The main altcoin, Ethereum (ETH), has skilled a 15% decline previously seven days. Nonetheless, on-chain knowledge has revealed that this worth dip merely mirrors the broader crypto market sell-off because the bullish bias towards the altcoin stays important.

This evaluation highlights two key on-chain metrics hinting at a possible rally towards the $4,000 worth zone within the close to time period.

Ethereum Sees Bullish Momentum Regardless of Worth Fall

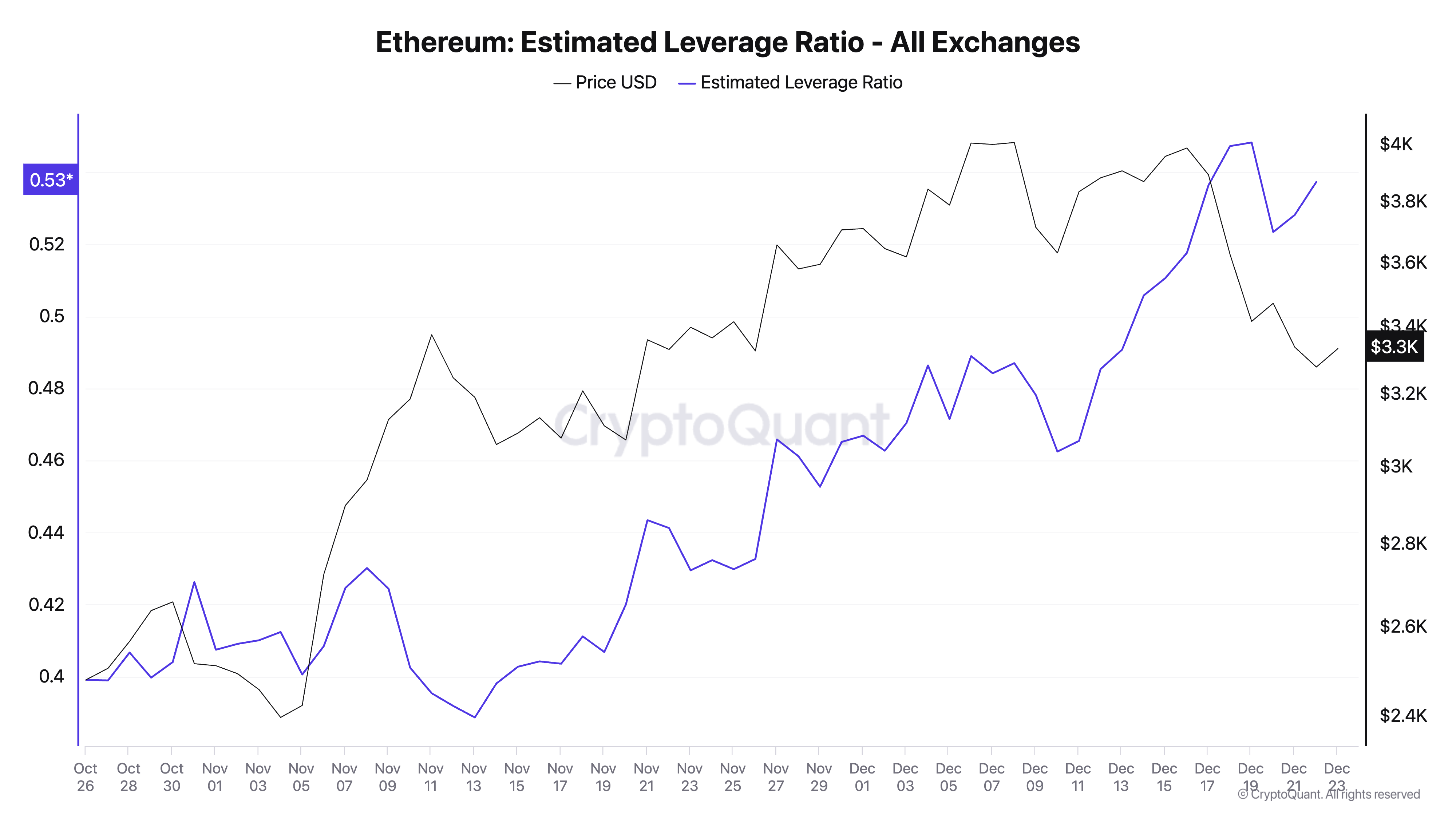

First, Ethereum’s rising Estimated Leverage Ratio (ELR) signifies a sustained urge for food for danger, reflecting the probability of a worth rebound. In response to CryptoQuant, it stands at 0.53 at press time.

Ethereum Estimated Leverage Ratio. Supply: CryptoQuant

An asset’s ELR measures the typical quantity of leverage its merchants use to execute trades on a cryptocurrency change. It’s calculated by dividing the asset’s open curiosity by the change’s reserve for that forex.

ETH’s climbing ELR signifies an elevated danger urge for food amongst merchants. It means that many buyers stay optimistic concerning the coin’s future worth progress and are prepared to leverage their positions to amplify potential features.

