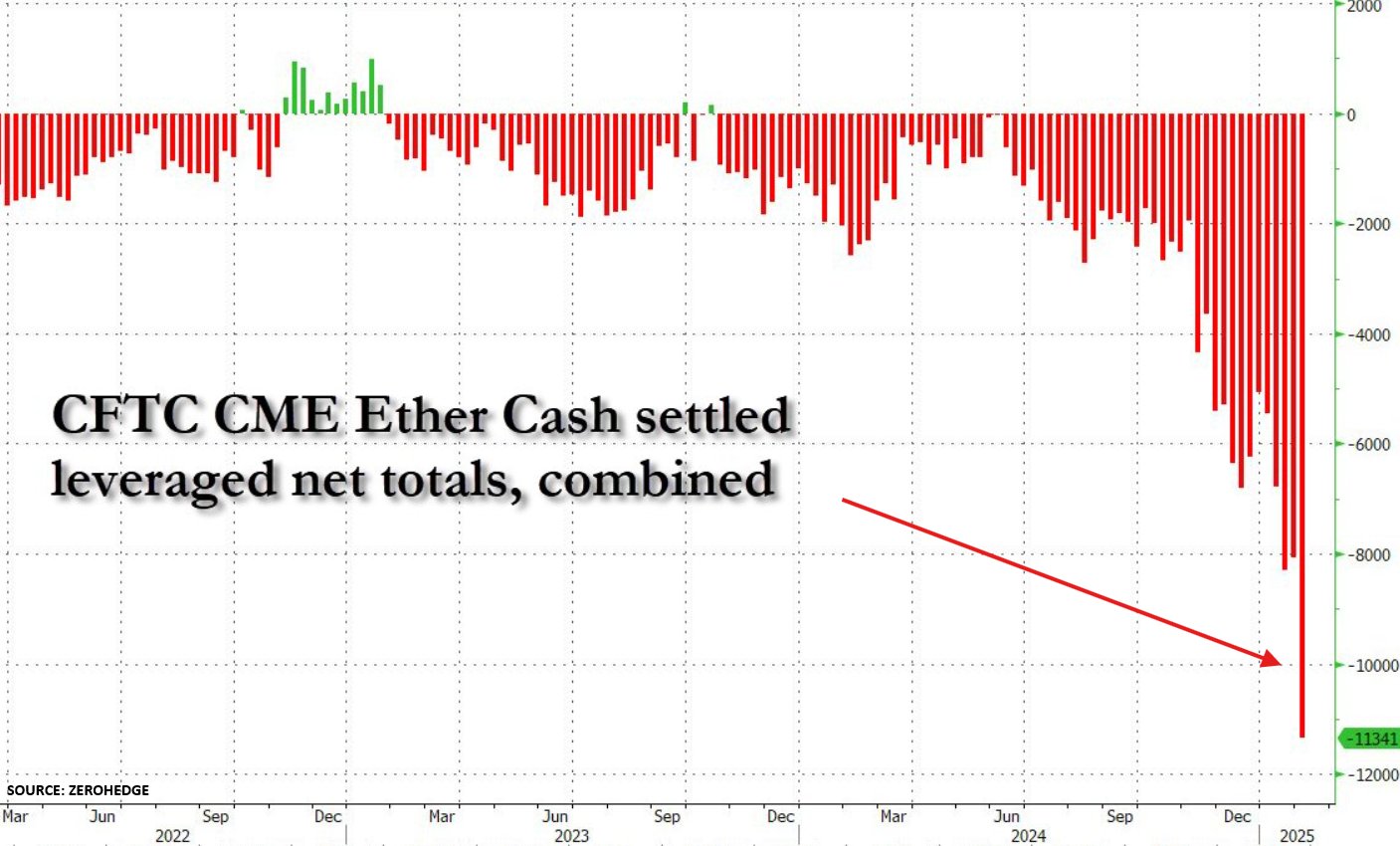

Ethereum (ETH), the second-largest cryptocurrency by reported market cap, is going through unprecedented brief promoting from hedge funds. Notably, brief positions in ETH have soared by 500% since November 2024, indicating heightened bearish sentiment towards the digital asset.

Institutional Buyers Dropping Religion In Ethereum?

In line with a current put up on X by The Kobeissi Letter, Ethereum value is witnessing mounting challenges as brief positioning within the cryptocurrency has ballooned in current occasions. Notably, ETH brief positions are up 40% within the final week, whereas they’re up 500% within the final three months.

It’s price highlighting that that is the best stage ever that Wall Avenue funds have been brief Ethereum. Earlier this month, the crypto market bought a sign of this bearish ETH positioning, because the digital asset crashed 37% in 60 hours amid Donald Trump’s proposed commerce tariffs on Canada, China, and Mexico.

Apparently, capital inflows to Ethereum exchange-traded funds (ETF) had been considerably excessive in December 2024. In simply 3 weeks, ETH ETFs attracted greater than $2 billion in new funds, with a file breaking weekly influx of $854 million.

Nevertheless, hedge funds’ positioning on ETH means that they aren’t very assured within the cryptocurrency’s short-term value outlook. A number of components could possibly be at play for institutional investor’s waning curiosity in ETH.

For example, ETH is presently buying and selling nearly 45% under its present all-time excessive (ATH) of $4,878 recorded approach again in November 2021. In distinction, Bitcoin (BTC) has had a stellar 2024, hitting a number of new ATH, and commanding a market cap that’s nearly six occasions bigger than that of ETH.

The Kobeissi Letter attributes ETH’s present lacklustre value efficiency to potential “market manipulation, innocent crypto hedges, to bearish outlook on Ethereum itself.” Nevertheless, the market commentator signifies that this extreme bearish outlook could set ETH up for a brief squeeze. They add:

This excessive positioning means large swings just like the one on February third shall be extra frequent. Because the begin of 2024, Bitcoin is up ~12 TIMES as a lot as Ethereum. Is a brief squeeze set to shut this hole?

ETH Quick Squeeze To Provoke Altseason?

A brief squeeze on ETH might teleport its value to as excessive as $3,000, and even $4,000. Nevertheless, in accordance to seasoned crypto analyst Ali Martinez, ETH should defend the $2,600 help stage to climb greater.

Current experiences point out that ETH has seemingly bottomed, paving the way in which for a development reversal to the upside. One other report by Steno Analysis suggests that ETH is more likely to outperform BTC in 2025, with potential targets as excessive as $8,000.

That stated, considerations nonetheless stay concerning the Ethereum Basis usually dumping ETH. At press time, ETH trades at $2,661, up 0.1% previously 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com