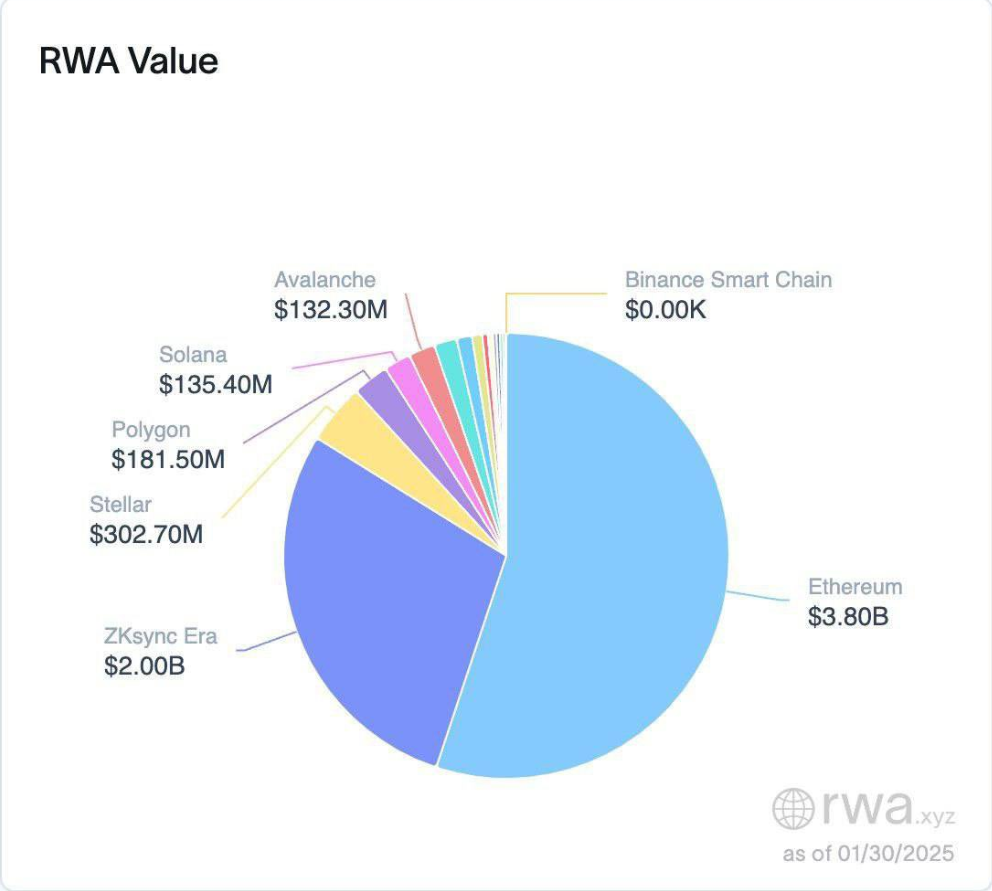

Ethereum continues to dominate the blockchain house, with 86% of all real-world belongings (RWAs) on-chain being held on Ethereum and Ethereum Layer 2 options.

Regardless of Ethereum’s dominance, Bitcoin and Ethereum are each seeing a constant stream of capital into stablecoins, suggesting cautious market sentiment.

The dearth of great altcoin motion additional indicators that the crypto market is in a consolidation part.

Ethereum Dominates the Actual-World Asset Market

Actual-world belongings allotted to the Ethereum mainnet and Layer 2 options function at $3.80 billion whereas dominating many of the on-chain market.

Ethereum maintains a considerable lead over blockchain platforms Solana and Polygon as a result of it holds $3.80 billion in belongings whereas Solana holds $135.4 million and Polygon holds $181.5 million.

Ethereum’s Layer 2 options elevated its transaction throughput whereas decreasing charges, which makes Ethereum the developer’s and investor’s prime choice.

Supply: rwa.xyz

Coping with its safe decentralized structure, builders choose Ethereum above different blockchain decisions due to its robust improvement ecosystem options.

By Optimism and Arbitrum, Ethereum Layer 2 options push the boundaries of Ethereum capability by enabling deflationary transactions at lowered prices to help DeFi progress.

Furthermore, Ethereum retains solidifying its blockchain revolution place by means of rising RWAs share metrics.

