HIVE Digital plans to develop its hash charge 4x by September 2025, probably inserting it among the many high 10 public Bitcoin miners by measurement. Concurrently, it has $100M ARR goal for HPC. Is that this small-cap miner an ignored alternative?

HIVE Digital Units Sights on Enlargement and HPC Income

The next visitor submit comes from Bitcoinminingstock.io, the one-stop hub for all issues bitcoin mining shares, instructional instruments, and trade insights. Initially revealed on Feb. 27, 2025, it was penned by Bitcoinminingstock.io creator Cindy Feng.

For a very long time, Bitcoin mining’s largest names get all the eye—however what about smaller ones? This 12 months, I’m launching a brand new collection to highlight small-cap miners that always fly below the radar. A few of these firms have the potential to rise as future stars, whereas others might battle to outlive. Understanding them now may help uncover hidden alternatives or be taught beneficial classes. On this collection, I’ll break down their enterprise fundamentals, financials, strategic course, and market positioning—supplying you with a transparent, unfiltered view of their strengths, weaknesses, and funding potential.

First up: Hive Digital Applied sciences, a multi-listed Bitcoin miner with publicity to each mining and Excessive-Efficiency Computing (HPC).

Firm Overview

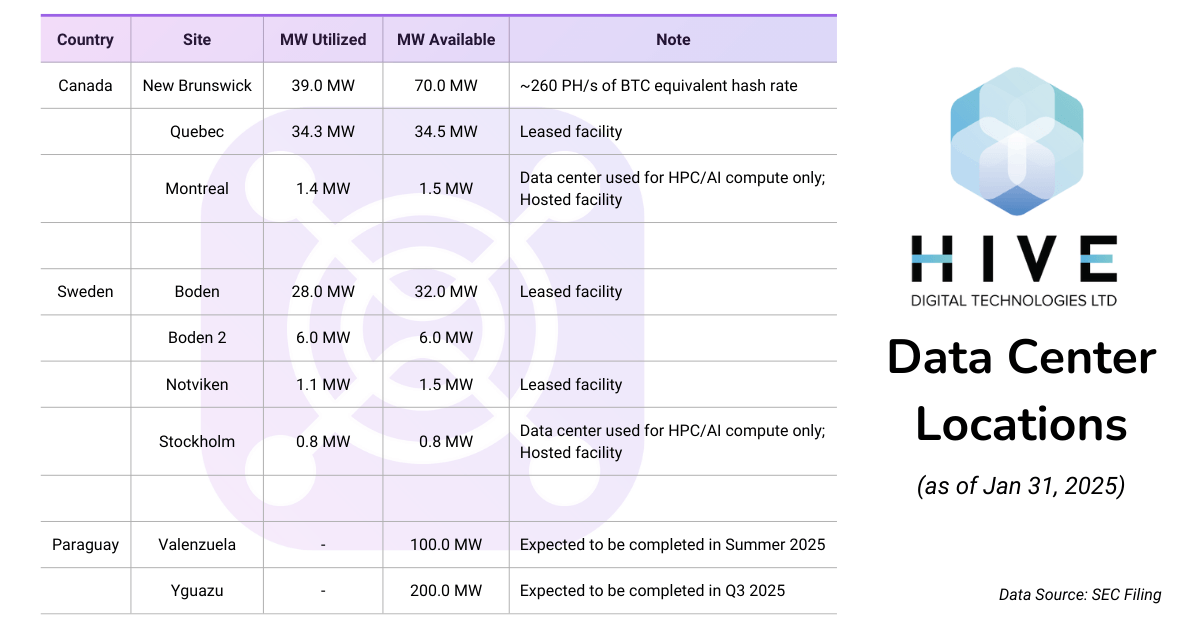

Hive Digital Applied sciences (TSX.V: HIVE; NASDAQ: HIVE ) is a publicly traded information heart operator that focuses on digital asset mining and HPC. In December 2024, it introduced the relocation of its head workplace to San Antonio, Texas, USA. The corporate has information facilities throughout a number of geographies, together with Canada, Sweden, and shortly Paraguay. It’s recognized for its dedication to inexperienced vitality, primarily using hydroelectric and geothermal to energy its operations.

