Ethereum (ETH) worth has gained 6% over the previous week, making an attempt to construct momentum for a surge towards the $4,000 degree. The latest formation of a golden cross, mixed with an RSI at the moment at 63.6, reveals the potential for continued upward motion.

Moreover, whale accumulation has resumed, with the variety of wallets holding at the least 1,000 ETH rebounding after a short decline earlier in January. As ETH hovers close to key assist and resistance ranges, its capacity to keep up bullish momentum can be essential in figuring out whether or not it may possibly maintain its rally or face a pullback.

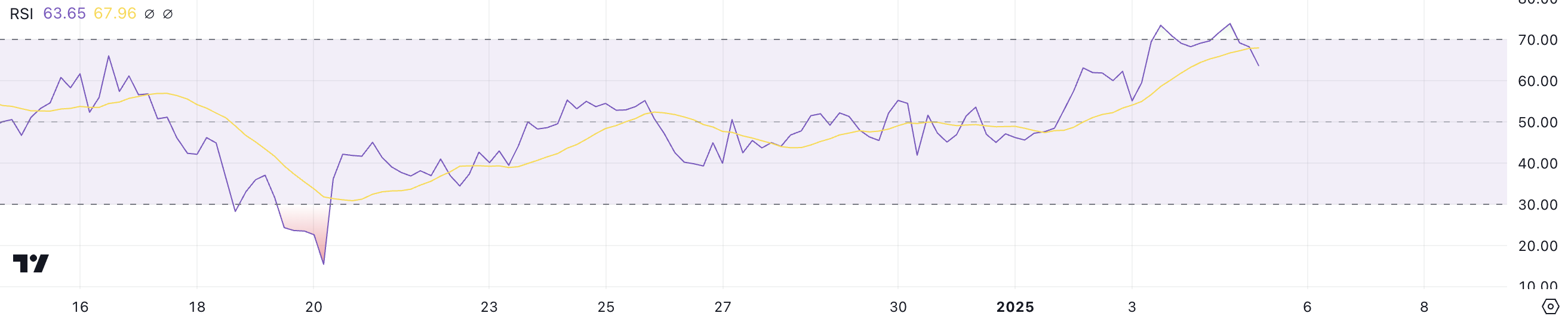

ETH RSI Is Down From 70

Ethereum Relative Power Index (RSI) is at the moment at 63.6, after briefly surpassing the overbought threshold of 70 between January 3 and January 4. The RSI measures the velocity and magnitude of worth actions on a scale from 0 to 100, providing insights into market momentum.

Readings above 70 point out overbought situations, suggesting a possible pullback, whereas readings under 30 sign oversold situations, which can level to a worth restoration. ETH’s present RSI under 70 signifies that whereas shopping for strain has eased, bullish momentum nonetheless stays in play.

ETH RSI. Supply: TradingView

At 63.6, ETH’s RSI suggests a neutral-to-bullish outlook for the quick time period. The retreat from overbought ranges may point out that the asset is coming into a section of consolidation or gentle correction as merchants take earnings.

Nonetheless, the RSI stays comfortably above 50, highlighting continued shopping for curiosity. If the RSI rises once more towards 70, ETH may see renewed upward momentum, however an additional drop under 50 would possibly sign waning bullish momentum, probably resulting in a broader worth retracement.

