Ethereum lately didn’t breach the $2,500 resistance, resulting in a pullback. The altcoin king has since fallen, now buying and selling at $2,354. Regardless of the decline, ETH exhibits indicators of a gradual restoration.

A key shift in investor conduct, notably amongst whale addresses, could present the assist wanted for an uptrend.

Ethereum Promoting Stops

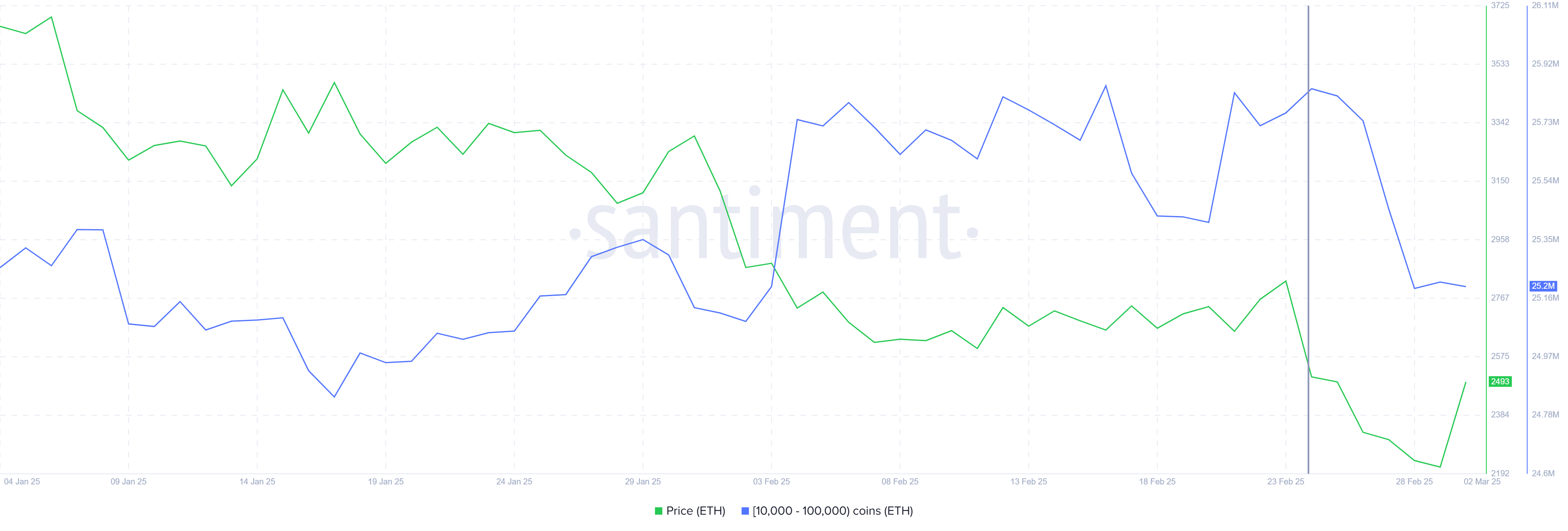

Whale addresses, holding between 10,000 to 100,000 ETH, had been promoting aggressively. Over the previous week, they offloaded 640,000 ETH price $1.5 billion, contributing to Ethereum’s battle close to $2,500. Nonetheless, promoting strain has eased, signaling a shift in sentiment.

Within the final 24 hours, whales have paused their sell-off, aligning with Ethereum’s current value stabilization. This behavioral change may point out confidence in ETH’s restoration. If massive holders proceed to carry their property, Ethereum may even see lowered volatility and stronger value assist.

