Ethereum‘s worth performances within the ongoing bull cycle could also be lagging behind different notable crypto belongings like Bitcoin, Solana, and XRP, which have shaped new all-time highs. Nonetheless, optimism about its worth prospects nonetheless lingers as evidenced by a persistent accumulation of the digital asset

Confidence In Ethereum Growin Amongst Traders

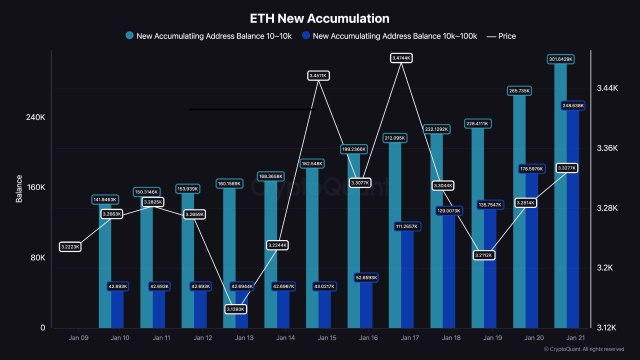

Regardless of Ethereum’s worth struggling to provoke a serious rally, an encouraging sentiment has been noticed amongst traders. Not too long ago, ETH traders have ramped up accumulation at a major price during the last two weeks.

Kyle Doops, a technical professional and host of Crypto Banter Present shared the event after analyzing the important thing Ethereum New Accumulation metric. Knowledge from Kyle Doops reveals a surge in pockets exercise, with each small and large-scale traders rising their ETH holdings.

The professional acknowledged that this pattern displays unwavering confidence from traders regardless of latest market fluctuations. Moreover, the increasing curiosity suggests sturdy religion in ETH’s potential in the long run, which is attracting many institutional and retail members.

Ethereum’s community enlargement and dominance of the Decentralized Finance (DeFi) and Non-Fungible Tokens (NFT) sectors might have performed a pivotal function within the persistent accumulation. In the meantime, if the accumulation section extends, it may act as a precursor for the altcoin’s subsequent main worth motion.

Nonetheless, waning market efficiency threatens its uptrend within the quick time period. Even within the face of market uncertainty, Kyle Doops claims that Ethereum’s future seems more and more promising, demonstrating his optimism concerning the asset’s functionality.

This strong investor exercise can be indicated by the Ethereum Estimated Leverage Ratio metric, which has been climbing for some interval. An increase on this key metric signifies heightened threat as merchants tackle extra positions with excessive leverage.

The surge in high-leverage positions seems to have been climbing as ETH consolidates between the $3,200 and $3,500 worth vary. Given the extended stasis inside the worth vary, Kyle Doops believes {that a} bullish breakout is probably going at this level.

Nonetheless, he has urged traders to be cautious as excessive leverage might trigger liquidations and volatility as seen previously whereby the event has led to a risky worth motion for the altcoin.

A Robust Rally For ETH On The Horizon?

ETH continues to face important resistance on the $3,500, elevating uncertainty about its subsequent worth path. Nonetheless, market professional and dealer Milkybull has expressed his confidence in ETH’s prospects, predicting a transfer to unprecedented ranges.

Inspecting ETH’s 1-month chart, the analyst claims that the notorious rise of ETH that may push it to the $12,000 milestone is gathering steam. His daring forecast is supported by a Rising Wedge sample, which generally oversees notable worth spikes.

On the time of writing, ETH was buying and selling at $3,381, demonstrating an virtually 5% rise within the final 24 hours. Traders are betting considerably on the renewed upward momentum as buying and selling quantity has elevated by greater than 60% previously day.

Featured picture from Unsplash, chart from Tradingview.com