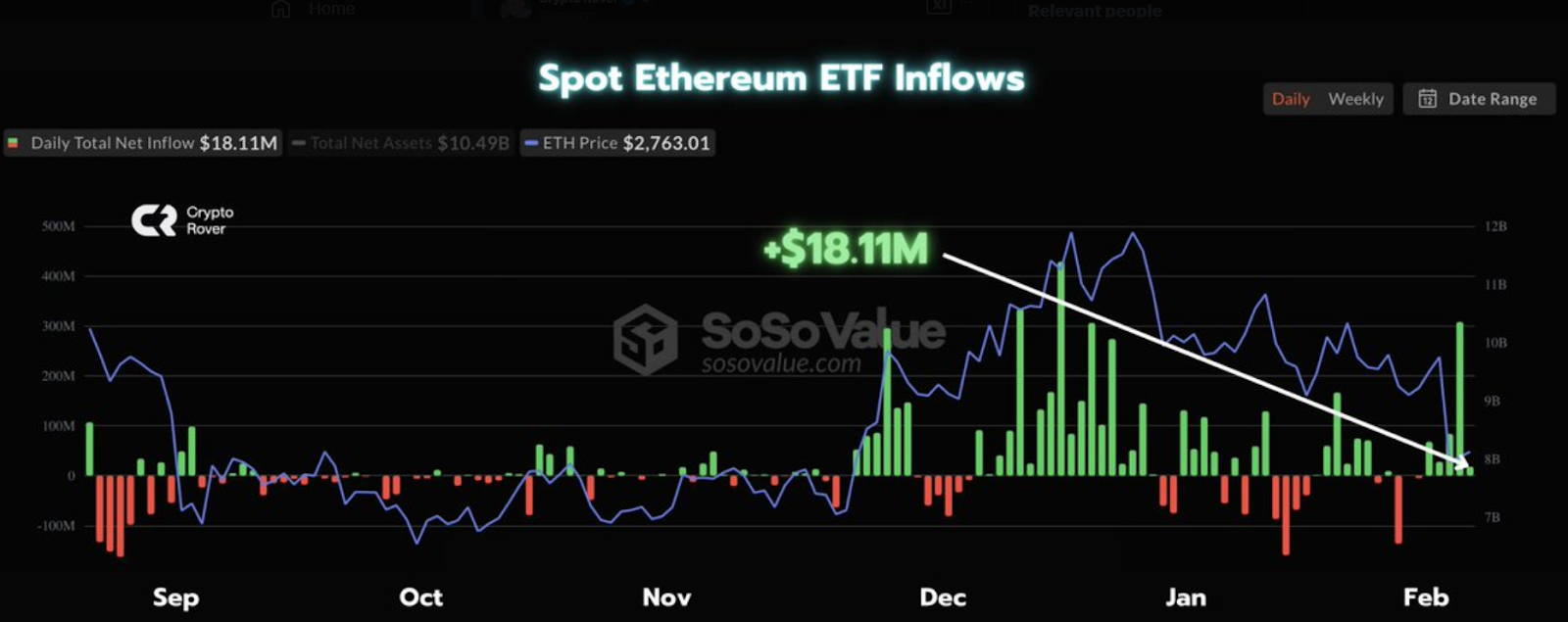

Latest investments within the Spot Ethereum ETF totaled $18.11 million as Ethereum continues its recognition progress.

Knowledge from SoSoValue confirms that investor belief is rising as a result of Ethereum calls for roughly $2,763 per unit.

The enticing influx enhance revealed by means of the inexperienced bar exhibits buyers returning to Ethereum funding alternatives.

Supply: SoSoValue

Ethereum Worth Evaluation: Key Assist at $2,500 and Potential Rebound Targets

Ali Chart evaluation of the Ethereum worth signifies $2,500 features as an important help level, which can set up a elementary shift in market path.

Ethereum stays near its present buying and selling vary at $2,500 and would most definitely rebound upwards if it sustains costs above that resistance degree.

Future market actions will decide if Ethereum costs can rise between $4,000 and $6,000.

