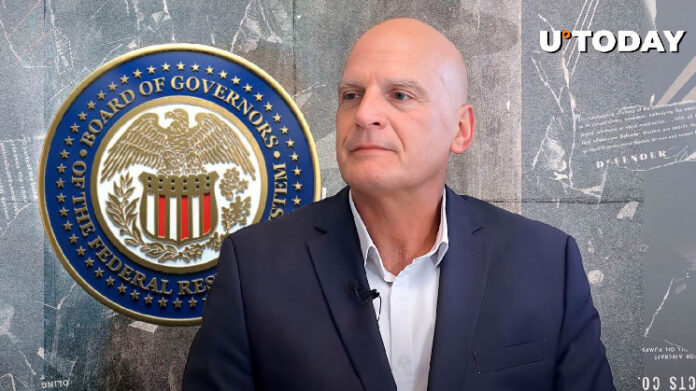

Mike McGlone, the senior commodities strategist for Bloomberg Intelligence, has revealed a tweet the place he shared his tackle the present scenario on the U.S. commodities markets and the way it could influence the choice of the Fed Reserve to implement additional tightening.

McGlone sounds uncertain on Fed’s additional easing coverage

Mike McGlone tweeted that at present rising developments in cryptocurrencies, commodities and shares will be noticed. The knowledgeable additionally indicated “sticky inflation” and low unemployment. McGlone reckons that each one these optimistic components might create a problem for the financial coverage of the Fed Reserve as of February 2025.

Rebounding Commodities May Gas Fed Tightening – The #stockmarket and #cryptocurrencies are creating huge presumed wealth, #inflation is sticky, unemployment has stopped rising and #commodities have turned increased. Is that this an setting for #FederalReserve easing?

Full… pic.twitter.com/AdxNDXCpzQ— Mike McGlone (@mikemcglone11) February 21, 2025

McGlone asks: “Is that this an setting for Federal Reserve easing?” as if hinting that he has severe doubts within the Fed persevering with its dovish coverage and it might preserve the present stage of the rates of interest and even start to boost them. This may occasionally have a detrimental impact on crypto costs, whereas throughout charges easing Bitcoin often goes up with altcoins following it.

To this point, the choice to carry the charges at 4.25-4.50% introduced by the U.S. central financial institution in January appears to be reflecting the Fed’s issues about protecting inflation and employment in stability, aligning with the financial circumstances.

Robert Kiyosaki highlights Bitcoin resilience

Robert Kiyosaki, effectively referred to as the creator of the best-selling ebook “Wealthy Dad Poor Dad,” has revealed a tweet, predicting an enormous market crash. He expects all main property — shares, bonds, actual property, gold, silver and Bitcoin — to break down.

Ought to this occur, Kiyosaki tweeted, he won’t promote his Bitcoin and can even purchase extra of it: “I’ll again up the truck and purchase extra.” That’s his “after-the-crash” plan, in keeping with his contemporary tweet.

What’s curious, the monetary guru believes that ought to Bitcoin crash when “The All the pieces Bubble” collapses, will probably be the one asset that may recuperate and surge to new highs sooner than the whole lot else available in the market.

After the two.58% surge over the previous 24 hours, the world’s bellwether cryptocurrency Bitcoin has instantly printed a big crimson candle on an hourly chart and went down sharply, dropping nearly 1%. On the time of this writing, BTC is altering palms at $98,590 per coin.