Ethereum’s whole worth locked dropped 27% to $97 billion in February, because the broader decentralized finance sector fell from $217 billion to $168 billion amid liquidity outflows.

Decentralized finance‘s whole worth locked fell by practically 23% in February, dropping from $217 billion to $168 billion as market volatility, liquidity shifts, and capital outflows pressured key protocols, says DappRadar’s analyst Sara Gherghelas.

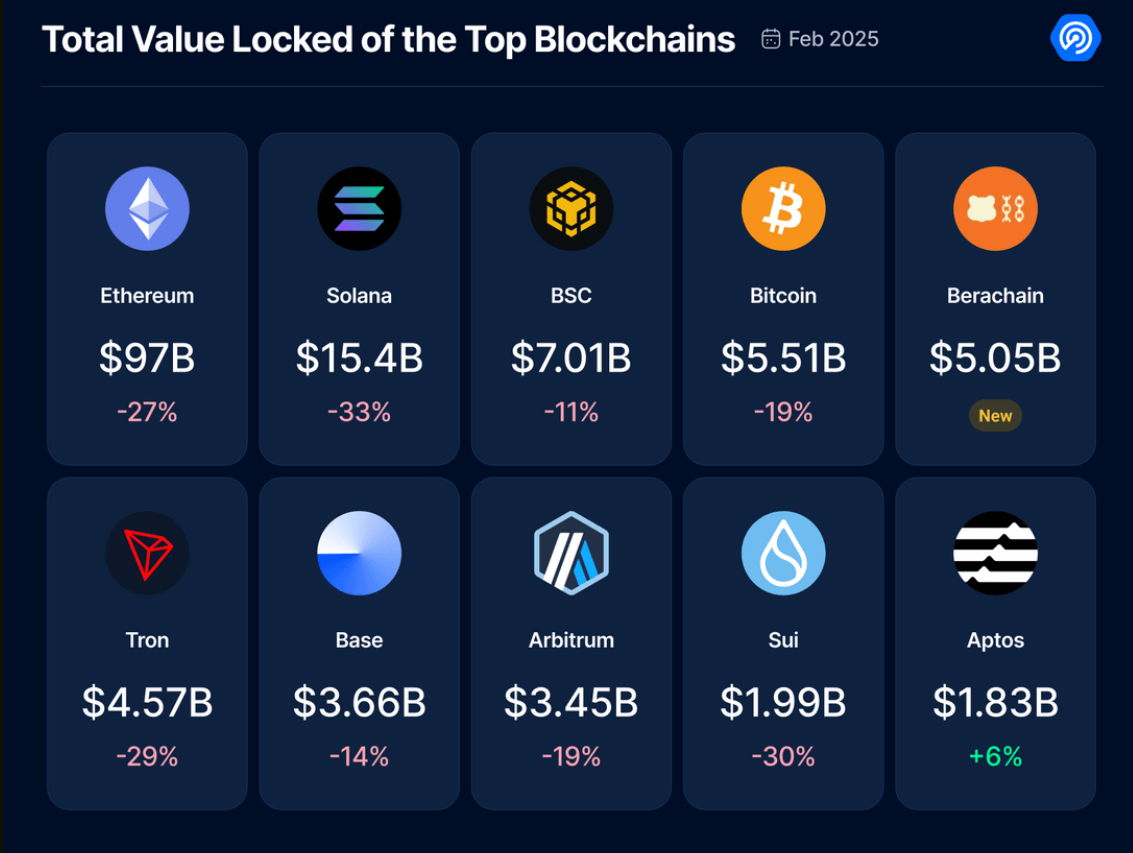

In a latest analysis report, Gherghelas identified that Ethereum (ETH), which holds practically 60% of DeFi’s liquidity, noticed its TVL fall 27% to $97 billion in February. The decline was primarily attributable to decrease liquidity in liquid staking protocols, the analyst notes. Nevertheless, regardless of the decline, Ethereum’s dominance on this space “stays unchallenged,” per Gherghelas.

TVL of the highest networks | Supply: DappRadar

Solana (SOL) suffered the most important losses in February as its TVL dropped by greater than 30% to $15.4 billion. The decline got here after a robust January and was possible pushed by “profit-taking and liquidity migration towards extra secure DeFi environments,” says the DappRadar analyst. On high of that, exercise additionally slowed on key Solana-based platforms like crypto alternate Jupiter and Raydium.

Whereas most main chains confronted challenges, Berachain (BERA) turned out to be one of many few winners, reaching a TVL of $5.05 billion, in line with information.

“The chain’s rise is fueled by its proof-of-liquidity mannequin, which has attracted customers by means of profitable liquid staking and yield farming incentives. As customers search excessive returns regardless of broader market declines, Berachain is positioning itself as a key participant within the evolving DeFi panorama.”

Sara Gherghelas

You may also like: Ethereum’s Pectra improve on Sepolia encounters points

BNB Chain (BNB) noticed a smaller drop of 11%, helped by stablecoin buying and selling. In the meantime, TRON’s (TRX) TVL fell 29%, possible attributable to weaker demand for Tether’s (USDT) transactions. Aptos (APT) was additionally one of many uncommon gainers, growing its TVL by 6% to $1.83 billion.

Ethereum’s drop in TVL comes as futures open curiosity in key cryptocurrencies additionally fell sharply. As crypto.information reported, merchants have began decreasing lengthy positions, with futures open curiosity falling amid issues over the commerce struggle and the Fed’s powerful stance. Matrixport analysts imagine many merchants are ready for clearer indicators earlier than re-entering the market.

Whereas the upcoming Pectra improve, which goals to enhance community performance and price effectivity, may present a short-term enhance, it’s unclear whether or not these upgrades will likely be sufficient to reverse the decline in DeFi exercise.

Learn extra: Crypto.com joins CF Benchmarks, enhancing Bitcoin and Ethereum indices