Bitcoin’s hashrate has been climbing steadily, with the community including 40 exahash per second (EH/s) over the previous 5 days, reaching 836 EH/s—edging near the protocol’s historic peak. As well as, as bitcoin’s value has moved upward, the hashprice—representing the estimated every day earnings from one petahash per second (PH/s) of computing energy—has additionally seen a rise.

Bitcoin Miners Navigate Tight Margins as Hashrate Nears Peak

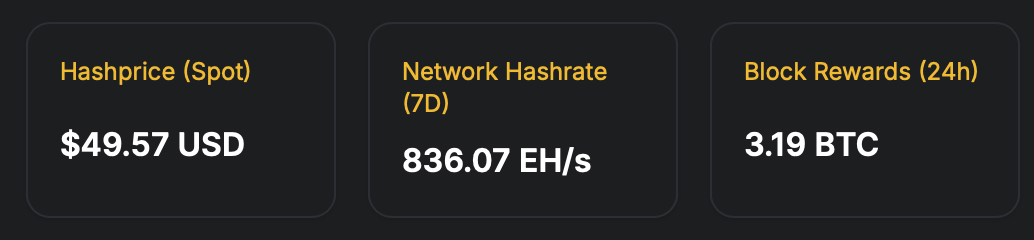

On Tuesday, March 25, 2025, bitcoin miners noticed improved earnings in comparison with the earlier week. On March 18, the estimated worth of 1 petahash per day stood at $46.21; right now, it has risen to $49.57, in line with statistics collected by hashrateindex.com.

Bitcoin hashprice, hashrate, and common 24-hour block rewards by way of hashrateindex.com on March 25, 2025.

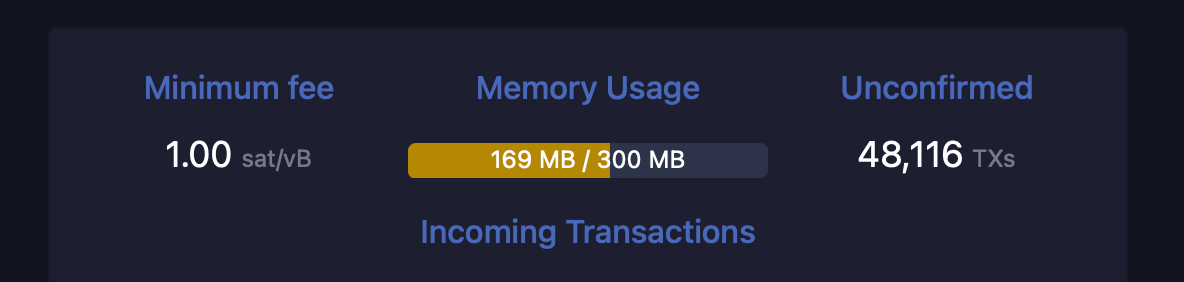

This uptick has supplied a modest reduction for miners, who had been experiencing tighter margins in the course of the preliminary three weeks of March. Information from mempool.house signifies a pickup in community exercise, with 48,116 unconfirmed transactions sitting within the mempool as of 6:30 p.m. Jap Time on Tuesday.

At current, the mempool has round 48,116 unconfirmed transactions ready for affirmation. Supply: mempool.house.

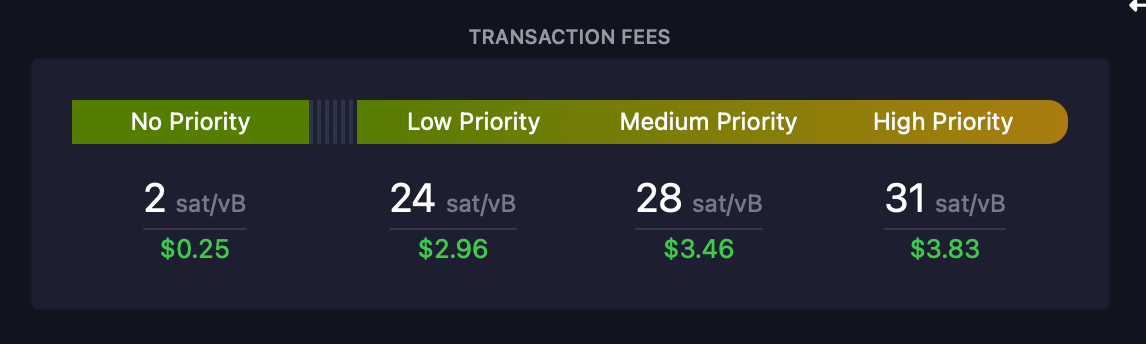

Transaction charges have inched up as effectively. On the present charge of 31 satoshis per digital byte (sat/vB), a high-priority switch now carries a value of $3.83. The current climb in BTC’s value is the first driver behind the income increase, as transaction charges have solely accounted for two.14% of whole earnings over the previous 24 hours.

Bitcoin charges have elevated in current instances. Supply: mempool.house.