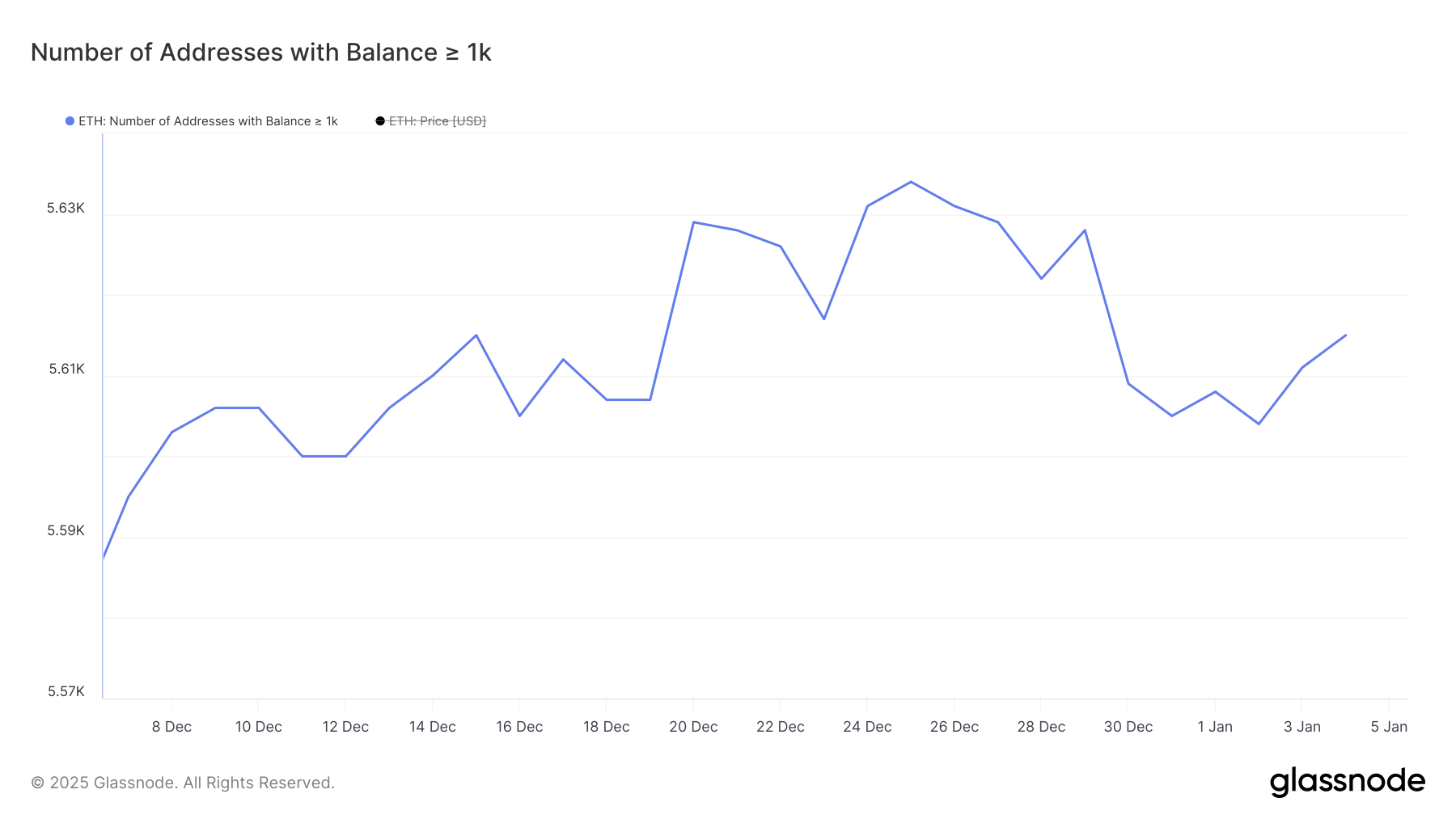

Ethereum Whales Are Accumulating Once more

The variety of Ethereum whales holding at the least 1,000 ETH reached a month-high of 5,634 on December 25 earlier than declining to five,604 by January 2. Monitoring whale exercise is essential as a result of these giant holders can considerably affect market developments.

A rise in whale accumulation typically alerts rising confidence within the asset, probably driving costs larger, whereas a decline could point out diminished curiosity or promoting strain.

Addresses with Steadiness >= 1,000 ETH. Supply: Glassnode

After reaching 5,604 on January 2, the variety of whales started climbing once more and now stands at 5,615. This rebound in whale exercise suggests renewed curiosity from giant traders, which may assist ETH worth within the quick time period.

If the upward development in whale accumulation continues, it may point out rising market confidence and elevated shopping for strain, probably fueling additional worth good points. Conversely, any decline in whale exercise would possibly sign hesitation amongst main traders, which may weigh on ETH momentum.

ETH Value Prediction: Will the $3,543 Assist Maintain Robust?

Ethereum worth lately shaped a golden cross on January 4, a bullish sign that happens when the short-term EMA crosses above the long-term EMA. Whereas ETH worth has but to see important good points following this formation, the technical setup suggests potential upward momentum.

If the uptrend strengthens, supported by RSI ranges and renewed whale exercise, ETH worth may take a look at the resistance at $3,827. A breakout above this degree may pave the way in which for additional good points, focusing on $3,987 subsequent.

ETH Value Evaluation. Supply: TradingView

Nonetheless, the assist at $3,543 is essential for ETH to keep up its present uptrend. If this assist fails, ETH may face elevated promoting strain, probably reversing its momentum. In such a state of affairs, ETH would possibly retest decrease ranges, with key assist zones at $3,300, $3,200, and $3,096 coming into focus.