Ethereum has entered a consolidation part after a short-term restoration, with the worth stalling beneath key resistance ranges. But, contemplating market sentiment, the asset may very well be on the verge of a deeper decline.

Technical Evaluation

By Edris Derakhshi

The Each day Chart

ETH’s every day chart exhibits that the worth remains to be struggling to interrupt above the $2,200 resistance zone. The restoration from the $1,800 low has misplaced momentum, and ETH continues to commerce effectively beneath the 200-day transferring common, which sits close to $2,900.

The RSI can be cooling off slightly below the 50 stage, reflecting an absence of robust development course. For the consumers to regain management, ETH should shut above $2,200 and observe via towards $2,400. Failure to take action dangers a gradual bleed again towards the $1,800-$1,900 assist zone.

The 4-Hour Chart

On the 4-hour timeframe, Ethereum is now breaking beneath the decrease boundary of the ascending channel, signaling a possible shift within the short-term development. The breakdown from this rising construction across the $2,000 mark exhibits bullish momentum has weakened, and consumers didn’t defend the channel’s assist.

Furthermore, the RSI is trending downward, reinforcing bearish strain. If this breakdown holds, ETH might revisit the $1,900 demand zone subsequent. A restoration again above $2,100 can be wanted to neutralize the bearish construction, however because it stands, the danger of additional draw back is rising.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

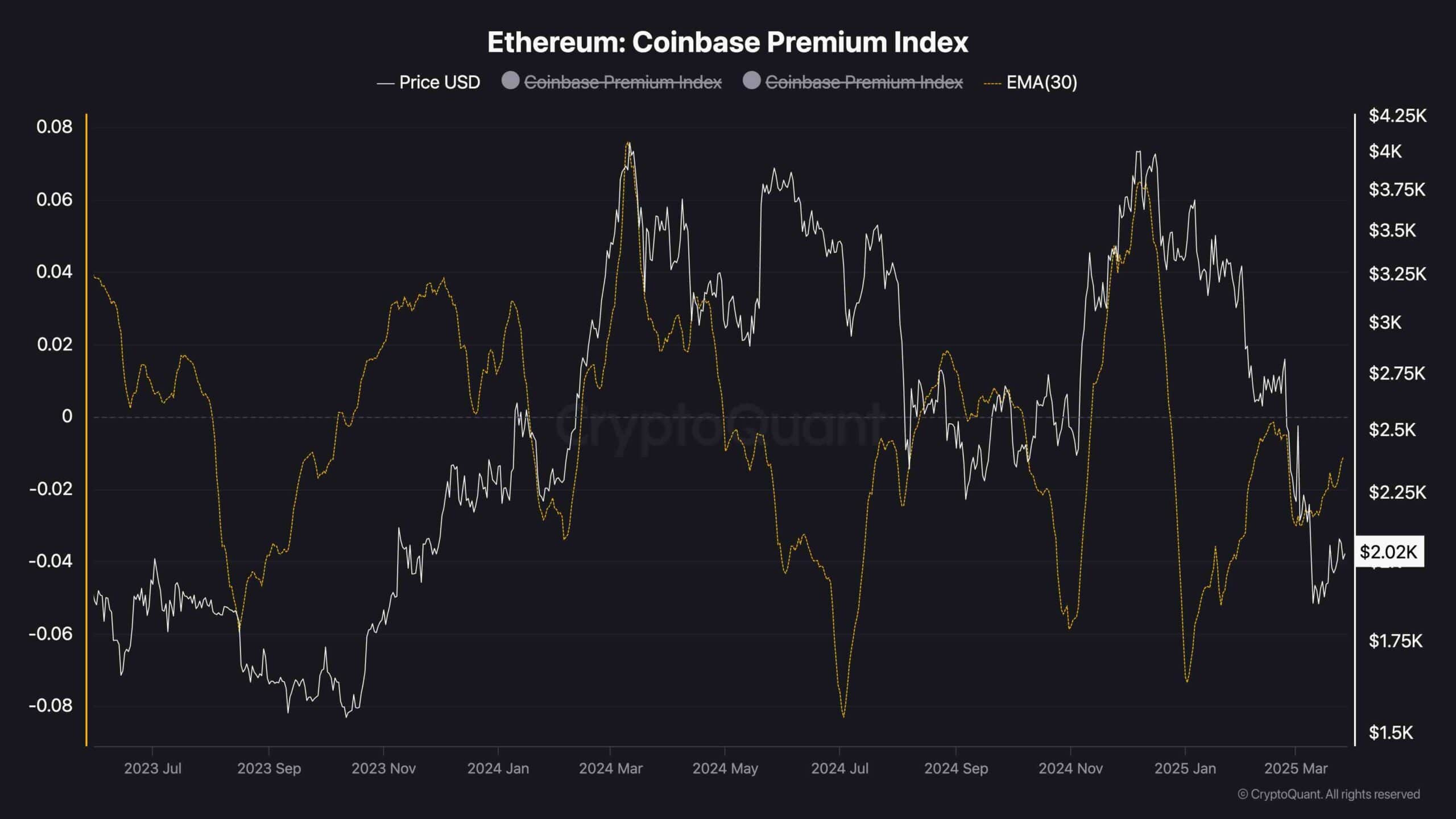

Coinbase Premium Index (30-day EMA)

The Coinbase Premium Index stays in unfavorable territory, indicating that Ethereum remains to be buying and selling at a reduction on Coinbase in comparison with different main exchanges. This implies that US-based traders — usually considered as institutional or extra conservative — present restricted demand and even distribute.

Persistent unfavorable premium usually displays weak spot market curiosity from the US, which might weigh on value motion, particularly throughout unsure market phases. Till this metric flips optimistic and holds, it indicators an absence of robust spot-driven accumulation and provides to the bearish undertone within the present ETH atmosphere.