When CMF rises whereas an asset’s worth declines, it signifies that purchasing strain is growing regardless of the downtrend.

This divergence signifies that ETH merchants are accumulating the asset at decrease costs, probably signaling a reversal. A sustained improve within the ETH’s CMF hints at a worth rebound as demand outweighs promoting strain.

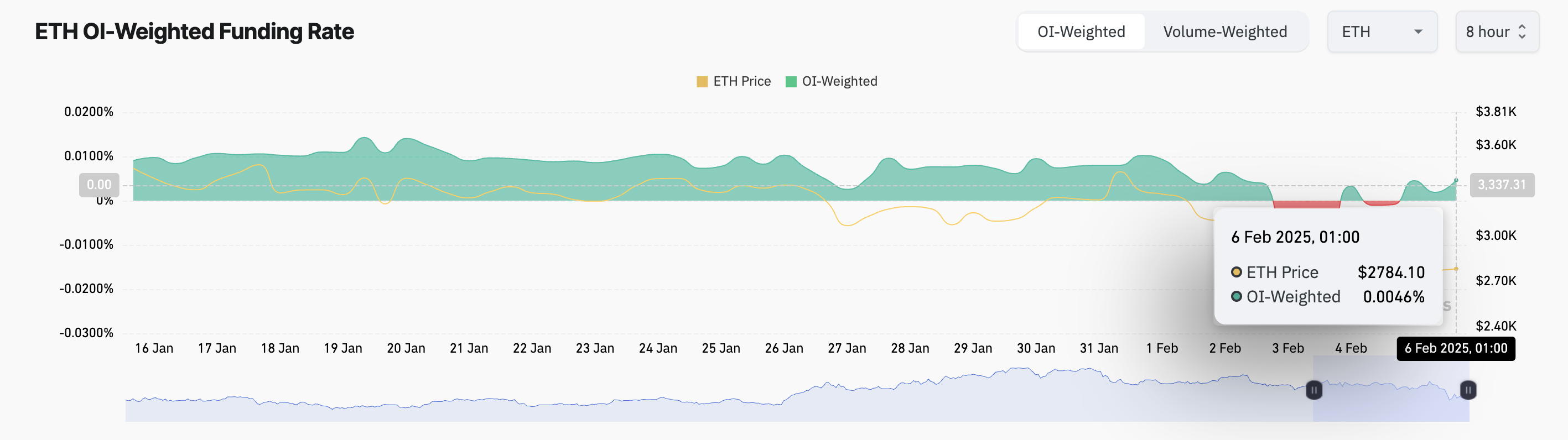

Furthermore, after a number of days of adverse values, ETH’s funding price has turned constructive once more. The shift in market sentiment means that futures merchants are more and more favoring lengthy positions, indicating renewed confidence in ETH’s worth restoration. At press time, this stands at 0.0046%.

ETH Funding Fee. Supply: Coinglass

The funding price is a periodic charge exchanged between lengthy and brief merchants in perpetual futures contracts. It ensures that the contract worth stays near the spot worth. When the funding price is constructive, it implies that lengthy merchants are paying brief merchants, indicating stronger demand for lengthy positions and a bullish market sentiment.

ETH Value Prediction: Is a Reversal on the Horizon?

Ethereum’s worth decline has precipitated it to commerce inside a descending channel over the previous few weeks. This sample is fashioned when an asset’s worth strikes inside a downward-sloping vary, creating decrease highs and decrease lows over time.

It sometimes alerts a bearish development, however a breakout above the channel may point out a possible reversal. If the demand for ETH soars, a possible breakout may propel the coin’s worth to $3,249.

ETH Value Evaluation. Supply: TradingView

Alternatively, a failed breakout try may trigger a worth decline towards the channel’s assist at $2,553.