Enterprise Arms

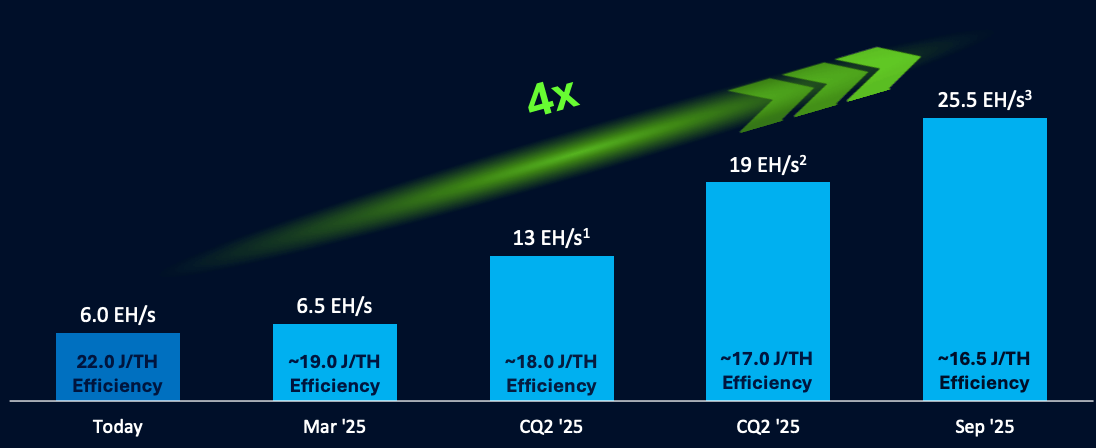

- Mining Operations: The corporate operates a complete hashrate of 6 EH/s (as of Jan 31, 2025), with an aggressive growth plan to succeed in 25 EH/s by September 2025.

HIVE plans for 4x hash charge development by September 2025 (screenshot from the corporate presentation)

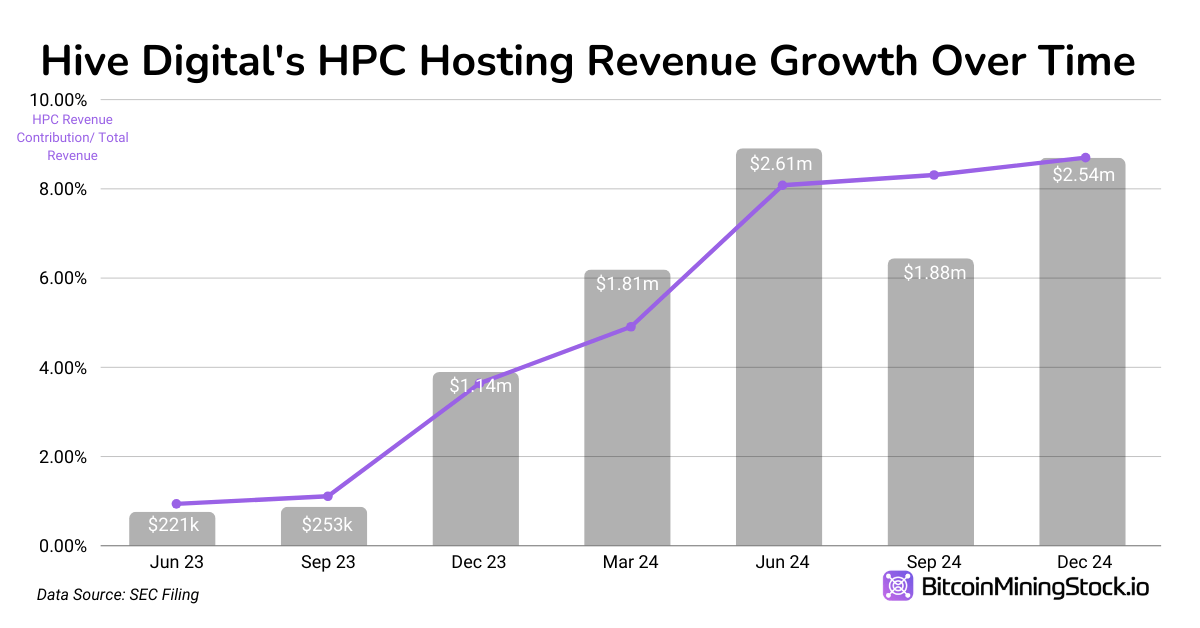

- HPC & AI Computing: HIVE was among the many first public miners to pivot to HPC, leveraging its GPU-based Ethereum mining experience. As early as 2023, the corporate reported $1.61 million in income from HPC internet hosting. Immediately, Hive continues to make the most of its present information facilities in Montreal (Canada) and Stockholm (Sweden) for HPC companies. Moreover, the corporate plans to supply GPU server leases by way of market aggregators and discover a brand new cloud service providing.

Monetary Highlights: Income Decline and Profitability Enchancment

Notes: HIVE presents monetary comparisons throughout completely different intervals in its newest report. The earnings assertion follows a typical year-over-year comparability (Dec 31, 2024, vs. Dec 31, 2023), whereas the stability sheet is in comparison with March 31, 2024. In the meantime, the money move assertion makes use of a nine-month comparability (Dec 31, 2024, vs. Dec 31, 2023). To make sure consistency and facilitate significant evaluation, this report primarily focuses on year-over-year comparisons the place accessible.

