Ethereum comparatively sluggish value efficiency in comparison with Bitcoin’s steady rise seems to have captured the eye of crypto analysts.

Whereas Bitcoin has created a brand new peak above $106,000 earlier as we speak, Ethereum’s value nonetheless sits under $4,000 with a present buying and selling value of $3,943, marking a modest 1.4% improve over the previous 24 hours.

Nevertheless, regardless of this gradual tempo, some analysts see indicators of power and potential development for Ethereum within the close to time period.

Retest Earlier than The Main Rally

One notable analyst, CryptoBullet, shared his insights on X, drawing comparisons between the present market setting and Ethereum’s January 2021 rally.

“Second consecutive weekly candle closed above the resistance,” the analyst noticed. “The form of the candle and general setting jogs my memory of January 2021. We’d wick to $3,700 this week, however it will likely be purchased again up shortly. Don’t ignore this ETH power.”

CryptoBulllet additional emphasised that Ethereum’s potential to carry its place above key resistance ranges is a robust indicator of bullish momentum, suggesting {that a} vital value motion might be on the horizon.

$ETH 1W replace

Second consecutive weekly candle closed above the Resistance 👌😁

The form of the candle and general setting jogs my memory of January 2021

We’d wick to $3700 this week however it will likely be purchased again up shortly 📈

Don’t ignore this #ETH power! https://t.co/rIamWMSAb6 pic.twitter.com/29bs5aTUd3

— CryptoBullet (@CryptoBullet1) December 16, 2024

Titan of Crypto, one other famend analyst locally echoed this optimism, noting Ethereum’s highest weekly candle shut since 2021 as a serious milestone.

“Ethereum New ATH Incoming. ETH simply achieved its highest weekly candle shut since 2021, a serious milestone,” he wrote. “A profitable retest might propel it to its earlier ATH and past.”

These observations point out rising confidence amongst market members that Ethereum might quickly reclaim its all-time excessive of $4,878, final achieved in November 2021.

Ethereum Merchants Faces Liquidation

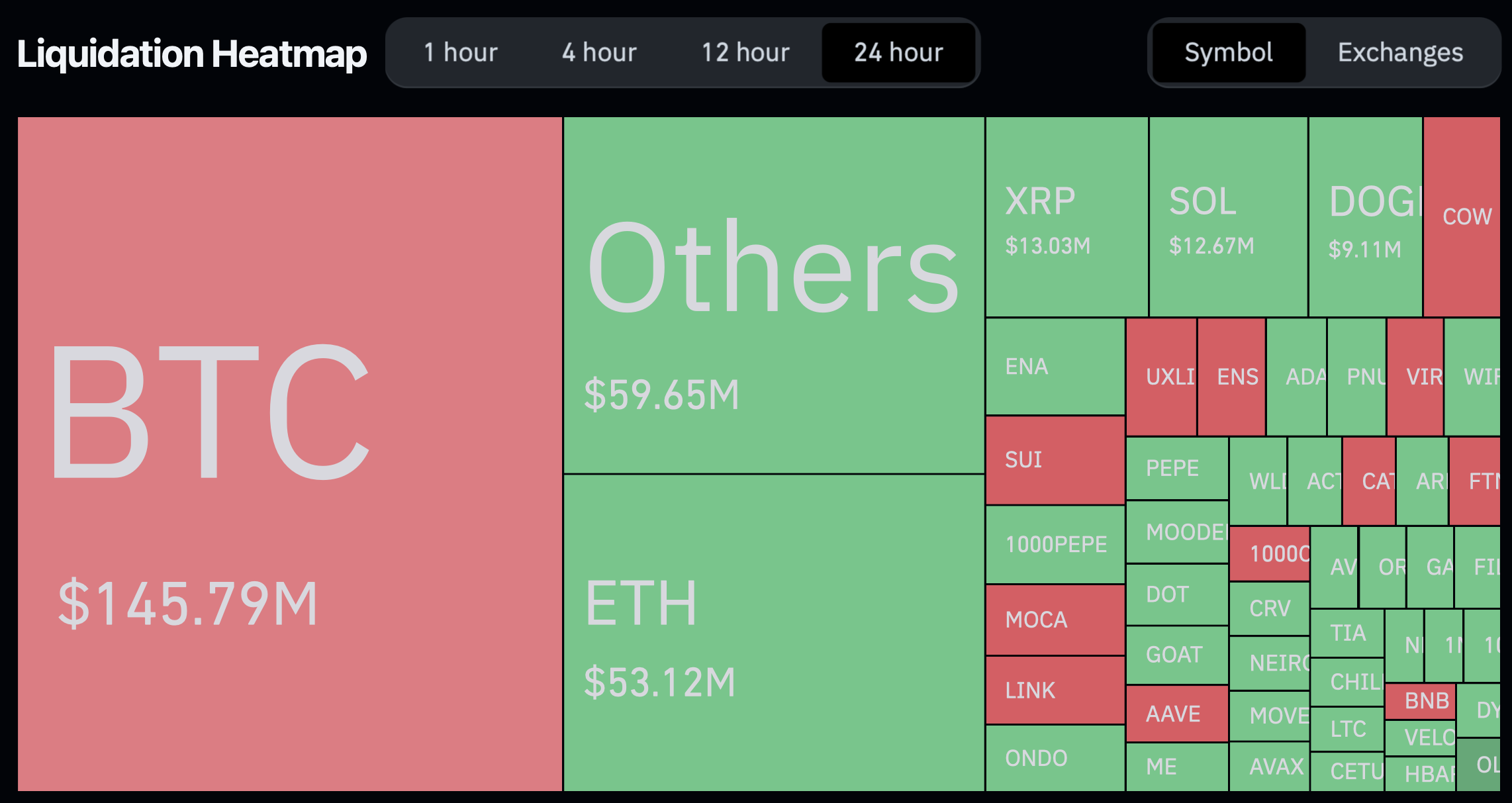

Regardless of these bullish projections, Ethereum’s latest value motion has not been favorable for all market members. In response to knowledge from Coinglass, 123,021 merchants have been liquidated over the previous 24 hours, leading to a complete of $396.41 million in liquidations throughout the crypto market.

Ethereum accounted for roughly $53.12 million of those liquidations, with lengthy positions taking the bigger hit at $28.4 million, whereas quick positions noticed liquidations value $24.69 million.

Notably, liquidation happens when a dealer’s place is forcibly closed by an trade as a consequence of inadequate funds to cowl losses. Within the case of Ethereum, the upper quantity of liquidations, notably amongst lengthy positions, displays a degree of over-leverage amongst merchants betting on the asset’s upward momentum.

Featured picture created with DALL-E, Chart from TrangView