Ethereum (ETH) seems to be gearing up for a serious breakout, with its market construction intently resembling Bitcoin’s (BTC) previous cycle.

Notably, an evaluation by Titan of Crypto means that Ethereum’s present value motion intently resembles Bitcoin’s trajectory simply earlier than its explosive breakout within the earlier bull run.

Ethereum key ranges and breakout alerts

A comparability of market cycles by the analyst exhibits that Bitcoin, throughout its third cycle, consolidated inside a symmetrical triangle earlier than experiencing a pointy breakout.

Now, Ethereum, in its fourth cycle, is following a virtually an identical sample, suggesting {that a} vital rally could possibly be on the horizon.

Ethereum is at present buying and selling round $2,707, with $3,000 rising as an important resistance stage that might decide its subsequent transfer.

If Ethereum efficiently flips $3,000 into assist, it may clear the way in which for a surge towards $4,000. A breakout above this zone would affirm bullish momentum, doubtlessly propelling Ethereum towards even greater value targets.

If the fractal sample holds, Ethereum could possibly be primed for its most explosive breakout but, just like Bitcoin’s historic rally from a comparable setup.

Nonetheless, failure to interrupt above resistance may lead to extended consolidation, delaying the anticipated transfer.

Including to the bullish outlook, a current evaluation by TedPillows means that Ethereum has entered a short-term growth part following a chronic interval of accumulation and manipulation.

This breakout from consolidation, as famous by the analyst, signifies that ETH could possibly be on the verge of a serious value surge, with projections pointing to new highs by March 2025.

Elements driving optimism for Ethereum

Ethereum’s bullish momentum is gaining traction, fueled by a mix of upcoming community upgrades, surging ETF inflows, and contemporary speculative curiosity sparked by Eric Trump’s endorsement.

The Pectra improve, scheduled for March 2025, is predicted to considerably improve Ethereum’s scalability, transaction speeds, and value effectivity.

With take a look at runs already underway on Ethereum’s Sepolia and Holesky networks, the improve may entice extra builders, additional driving demand for ETH.

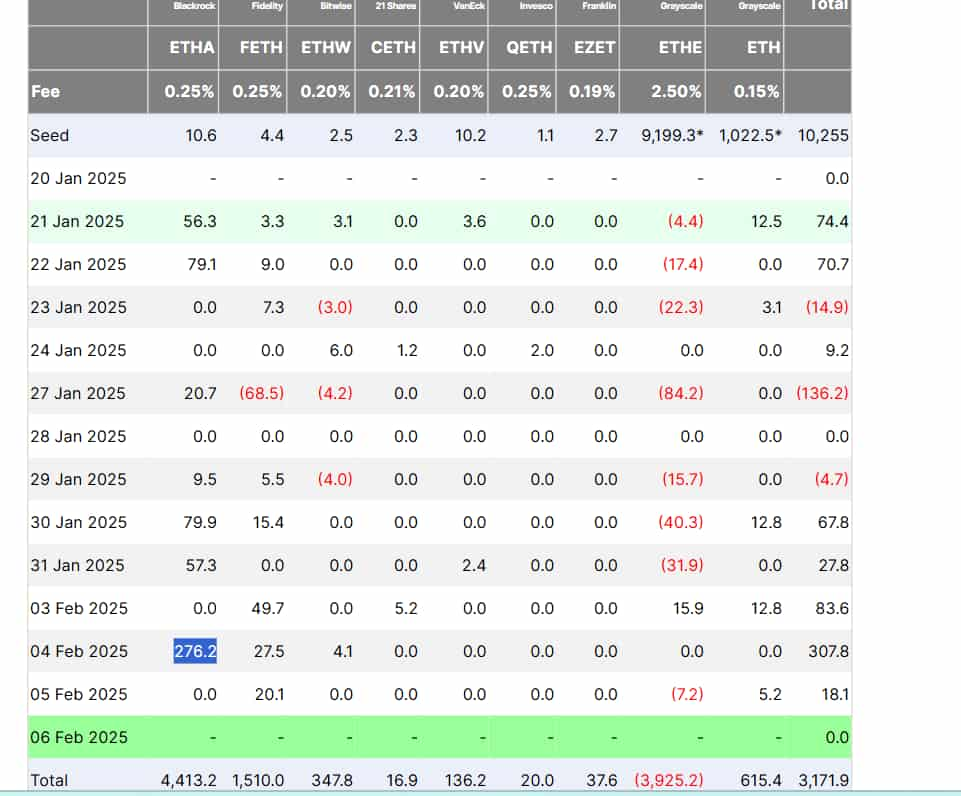

Furthermore, institutional curiosity in Ethereum is on the rise, with US-based spot Ethereum ETFs recording 5 consecutive days of inflows, totaling $505.1 million from January 30 to February 5, 2025, in accordance with knowledge from Farside.

Main the surge, BlackRock’s ETHA fund emerged as the highest purchaser, accumulating $579 million in inflows between January 21 and February 5.

In the meantime, Eric Trump’s current endorsement of Ethereum has additionally triggered renewed speculative curiosity, notably amongst retail traders.

Whereas such endorsements don’t instantly influence Ethereum’s fundamentals, they typically contribute to short-term shopping for momentum, additional supporting ETH’s restoration.

What’s subsequent for Ethereum?

With rising curiosity from institutional traders and enormous particular person holders, Ethereum seems well-positioned to maintain its upward momentum.

Because the cryptocurrency inches nearer to the essential $3,000 resistance stage, market members are watching intently to see if it may break by way of and ensure a bullish pattern.

With technical indicators aligning and basic elements strengthening, Ethereum’s present part may set the stage for a surge towards new all-time highs within the coming months.

Featured picture through Shutterstock