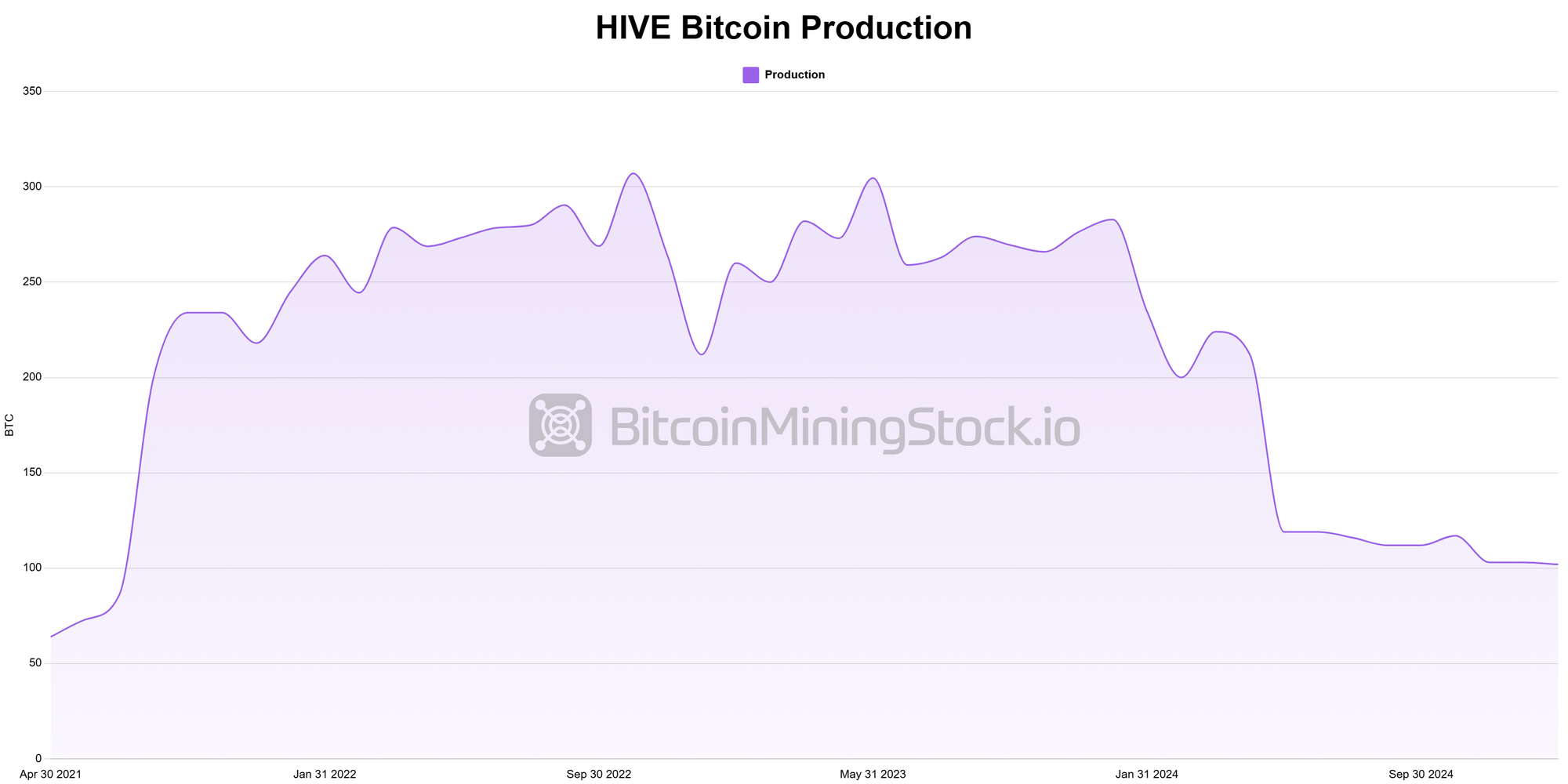

HIVE Digital Applied sciences’ fiscal Q3 2025 (Oct 1 – Dec 31, 2024) noticed a decline in income in comparison with earlier 12 months. The first issue of decline is much less BTC manufacturing as a result of Bitcoin halving occasion in April 2024. Nonetheless, the corporate has a big turnaround with web revenue ($1.27 million vs -$6.95 million), benefiting from Bitcoin value appreciation, rising HPC enterprise and price optimizations.

Key Revenue Assertion Metrics

- Income: $29.2 million (-6.5% YoY) vs. $31.3 million in Q3 2024. This decline was pushed by a drop in Bitcoin mining income (-11.3% YoY) on account of decrease manufacturing (322 BTC vs. 830 BTC in Q3 2024), following the April 2024 Bitcoin halving. Nonetheless, Bitcoin value appreciation and robust HPC income development (+123.6% YoY, reaching $2.5M) helped offset the decline.

- Adjusted EBITDA: $17.3 million (vs. $17.4M in Q3 2024).

- Internet Revenue: $1.3 million (vs. a $7.0 million web loss in Q3 2024). The swing to profitability was pushed by a $6.9M achieve on asset gross sales, $5.7M international trade achieve, and improved price efficiencies, regardless of a decrease gross margin in comparison with the earlier 12 months.

- Gross Margin: 21% (vs. 36% in Q3 2024), impacted by a sharp rise in community problem (99.9T vs. 64.1T YoY) and increased vitality prices, notably in Sweden, the place tax coverage adjustments led to elevated electrical energy bills.