Ethereum Whale Holding. Supply: Glassnode

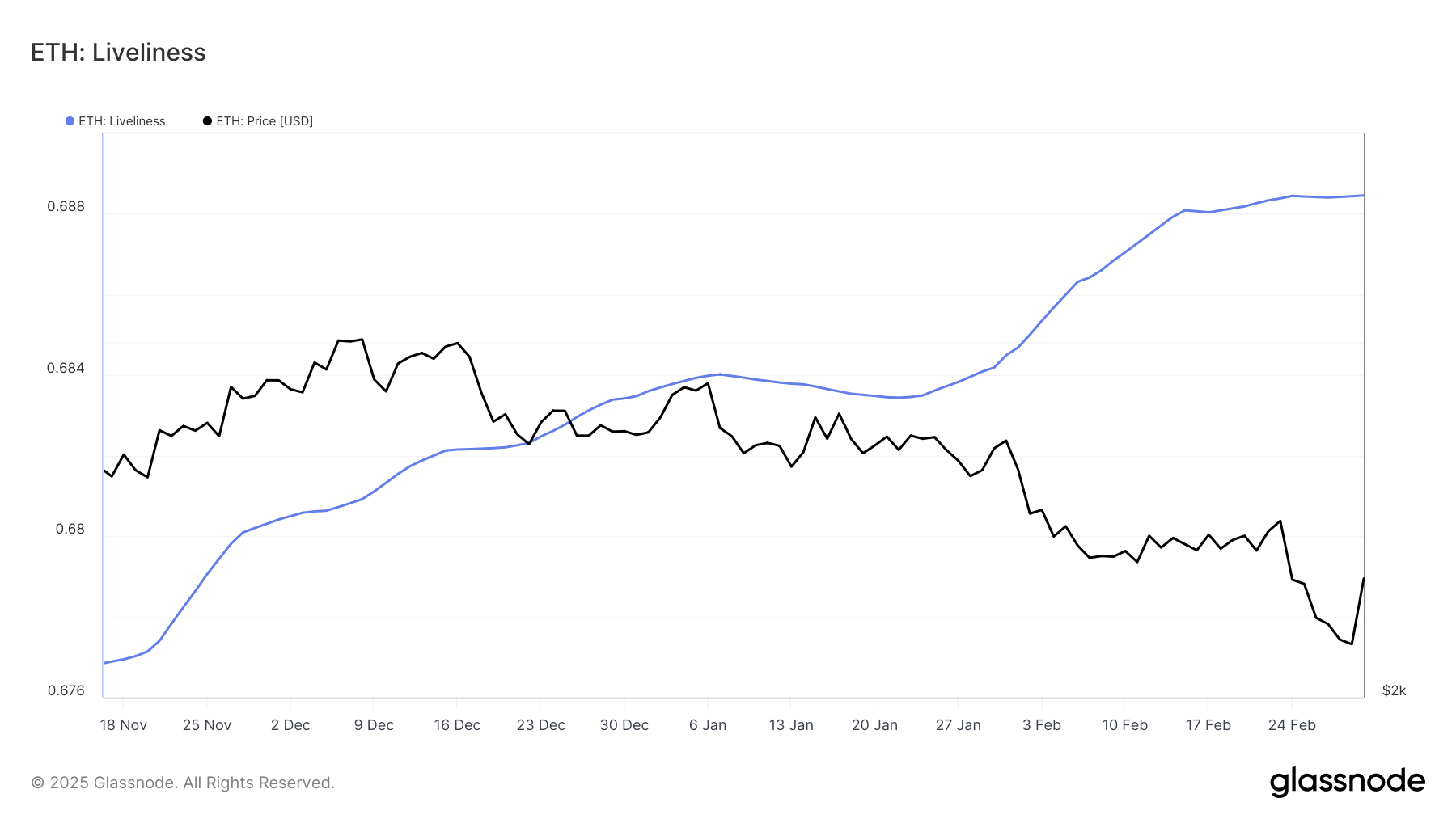

Ethereum’s Liveliness indicator suggests long-term holders (LTHs) have additionally stopped promoting. This metric rises when LTHs liquidate holdings and declines once they accumulate or maintain. Over the previous few days, the indicator has remained flat, signaling a pause in promoting.

This development helps Ethereum’s value stability as long-term buyers protect market confidence. If LTHs keep their holdings, ETH may construct momentum for a breakout. A sustained downtick in Liveliness would reinforce bullish sentiment, indicating accumulation moderately than distribution.

Ethereum Liveliness. Supply: Glassnode

ETH Worth Restoration Forward

Ethereum is making an attempt to safe $2,344 as a assist ground, now buying and selling at $2,354. Holding this degree may permit ETH to recuperate current losses, focusing on $2,549 as the subsequent resistance. A profitable retest of this zone would verify bullish momentum.

If ETH breaches $2,549, it may rally towards $2,654. Surpassing this degree could push Ethereum into consolidation under $2,814, mirroring earlier market cycles. This is able to set up a steady value vary earlier than additional upward motion.

Ethereum Worth Evaluation. Supply: TradingView

Nonetheless, failing to carry $2,344 may set off a decline. ETH could fall by means of $2,267, probably testing $2,170 as the subsequent main assist. A drop under this degree would invalidate the bullish outlook, reinforcing bearish momentum within the quick time period.