Cryptocurrencies backed by gold have underperformed over the week as the value of the valuable steel noticed a major drop after transferring up greater than 10% thus far this 12 months. The decline got here as hypothesis surrounding Trump’s tariffs being a negotiating software.

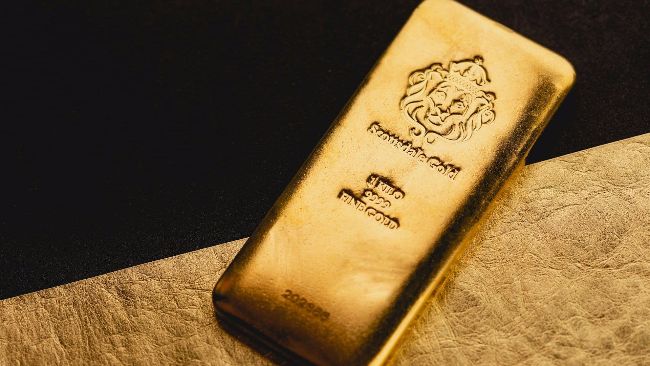

Gold-backed tokens, together with Paxos gold (PAXG) and Tether gold (XAUT), have declined roughly 1% over the previous week to commerce round $2,900 whereas the broader crypto market rallied. The CoinDesk 20 Index rose 5.7% over the identical interval, and the broader MarketVector Digital Property 100 Index (MVDA) rose 3.4%.

The dear steel noticed its value drop amid rising hypothesis that the brand new tariffs threatened by U.S. President Donald Trump are supposed to be a negotiating software. This hit the value of safe-haven belongings, together with the commodity and the U.S. greenback.

Trump introduced reciprocal tariffs had been on the desk to match the tariff imposed by different international locations on U.S. imports. Reciprocal tariffs might take months to implement, resulting in hypothesis these are supposed to permit the U.S. to barter with different international locations.

Nevertheless, in accordance with a current Morgan Stanley report, gold’s current dip might nonetheless current an “alternative for these in search of hedges” amid world reflation, geopolitical tensions, and rising fiscal spending. Wall Road giants have not too long ago raised their gold value forecasts, which might additionally assist the value of gold-backed digital belongings rise as these are backed by bullion saved in vaults.

Citi strategists not too long ago raised their short-term gold value goal to $3,000 and their common forecast for the 12 months to $2,900. In the meantime, UBS has hiked its 12-month gold goal to $3,000 an oz.