- Bitcoin Manufacturing: 322 BTC (-61% YoY) vs. 830 BTC in Q3 2024. The Bitcoin halving occasion decreased mining rewards, regardless of enhancements in HIVE’s general hashrate and effectivity.

Historic information of public Bitcoin miners is now accessible on Bitcoinminingstock.io.

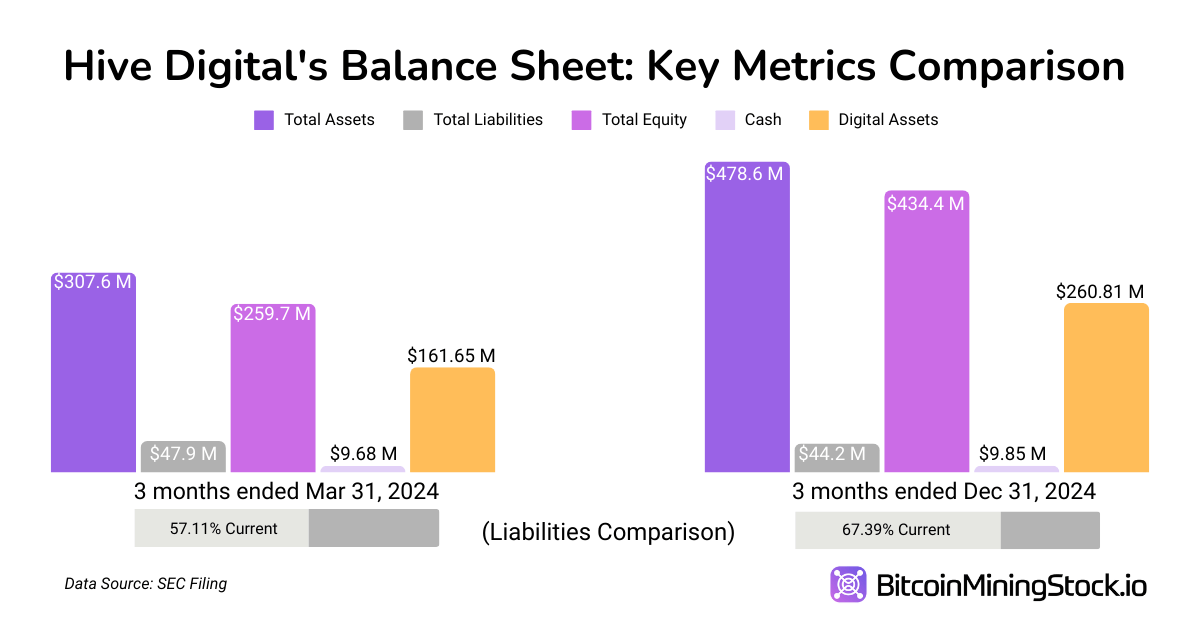

Key Stability Sheet Metrics (Three months ended December 31, 2024, vs. Three months ended March 31, 2024 )

- Whole Property: $478.6 million (+55.6%) vs. $307.6 million. The rise was pushed by increased Bitcoin holdings (2,805 BTC) and ongoing investments in mining infrastructure, notably fleet upgrades and new information heart expansions in Paraguay.

- Whole Present Liabilities: $29.8 million (+8.8% ) vs. $27.4 million. The rise displays increased short-term obligations linked to infrastructure investments.

- Lengthy-term Liabilities: $14.4 million (-29.8%) vs. $20.5 million. The lower is attributed to ongoing debt repayments, bettering HIVE’s monetary stability whereas sustaining adequate liquidity for growth.

- Stockholders’ Fairness: $434.4 million (+67.3%) vs. $259.7 million. Development in fairness was fueled by profitable fairness choices, increased asset valuations, and retained earnings.

- D/E Ratio: 0.10 (vs. 0.18 ). The corporate maintained a really low leverage, utilizing fairness raises reasonably than debt to fund growth.

