Ethereum (ETH) value is up over 3% within the final 24 hours, displaying indicators of restoration because the yr ends. Not like Solana and Bitcoin, which reached new all-time highs in 2024, ETH fell wanting attaining this milestone.

Key indicators like RSI and DMI counsel that bullish momentum is constructing, with ETH nearing a crucial resistance at $3,523. Whether or not the altcoin can break larger or retest decrease assist ranges will outline its short-term value trajectory.

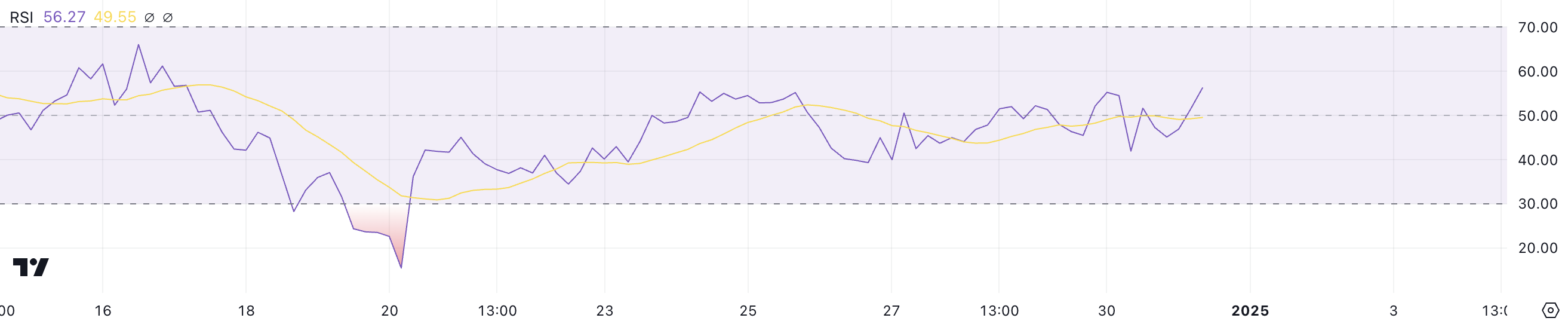

ETH RSI Is Going Up

Ethereum Relative Energy Index (RSI) is presently at 56.2, reflecting a gradual restoration after dropping beneath 20 on December 20. This rebound signifies that purchasing strain has regularly returned, lifting ETH out of oversold situations and right into a neutral-to-slightly-bullish zone.

An RSI of 56.2 means that momentum is leaning extra towards the optimistic aspect, signaling the potential of a gentle upward motion within the ETH value because it stabilizes.

ETH RSI. Supply: TradingView

The RSI is a momentum indicator that measures the pace and power of value actions on a scale from 0 to 100. Values above 70 point out overbought situations, typically signaling a possible value pullback, whereas values beneath 30 counsel oversold situations, hinting at a potential restoration.

With Ethereum RSI at 56.2, it stays in a impartial zone however is near coming into bullish territory. Within the quick time period, this might imply ETH has room for reasonable beneficial properties, though an absence of sturdy momentum would possibly restrict vital upward motion until shopping for strain intensifies additional.

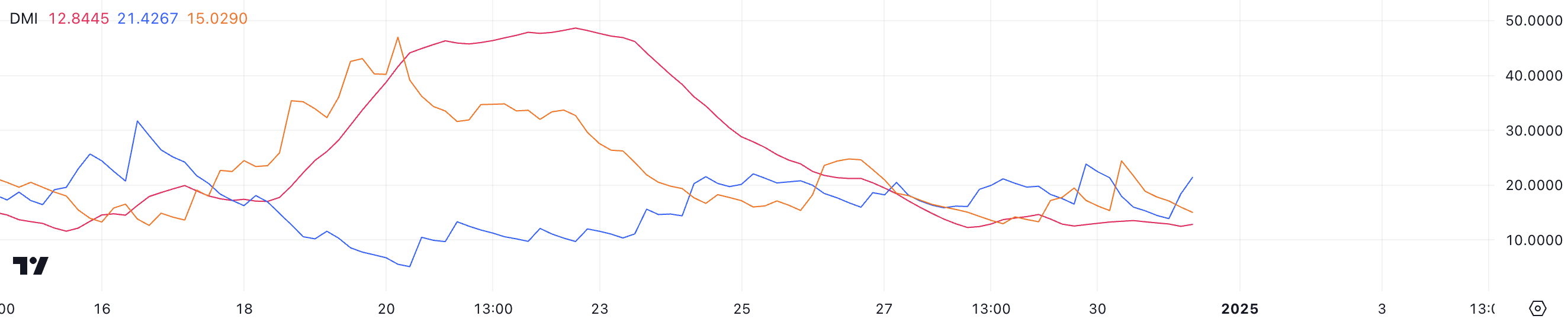

Ethereum DMI Hints at Bullish Shift

ETH DMI chart signifies that its ADX is presently at 12.8, remaining beneath 20 since December 27. This low ADX studying means that the development power is weak, reflecting an absence of sturdy momentum in both path.

Nevertheless, the current crossover of the +DI above the -DI, with the +DI rising to 21.4 and the -DI at 15, exhibits that purchasing strain has began to dominate over promoting strain. This setup signifies the early levels of a possible uptrend, though the weak ADX alerts that the development just isn’t but firmly established.

ETH DMI. Supply: TradingView

The Common Directional Index (ADX) measures the power of a development, no matter its path, on a scale of 0 to 100. Values above 25 point out a robust development, whereas readings beneath 20 counsel weak or absent development power. The +DI (Directional Indicator) tracks shopping for strain, whereas the -DI tracks promoting strain.

With the +DI crossing above the -DI and displaying the next worth, bullish momentum is starting to construct. Nevertheless, for ETH’s uptrend to achieve traction, the ADX would want to rise above 20 to verify stronger development momentum. Within the quick time period, ETH may even see gradual beneficial properties, however sustained upward motion will rely on a rise in total development power.

ETH Value Prediction: A Potential 16% Upside

If a robust uptrend materializes, ETH value might take a look at the resistance at $3,523, marking a major milestone in its restoration efforts.

A breakout above this stage might pave the way in which for additional beneficial properties, with targets at $3,827 and probably $3,987, a stage ETH hasn’t examined since December 17.

ETH Value Evaluation. Supply: TradingView

However, if the present momentum fails to type a robust uptrend, Ethereum value might revisit assist at $3,300, a stage it examined on December 27 and December 30.

Failure to carry this assist might result in additional declines, with the subsequent targets at $3,218 and $3,096.