Ethereum whale dominance is on the peak and it’s laborious to disregard what this might imply for the longer term. It’s highest in historical past to date. Whereas smaller buyers maintain lower than ever, whales are quietly accumulating extra ETH. Is that this an indication of one other bull run, or one thing else completely?

Whales Are in Management

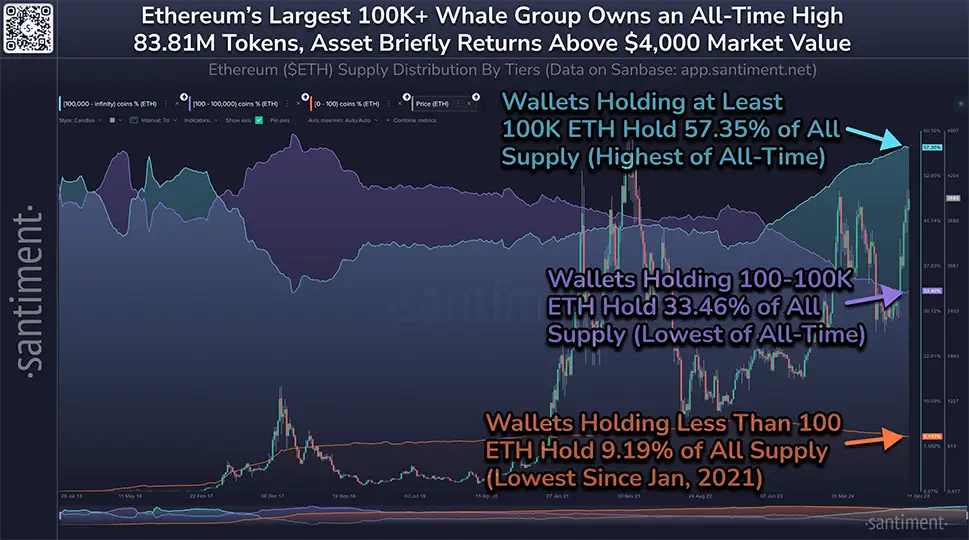

As of now, 104 wallets maintain over 100,000 ETH every. That’s 57.35% of Ethereum’s complete provide, the very best degree ever recorded. Whereas these large wallets develop in energy, mid-sized buyers (these holding between 100 and 100,000 ETH) now management simply 33.46%, the bottom share in historical past.

Supply : Santiment

It’s not wanting nice for small buyers both. Wallets with lower than 100 ETH make up simply 9.19% of the availability. That’s their smallest slice since January 2021. The pattern has been constructing since late 2022, when large buyers started aggressively accumulating ETH. Clearly, the whales know one thing, and so they’re taking part in the lengthy recreation marking the rise in Ethereum whale dominance.

Historical past Reveals Whales Transfer the Market

This isn’t the primary time whales have formed Ethereum’s value. Again in late 2020 and early 2021, related ranges of whale accumulation kicked off an enormous bull run that despatched ETH to new heights. However there’s a flip facet to this. When whale dominance peaked in 2022, it was adopted by a pointy value correction.

Whale exercise doesn’t simply occur—it’s usually a sign. Proper now, ETH sits at $4,015, with rapid resistance at $4,109. On the 4-hour chart, the closest 20-day shifting common (MA) is at $3,931, and robust help rests at $3,575, backed by the MA 200.

The technical indicators present cautious optimism. The Relative Power Index (RSI) sits at 58.42, that means ETH isn’t in overbought territory but. Nonetheless, On-Stability Quantity (OBV) at -44.94 displays a degree of hesitation amongst buyers.

Cash In, Cash Out: Investor Breakdown

A better take a look at investor conduct provides extra context. Based on IntoTheBlock information, 74% of Ethereum holders have saved their belongings for over a yr. Quick-term holders break down like this:

- 22% purchased ETH between 1 month and 12 months in the past.

- 4% are newer buyers, shopping for throughout the final month.

Profitability paints a bullish image, too. Proper now:

- 94% of buyers are in revenue.

- 3% are breaking even.

- Solely 3% are at a loss, primarily those that purchased throughout Ethereum’s all-time excessive (ATH) of $4,891 in November 2021.

Supply : IntoTheBlock

Nonetheless, there are nonetheless round 4.27 million addresses holding 1.21 million ETH in loss. Most of those losses occurred when ETH was bought between $4,093 and $4,891—not removed from the present value degree.

What’s Subsequent?

So what does all of this imply for the common investor? Effectively, it relies upon. On the bullish facet, whales appear assured. They’re shopping for up Ethereum, particularly throughout dips, and this usually indicators long-term optimism. If this pattern continues, ETH may climb to the $4,500 – $5,000 vary.

However there’s a threat, too. When a number of wallets maintain a lot of the availability, the market turns into susceptible. A coordinated sell-off from these whales may trigger a sudden drop. It’s one thing to observe intently as ETH’s story unfolds.

Both means, Ethereum whale dominance is a transparent reminder: the large gamers nonetheless have probably the most energy on this market.