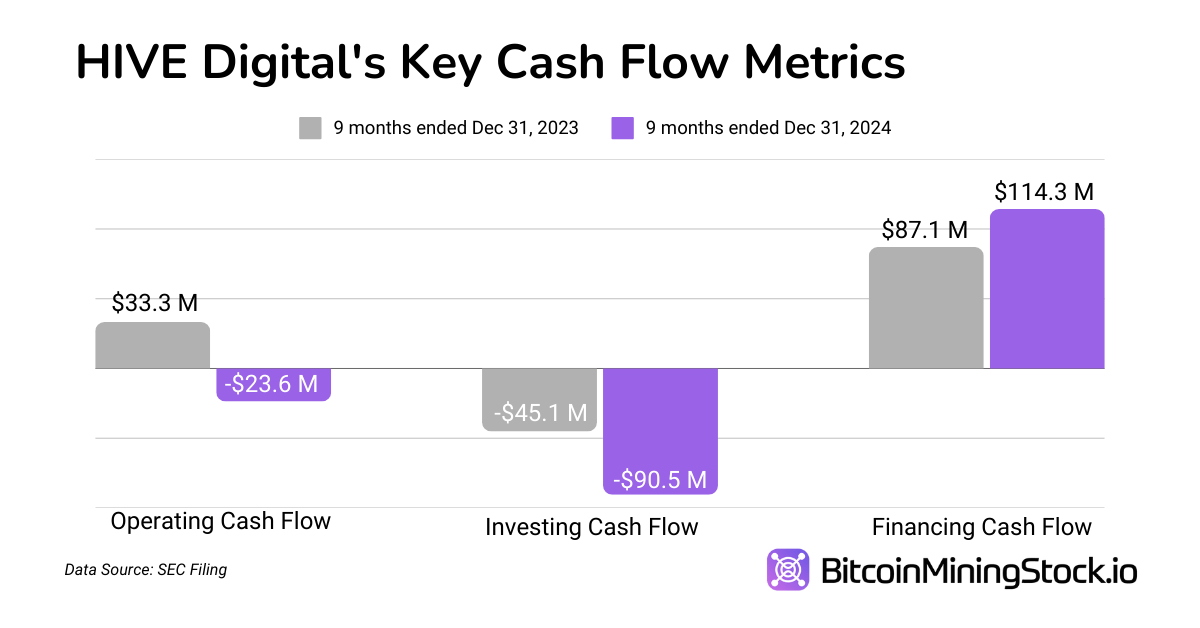

Key Money Circulation Metrics (9 months ended Dec 31, 2024, vs. 9 months ended Dec 31, 2023)

- Working Money Circulation: $23.6 million outflow (vs. $33.3M influx). This shift to destructive working money move was on account of decrease BTC gross sales quantity and better working capital wants, as the corporate HODL’d Bitcoin reasonably than promoting at decrease costs.

- Investing Money Circulation: $90.5 million outflow (vs. -$45.1 million). HIVE doubled capital investments, allocating $59.6M for brand new mining tools and buying the Boden 2 information heart in Sweden, as a part of its long-term growth technique.

- Financing Money Circulation: $114.3 million influx (vs. $87.1M). HIVE raised $121.0M by way of fairness choices, whereas repaying $3.0M in loans, sustaining a robust money place for upcoming infrastructure.

Foremost Valuation Metrics

Hive’s market cap at present stands at $385.4 million (Advertising and marketing closing on Dec 31, 2024). To raised perceive its valuation, we examine it towards key monetary metrics:

- Enterprise Worth (EV): $158.97 million (Market Cap + Debt – Money & Bitcoin Holdings). Hive trades at an EV per BTC mined of $89,834, near BTC’s market value. If Hive efficiently executes its growth and HPC technique, its present undervaluation presents a possible re-rating alternative.

- EV/EBITDA Ratio: 7.6x ($158.97M / $20.7M)

- Shares Excellent: 140.20M (+32%)

- EPS: $0.00988 (bettering from earlier −$0.0788)

- P/S Ratio: 13.2x ($385.4M / $29.2M)

- BTC Holding per Market Cap: 67.5%, which means a big portion of its valuation is tied on to BTC reserves.

