Ethereum’s worth is lastly exhibiting indicators of bullish continuation after reclaiming a key degree.

Nonetheless, there’s nonetheless work to do for the market to pave its manner towards a brand new all-time excessive.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Every day Chart

On the every day chart, the value has rebounded from the $3,200 assist degree and broke $3,500 to the upside. If the asset is ready to maintain above this space, a rally towards the $4,000 degree may very well be anticipated within the quick time period.

With the RSI additionally exhibiting values above 50%, the momentum is bullish as soon as once more, which provides to the chance of this state of affairs occurring.

The 4-Hour Chart

The 4-hour chart reveals a extra clear image of current worth motion. Nonetheless, it additionally demonstrates a doubtlessly worrying sign. Whereas the market has damaged by the $3,500 degree with pressure, the bearish divergence between the current worth highs and the RSI indicator is a sign that must be considered.

This bearish divergence may result in at the least a pullback and retest of the $3,500 degree earlier than any continuation greater within the coming days.

On-Chain Evaluation

By Edris Derakhshi (TradingRage)

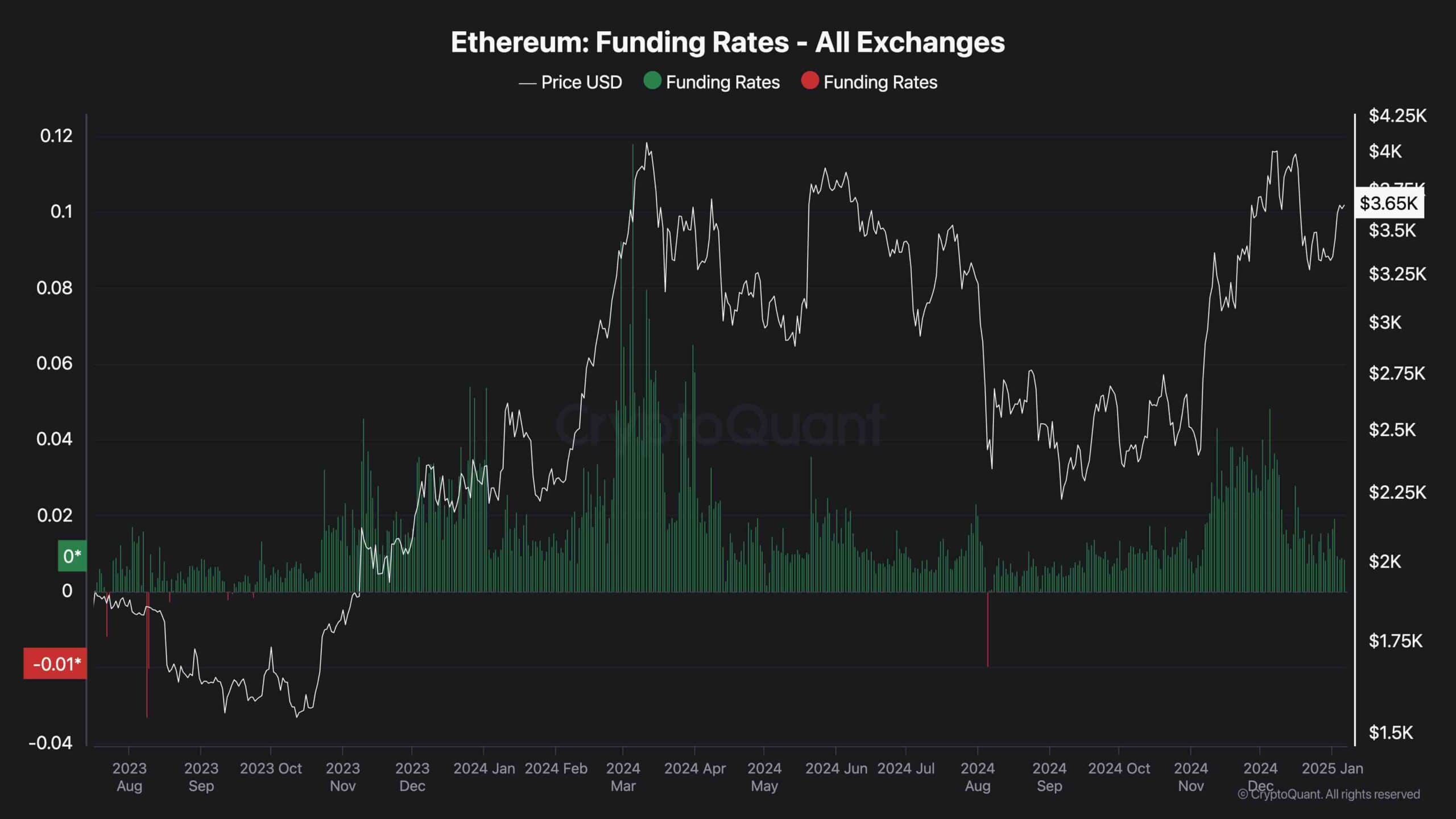

Ethereum Funding Charges

Whereas Ethereum’s worth has been holding above the $3,000 mark over the previous few months, many traders had been closely optimistic that the market will create a brand new all-time excessive quickly. Nonetheless, this important optimism has additionally led to a correction that halted the asset’s uptrend.

This chart presents the Ethereum funding charges metric, which measures whether or not the consumers or the sellers within the futures market are executing their orders extra aggressively. Because the chart presents, the funding charges confirmed extraordinarily excessive values when the value first approached the $4,000 degree. Nonetheless, the lengthy liquidation cascades occurring afterward have led to a correction and consolidation.

In the meantime, funding charges have decreased over the previous few weeks, indicating that the futures market sentiment has cooled considerably. This might end in a sustainable rally within the coming weeks if adequate demand is current within the spot market.