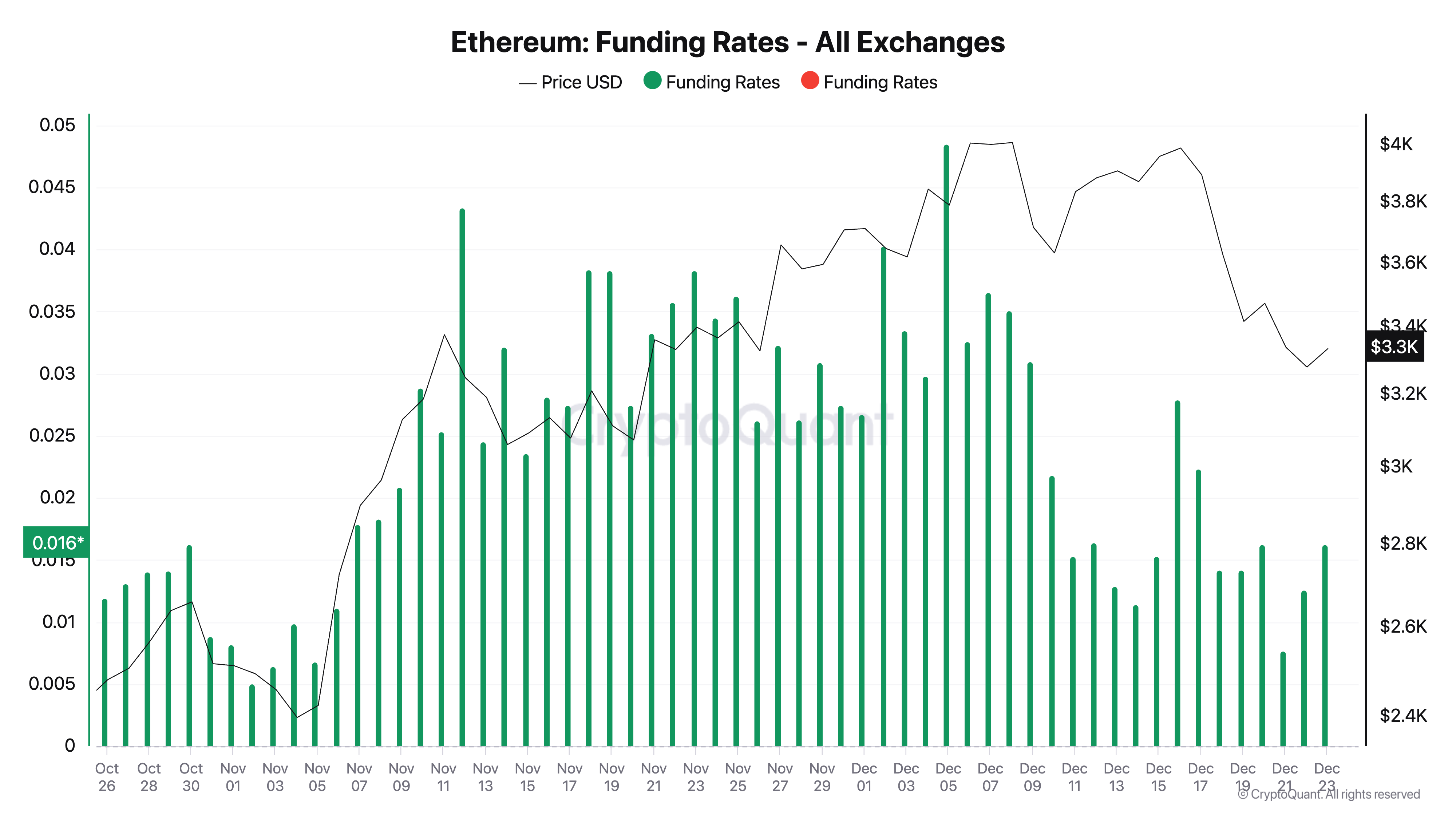

Additional, ETH’s constructive funding charge is one other signal that its worth might quickly witness a rebound. In response to CryptoQuant, this at present stands at 0.016. Regardless of the current worth decline, the funding charge throughout cryptocurrency exchanges has stayed constructive, reflecting a bullish sentiment towards ETH.

Ethereum Funding Price. Supply: CryptoQuant

An asset’s funding charge is a periodic charge exchanged between lengthy and brief merchants in its futures market. It ensures the perpetual futures worth aligns with the spot worth. When it’s constructive, lengthy merchants are paying shorts, indicating bullish sentiment and expectations of worth will increase.

ETH Worth Prediction: Will $4,000 Be the Subsequent Cease?

ETH is at present buying and selling at $3,344. If the bullish bias persists and shopping for exercise picks up, ETH’s worth may rally above the $3,439 resistance. A breakthrough at this stage may drive the coin towards $3,733, paving the way in which for it to surpass the $4,000 psychological barrier.

Ethereum Worth Evaluation. Supply: TradingView

Nonetheless, if the downward pattern persists, ETH’s worth may drop to $3,232, invalidating this bullish outlook.