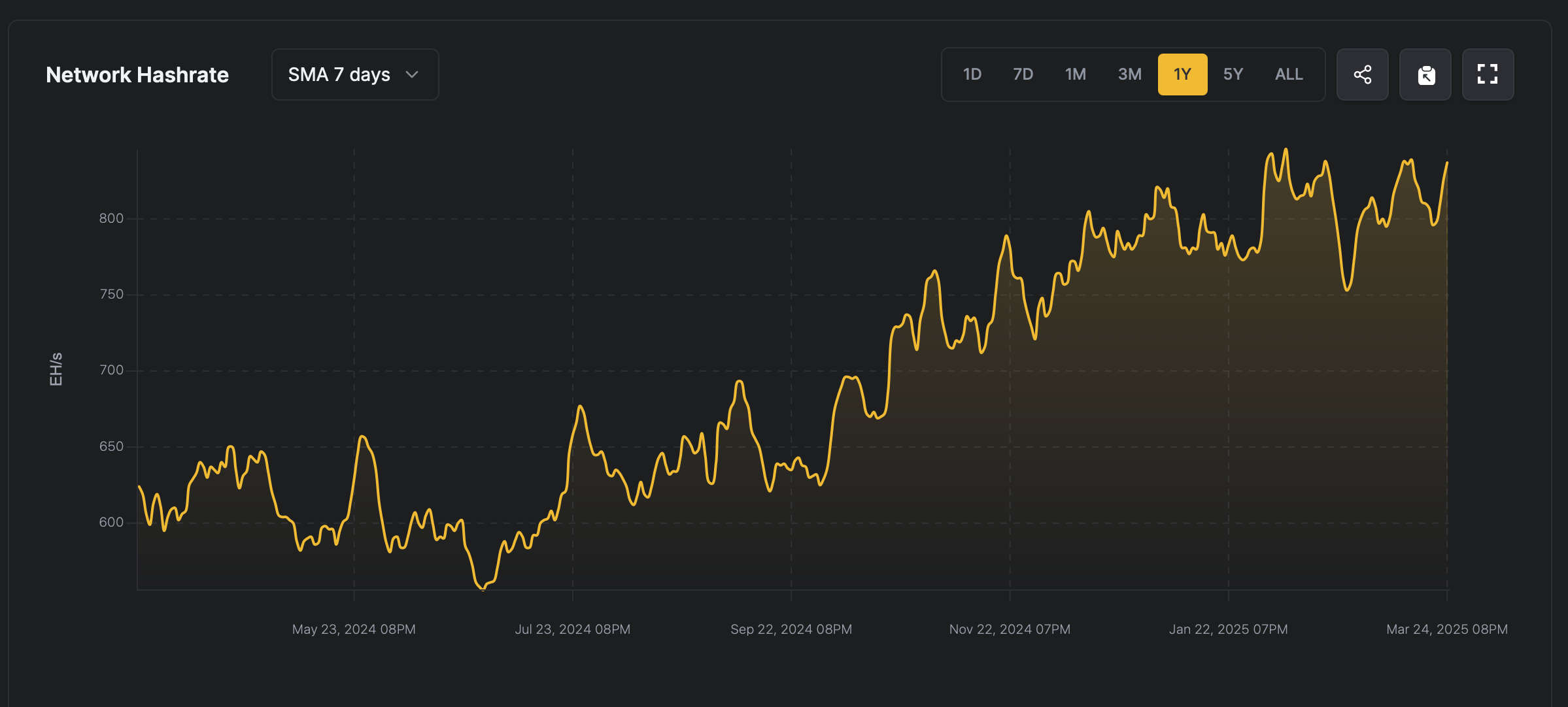

The most recent value motion has additionally pushed the hashrate increased, with the community gaining 40 EH/s—rising from 796 EH/s on March 20 to 836 EH/s right now. This upward pattern coincides with a 1.43% issue adjustment that befell two days in the past at block top 889,056.

Presently, mining issue is about at 113.76 trillion, barely under the all-time excessive of 114.17 trillion recorded six weeks earlier at block top 883,008. The present shift in community dynamics suggests a recalibration interval for miners, balancing operational prices towards earnings as issue and value fluctuate.

Bitcoin’s computational energy (seven-day easy shifting common) by way of hashrateindex.com on March 25, 2025.

With transaction charges nonetheless taking part in a minor position in income, miner profitability seems more and more tethered to BTC’s market worth. Because the protocol inches towards historic thresholds, individuals might have to adapt methods to navigate tightening margins and evolving community situations.

However, advances in application-specific built-in circuit (ASIC) {hardware} might also be contributing to the rise in computational output. Empirical evaluation reveals that fluctuations in bitcoin’s fiat valuation precipitate corresponding variations in community hashrate, manifesting after a temporal delay spanning one to 6 weeks—a rhythm dictated by miners calibrating operations to align with evolving revenue incentives.