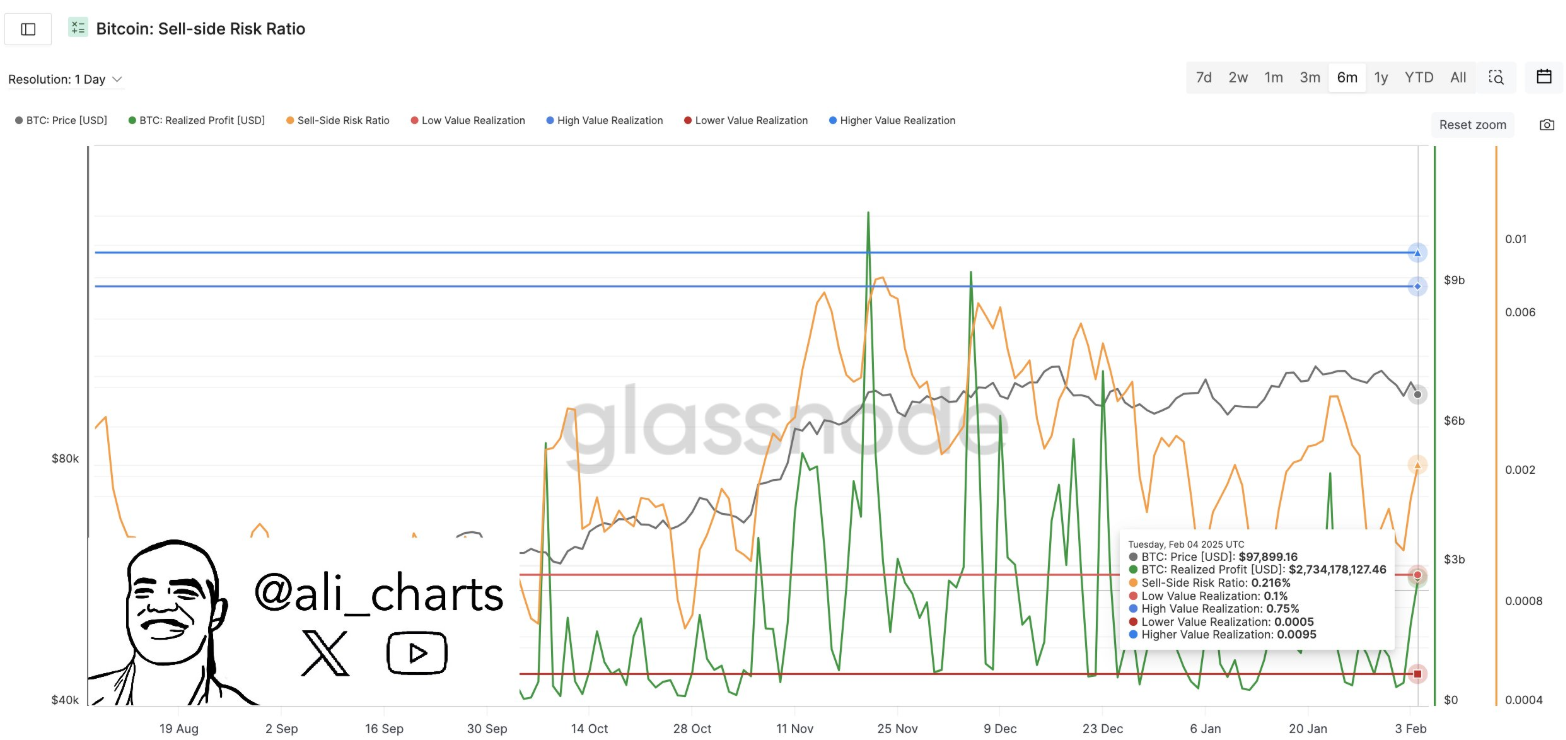

Supply: Ali Charts

The failure of Ethereum to maintain $2,500 help will set off a downward worth motion towards $1,700 earlier than it might probably affirm a brand new development.

Bullish sentiment relating to the token requires the $2,500 worth degree to stay intact.

Present worth motion signifies Ethereum follows a gradual upward development ranging from mid-2023, which ceaselessly checks and exceeds the $2,500 goal.

The cryptocurrency stands to expertise further worth progress in forthcoming months in response to the energy of its help, which exhibits indications of reaching its higher channel boundaries.

Bitcoin and Ethereum See Continued Capital Outflows into Stablecoins

Moreover, Bitcoin and Ethereum proceed to face capital outflows to stablecoins.

Fund transfers into stablecoins show a longtime sample as a result of market gamers favor stablecoin stability as a consequence of current market uncertainty.

Stablecoins have obtained rising capital since buyers keep a place of ready for definitive market indicators.

Supply: Ali charts on X

The Altseason Indicator exhibits no signal of an altseason rally, since altcoins stay beneath Bitcoin and Ethereum market worth.

{The marketplace} demonstrates an total conservative strategy as a result of merchants count on decisive indicators similar to regulatory breakthroughs or Ethereum and Bitcoin benchmark modifications to drive market modifications.

Present market circumstances present nervousness as buyers both count on Bitcoin’s momentum to surge once more or require a triggering occasion to provoke altseason.