The Ethereum value gave the impression to be lastly gearing for a powerful bullish breakout after a number of weeks of disappointing and sluggish motion. Nonetheless, this bullish dream ended virtually instantly after it began as almost $1.5 billion price of ETH tokens had been drained from the ByBit change.

Ethereum, which traded as excessive as $2,840 earlier on Friday, February 21, dropped in direction of $2,600 on the again of stories of the ByBit hack. Apparently, latest on-chain knowledge means that the altcoin’s value may nonetheless make its strategy to $4,000 earlier than the top of this cycle.

Might ETH Value Nonetheless Document A 60% Rally This Cycle?

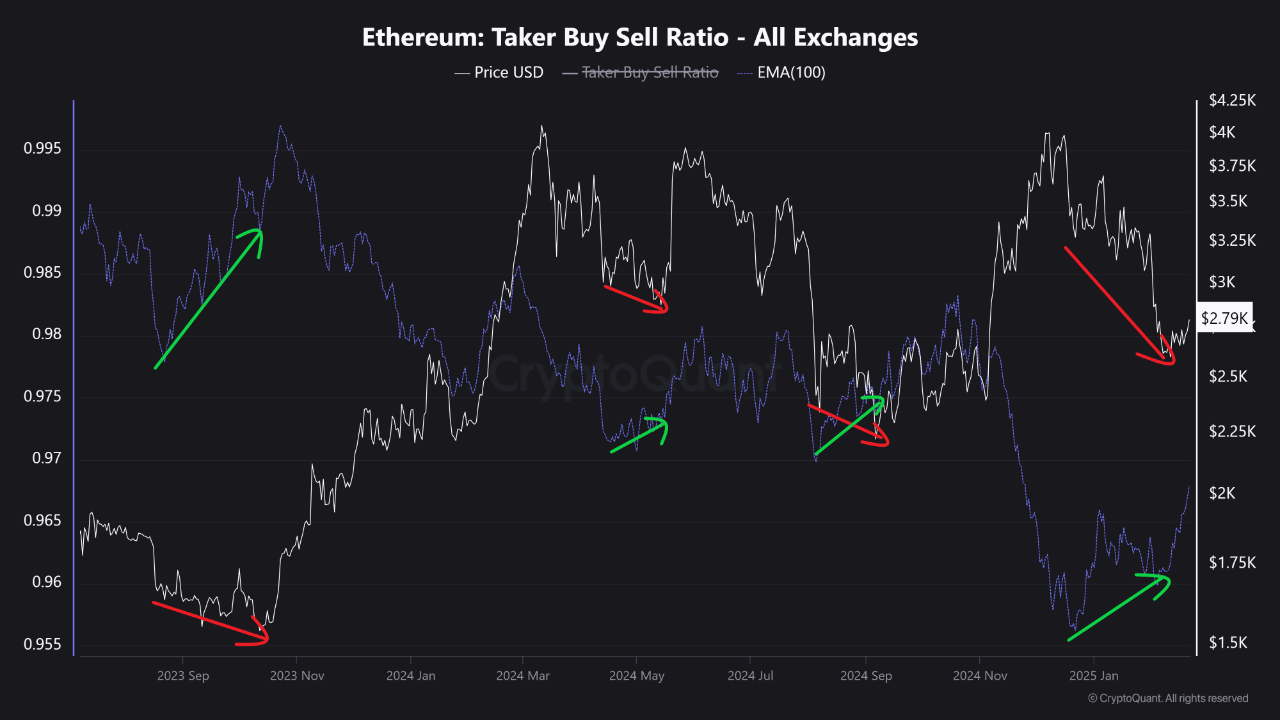

In a Quicktake publish on the CryptoQuant platform, an analyst with the pseudonym Crypto Sunmoon recognized a selected bullish divergence that provides perception into the Ethereum value efficiency within the close to future. This bullish statement relies on latest actions of ETH’s “taker purchase/promote ratio” throughout all exchanges.

This metric measures the taker purchase and taker promote volumes for a selected cryptocurrency (Ethereum, on this case). When the taker purchase/promote ratio is bigger than one, it implies that the taker purchase quantity is increased than the taker promote quantity. That is sometimes thought of a bullish sign, indicating the willingness of traders to pay a better value for an asset.

Quite the opposite, a less-than-one taker purchase/promote ratio signifies that sellers are overwhelming the consumers available in the market. This situation means that extra sellers are prepared to dump their property at a lower cost, signaling a bearish shift in investor sentiment.

Crypto Sunmoon famous that the 100-day exponential shifting common (EMA) of the Ethereum taker purchase/promote ratio on all exchanges has been rising in latest weeks. The Ethereum value, however, has been declining since mid-December.

In line with the analyst, this divergence is constructive, because it signifies {that a} bearish pattern has ended and an upward pattern could possibly be beginning. The final time this bullish divergence occurred, the Ethereum value traveled from beneath $2,500 to above $4,000 (over 60% rally).

Whereas traders would view a reclaim of $3,000 as a victory for Ethereum, historical past and this bullish divergence recommend that the altcoin’s value may nonetheless climb towards the $4,000 mark earlier than the top of the present cycle.

Ethereum Value At A Look

As of this writing, the value of Ethereum stands round $2,650, reflecting an almost 4% decline up to now 24 hours.

Featured picture from iStock, chart from TradingView