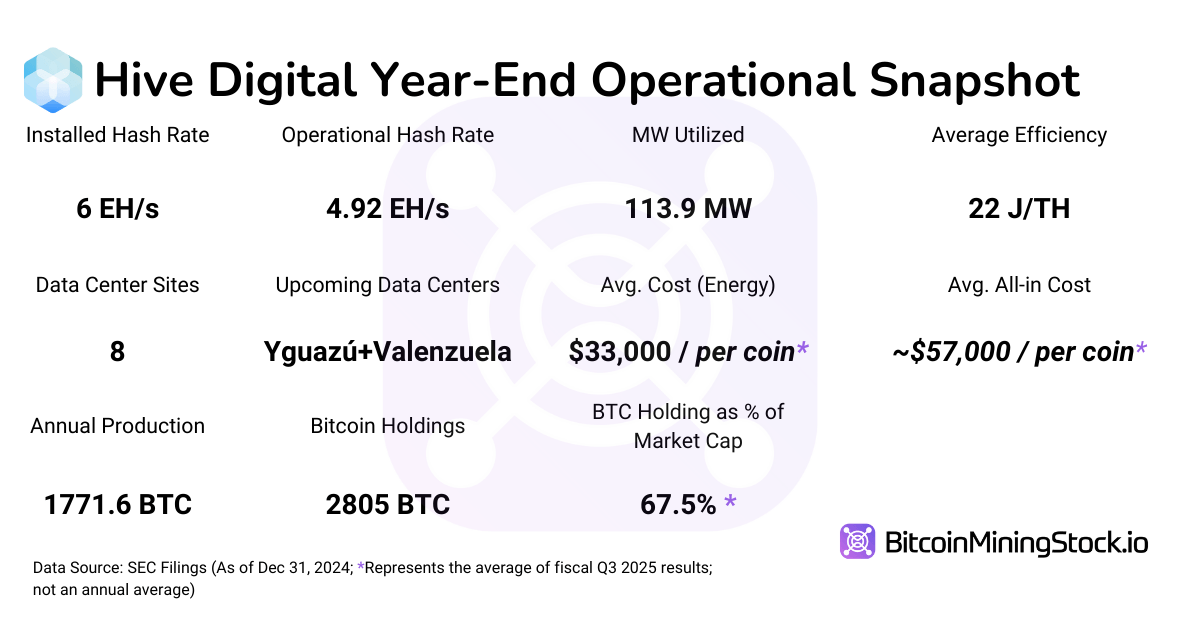

Operational Metrics: Hash Price & Effectivity

Key Hash Price & Effectivity Metrics:

- Hash Price: 6 EH/s, with a goal of 25 EH/s by September 2025.

- Fleet Upgrades: 11,500 items of Avalon A1566 ordered in Oct and Nov 2024 (6,500 of which has been deployed by Feb 11, 2025)

- Common Effectivity: 22 J/TH, anticipated to enhance to 16.5 J/TH by September 2025.

- Direct Vitality Price Per BTC: $33,000

- Whole Price Per BTC (Together with Depreciation & Financing): ~$57,000

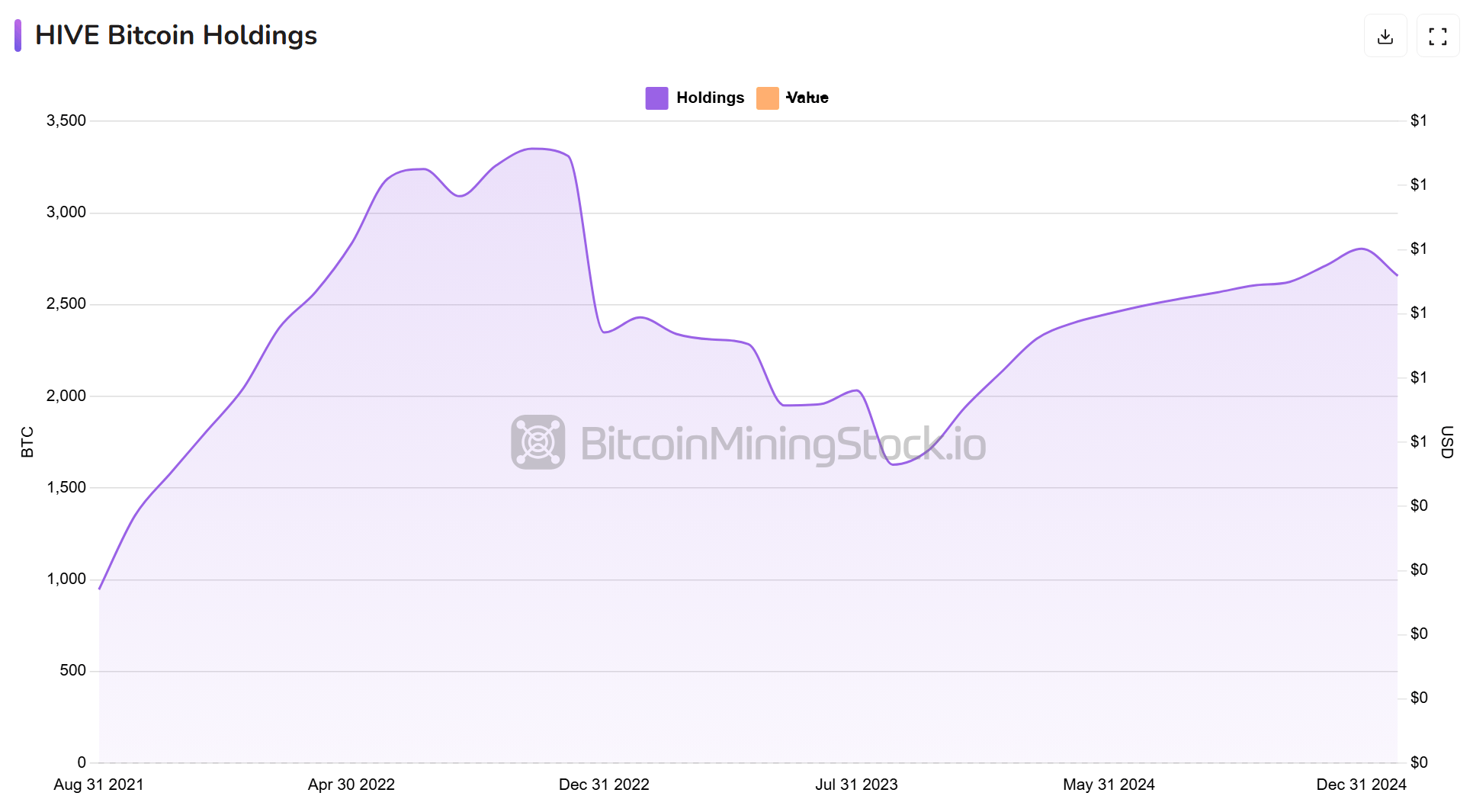

Key Digital Property Holding & Gross sales Knowledge:

- Whole Bitcoin Held: 2,805 BTC (unencumbered, mined with clear vitality).

