Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has been a key participant within the crypto market, driving innovation in decentralized finance (DeFi), sensible contracts, and blockchain functions. Nonetheless, after reaching an all-time excessive of $4,878 in November 2021, ETH has struggled to reclaim these heights, going through a number of worth corrections.

Presently buying and selling round $1,967, ETH worth has been in a chronic downtrend, elevating issues amongst traders. With the crypto market displaying indicators of restoration and institutional curiosity rising, the query stays: Can Ethereum get away of its bearish development and rally to an formidable goal of $7,000?

To reply this, we’ll analyze ETH’s worth motion, key resistance and assist ranges, technical indicators like RSI and MACD, and the basic catalysts that would drive Ethereum to new highs. Let’s dive into the charts and discover whether or not ETH has the potential to make a parabolic transfer towards $7,000.

Ethereum Worth Prediction: Is Ethereum Primed for a Main Breakout?

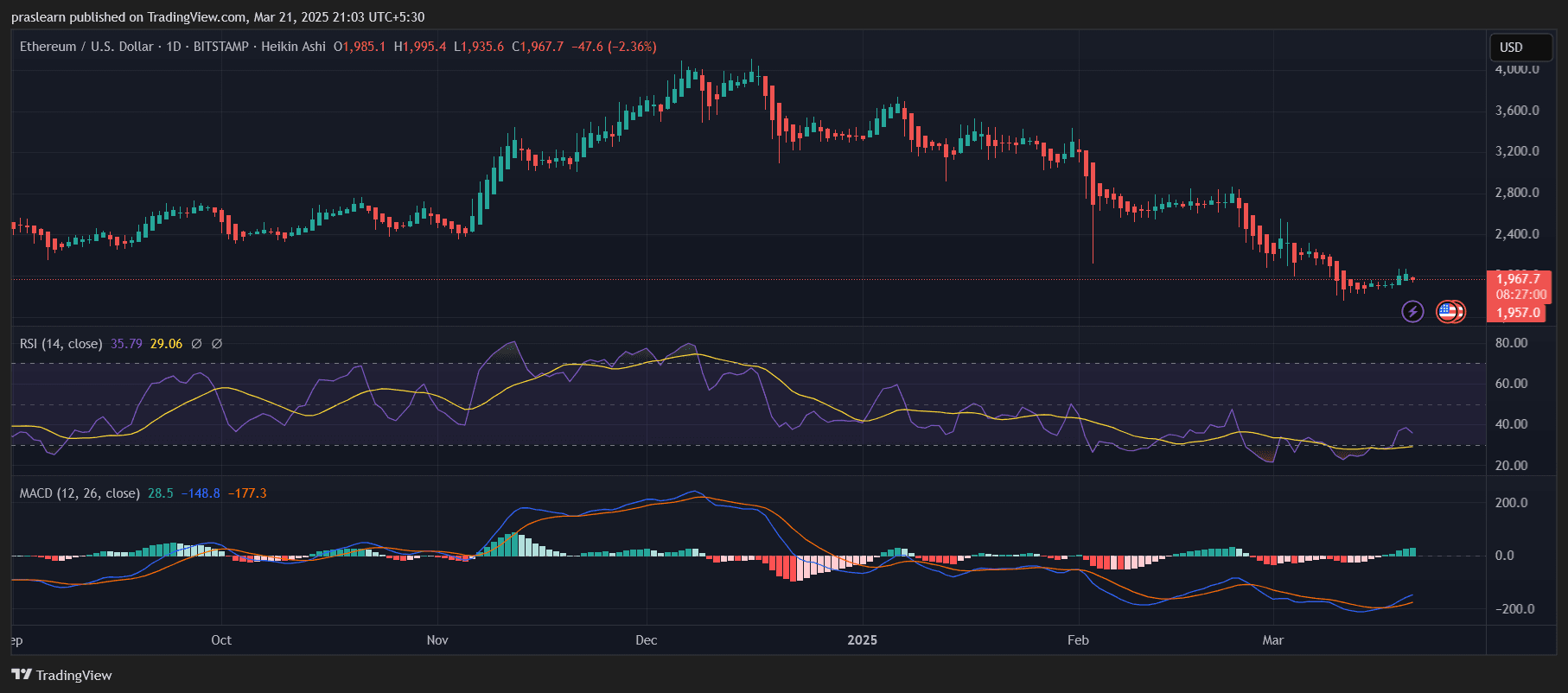

ETH/USD Every day Chart- TradingView

Ethereum’s worth has been beneath stress, struggling under key resistance ranges. The every day chart reveals a continued downtrend, with ETH at the moment hovering round $1,967 after failing to carry increased assist zones. A important query arises—can Ethereum overcome this bearish momentum and attain the formidable $7,000 goal?

From a technical perspective, the market construction displays a bearish sentiment, however a possible reversal sample could also be forming. The Relative Power Index (RSI) is close to oversold ranges, and the MACD is displaying early indicators of bullish divergence. These indicators recommend that Ethereum is perhaps nearing a short-term backside, which may set the stage for a restoration.

What Are the Key Resistance and Help Ranges?

Ethereum faces robust resistance at $2,100, the place previous worth motion has seen a number of rejections. If ETH worth efficiently breaks this stage, the following targets could be $2,500 and $3,000. Nonetheless, failure to take action may result in a retest of assist round $1,800.

A key bullish sign could be ETH reclaiming $2,500 as assist, as this might present the momentum wanted for a long-term uptrend. On the draw back, if Ethereum loses the $1,800 assist, we may see additional bearish motion towards $1,500 earlier than any potential restoration.

What Does the RSI and MACD Point out About Ethereum’s Subsequent Transfer?

The RSI (14) is at the moment at 35.79, which may be very near the oversold territory (under 30). This means that promoting stress is perhaps nearing exhaustion, and a aid rally might be on the horizon. If the RSI strikes above 40 and sustains, it could verify the beginning of bullish momentum.

The MACD (12, 26), nevertheless, stays bearish with adverse histogram bars. The MACD line is under the sign line, confirming a downtrend, however the adverse momentum seems to be slowing. If the MACD line crosses above the sign line, it could verify a bullish development shift, signaling a possible rally.

Ethereum Worth Prediction: Can Ethereum Rally to $7,000?

For Ethereum worth to achieve $7,000, it could have to expertise a serious macroeconomic shift or a major elementary catalyst, akin to:

- Bitcoin Rallying Above $100K – ETH typically follows BTC’s lead, and a parabolic Bitcoin rally may push Ethereum past its earlier all-time excessive.

- Elevated DeFi and Layer-2 Adoption – Progress in Ethereum’s ecosystem, together with rollups like Arbitrum and Optimism, may enhance demand for ETH.

- International Liquidity Growth – If central banks shift in direction of easing insurance policies, liquidity-driven rallies may push ETH to new highs.

Presently, ETH worth is much from the $7,000 goal, however a break above $3,500 could be a serious bullish affirmation, setting the stage for a long-term rally towards increased worth targets.

Is Ethereum a Purchase Proper Now?

At $1,967, Ethereum is buying and selling at a major low cost in comparison with its earlier highs. The indications recommend a possible backside formation, however affirmation is required by worth reclaiming key resistance ranges like $2,100 and $2,500.

For brief-term merchants, ready for a breakout above $2,100 might be a safer technique. For long-term traders, accumulating ETH at present ranges may provide robust returns if Ethereum’s fundamentals proceed bettering.

Whereas $7,000 is an formidable goal, it isn’t not possible. If ETH breaks out above $3,500 and Bitcoin reaches new highs, Ethereum may enter a parabolic section, making $7,000 achievable within the subsequent bull cycle.