- BTC Bought Throughout the Quarter: ~$8.4M vs. ~$30.7M in 2023

- Funding Operations: Fairness financing of $121M as a substitute of extreme BTC gross sales.

- Cash are saved with Fireblocks Inc., not on exchanges

- No pledge or staking on BTC holdings

*Hive nonetheless holds $371k price of different cash (ETC+ others)

Strategic Strikes

Bitfarms Website Acquisition in Paraguay: The Core Development Engine

Buying Bitfarm’s facility is “a formative step in direction of our technique to have 25 EH/s by September.” The deal features a 200MW hydro-powered mining web site (nonetheless below development) in Yguazú, Paraguay.Upon completion, Hive’s operational capability in Paraguay will whole 300MW, which can be one of many largest Bitcoin mining operations in Latin America.

Administration additionally has strengthened that Paraguay stays the corporate’s main focus for scaling operations. As CEO Aydin Kilic said, “We see alternatives within the U.S. on account of a extra favorable regulatory setting, however our main focus stays on scaling operations in Paraguay for now.”

Enlargement Roadmap:

- 100MW Yguazú Part 1 (April 2025): Including 6 EH/s.

- 100MW Valenzuela (June 2025): Including 6.5 EH/s.

- 100MW Yguazú Part 2 (September 2025): Including 6.5 EH/s.

- Goal fleet effectivity: 16.5 J/TH by September 2025.

Hive Digital’s Enlargement Roadmap in Paraguay (screenshot from the corporate web site)

Funding in HPC & AI Infrastructure: Small however Rising

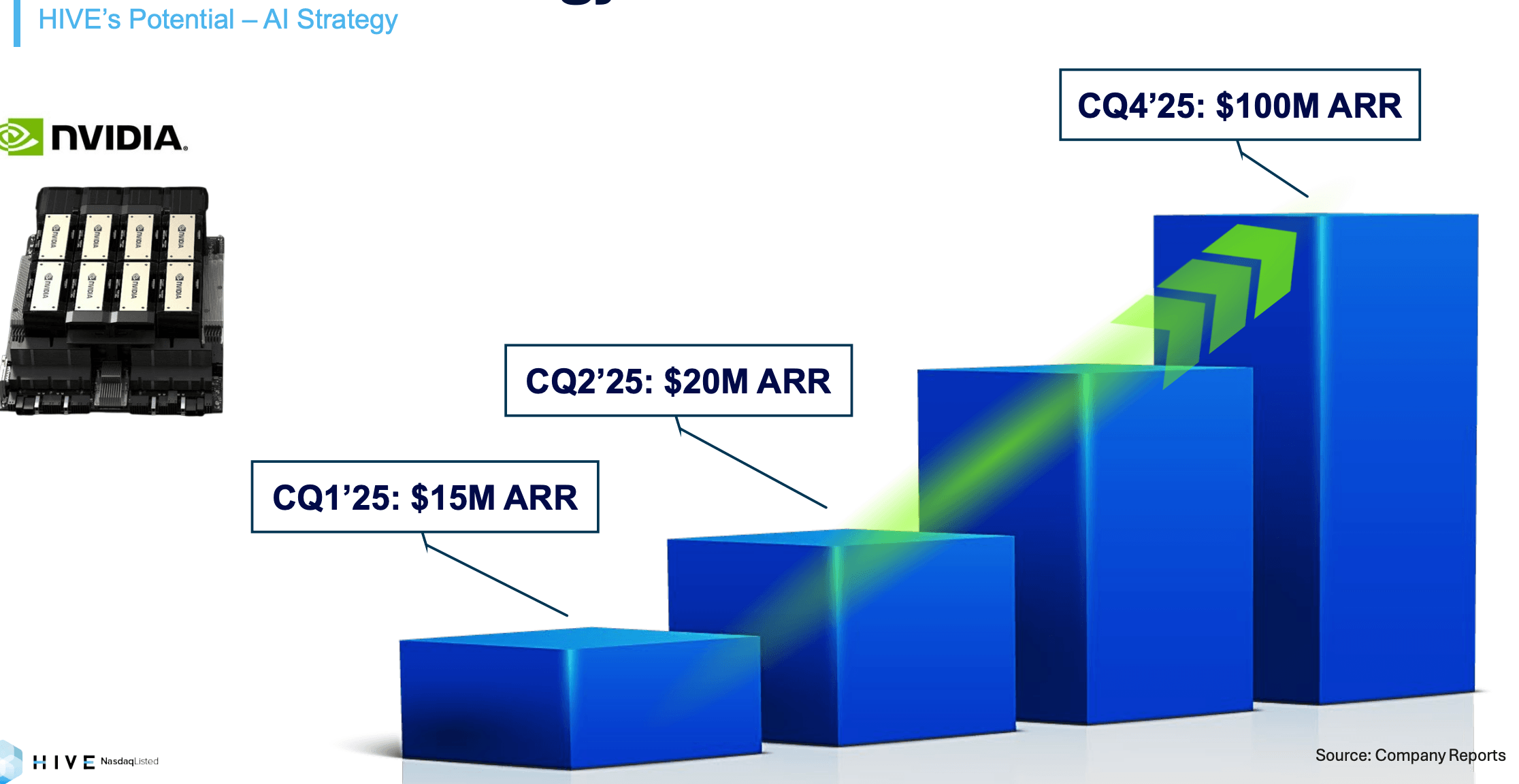

Whereas nonetheless small, AI/HPC income is rising quickly. Hive reached $2.5 million income in fiscal Q3 2025 (up 124% YoY) from its HPC operations, and the corporate initiatives to succeed in $20 million subsequent quarter and $100 million annualized income by the top of 2025.

Hive’s HPC/AI Income Development Projection (screenshot from the corporate presentation)

Present infrastructure:

- 4,000 GPUs in use (together with NVIDIA A4000, A5000, A40, and H100 )

- 508 Nvidia H200 GPUs anticipated by Q1 2025 (add $9 million in top-line income as soon as deployed)

- In preparation to place themselves for next-generation liquid-cooled Nvidia Blackwell GPUs

- Nvidia Cloud Companion standing secured, bettering credibility.

In contrast to friends who give attention to partnerships with hyperscalers, Hive plans to lease on to end-users for LLM computations by way of on-demand market aggregators, along with providing HPC internet hosting. This enterprise section continues to develop and develop.

Different Notable Modifications:

- Head workplace relocation to San Antonio, Texas. In accordance with Frank Holmes, the Govt Chairman, “HIVE feels safer working within the U.S., given the shift in authorities help towards Bitcoin mining, blockchain networks, and self-custody of digital belongings.”

- Transitioning to the U.S. GAAP reporting in fiscal year-end March thirty first to enhance transparency and comparability with different Bitcoin miners.” Personally I actually like this transfer as it’ll assist standardize monetary reporting and make cross-company evaluation extra dependable.

For instance, HIVE’s newest investor presentation highlights “best-in-class ROIC” and the “lowest company G&A,” however my handbook calculations yield completely different outcomes. The principle distinction is that HIVE makes use of adjusted non-IFRS metrics, excluding prices similar to depreciation, stock-based compensation, and Bitcoin truthful worth changes, which may current a extra favorable monetary image.

To make sure goal comparisons, this report excludes such metrics and focuses on standardized monetary information. The transition to GAAP ought to improve readability for buyers assessing HIVE towards its trade friends.

Ultimate Ideas

Hive affords a dynamic mix of bitcoin mining and HPC companies, positioning it for each substantial development and inevitable volatility. From a stability sheet perspective, the corporate stays financially conservative with a low D/E ratio, nevertheless it does rely closely on fairness raises to fund its capital-intensive growth plan (4x by September 2025). Its improvement in Paraguay may considerably enhance mining capability and place it among the many high 10 public miners by way of measurement, enhancing its trade visibility. Mixed with the shift to U.S. GAAP reporting and the relocation of headquarters to Texas, this transition might assist entice buyers searching for regulatory readability and transparency.

HIVE’s Bitcoin mining enterprise presents each strengths and challenges. The corporate at present advantages from a decrease common Bitcoin manufacturing price, even compared to CleanSpark, one of the environment friendly miners. With improved fleet effectivity, better scale, and entry to decrease electrical energy prices in Paraguay, its mining operations may turn out to be extra aggressive throughout the trade. Nonetheless, the improvement of its Paraguay websites is topic to potential delays from unexpected circumstances, and Bitcoin’s value stays extremely unstable. Given its present low gross margin, any downturn in Bitcoin’s value may put important stress on profitability.

On the similar time, HIVE’s HPC enterprise, although nonetheless a small contributor, is gaining traction and has the potential to turn out to be a significant income driver. The corporate is actively increasing this section by introducing new cloud service choices and scaling its AI computing operations. If HIVE efficiently attracts high-value AI clients and reaches its aim of $100 million in annualized income by the top of 2025, its HPC enterprise may present a steady, high-margin income stream, serving to to offset the volatility of Bitcoin mining. Nonetheless, this goal is extremely formidable, as the corporate generated solely $8.84 million from HPC in 2024, which means it could have to develop almost 10x inside a 12 months.

For buyers with a excessive tolerance for threat—notably these optimistic about long-term Bitcoin value tendencies and the evolving AI ecosystem—HIVE could also be a sexy high-risk, high-reward speculative alternative. Nonetheless, its success will depend upon the Bitcoin value, the efficient execution of its growth plans in Paraguay, and the development of its HPC enterprise. Buyers ought to carefully monitor these components, as they are going to be essential in figuring out HIVE’s future efficiency.