Informal observers of Bitcoin miners’ This fall earnings could possibly be forgiven pondering it’s been nothing however easy crusing for the trade.

However there’s no ignoring the truth that publicly traded Bitcoin miners misplaced $23 billion off their collective market capitalization prior to now month, in keeping with a current JP Morgan report.

It’s not all that shocking given the value of Bitcoin started February above $102,000 after which sank as little as $78,000 whereas markets had been affected by President Donald Trump’s commerce struggle speak.

Aside from hoping Bitcoin’s worth goes up, inventory analysts informed Decrypt that they’re keeping track of information heart offers, vitality prices, and the way miners are making their present fleets extra environment friendly.

Initially of the week, Hut 8 reported $162.4 million income for 2024—a 69% enhance in comparison with 2023, the corporate stated. However that’s not why Mike Colonnese, a managing director and senior crypto analyst at H.C. Wainwright, stated he’s feeling optimistic concerning the agency.

“We expect Hut 8 is near signing a serious HPC/AI take care of a hyperscaler,” he informed Decrypt. “The corporate would construct and function an HPC/AI information heart for a shopper in a colocation sort of mannequin the place Hut would generate long-term excessive margin revenues from a tenant for managing the infrastructure during which that tenant’s GPUs are deployed to run AI workloads.”

To place a cherry on high, the corporate additionally famous in its report that it’s managed to slash its vitality prices by 30%. That helped it create an 8 level enhance in gross margin per Bitcoin mined, when evaluating This fall 2024 to the earlier yr.

That’s no simple feat to drag off the identical yr the Bitcoin community underwent its fourth halving occasion and slashed the block reward paid to miners by half.

Basically, Colonnese stated he thinks mining prices will rise in 2025, as community problem continues to extend alongside progress within the community hash fee and there aren’t vital upgrades to the preferred mining rigs on the horizon.

“Nonetheless, I count on BTC worth appreciation to outpace progress in problem,” he added, “so miners ought to profit from a major enchancment in mining economics in 2025.”

Nishant Sharma agrees it’s crucial to look at how miners handle their overhead, however makes use of what he’s coined hashcost. It’s a calculation of the miners’ fleet effectivity and the cash it takes to maintain Bitcoin mining rigs operating.

Sharma, previously of Bitcoin mining rig behemoth Bitmain, is the founding father of communications and analysis agency for the mining trade Blocksbridge Capital.

“This gives a clearer image of how cost-effectively the corporate mines Bitcoin,” he informed Decrypt. “Nonetheless, when assessing a mining firm’s inventory, buyers ought to look past simply mining effectivity.”

He identified that almost all mining corporations, like Hut 8, have already diversified their income streams by providing information heart house to AI and high-performance computing (HPC) shoppers. However that’s not the one manner ahead.

Others, like Core Scientific, have been working to design their very own ASIC chip. “These strategic strikes introduce further elements that buyers should weigh primarily based on their funding thesis and outlook,” he added.

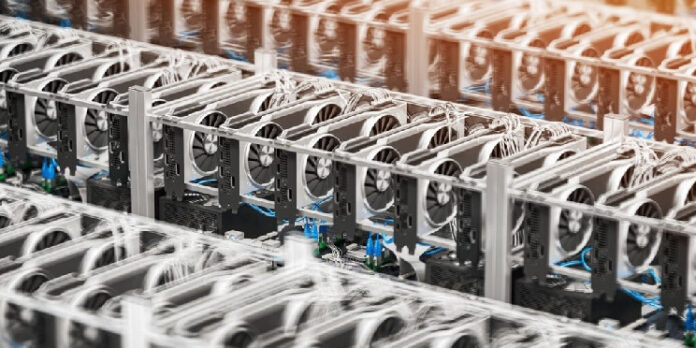

An ASIC, or application-specific built-in circuit, is the all-important chip that optimizes {hardware} particularly for crypto mining. It’s what makes mining rigs head and shoulders extra environment friendly than mining crypto with a private pc.

Core Scientific introduced in 2024 that it was teaming up with Jack Dorsey’s Block Inc. to design ASIC chips. Traders will get to see these chips in motion quickly sufficient.

“We don’t count on to extend or refresh our Bitcoin mining fleet till we procure the brand new Block ASIC chips within the second half of 2025,” stated Denise Sterling, Core Scientific’s chief monetary officer, throughout the firm’s earnings name final month.

To listen to Max Shannon inform it, Core Scientfic’s earnings name was in any other case unremarkable. Shannon is an analyst at crypto funding agency CoinShares.

“On the mining entrance, efficiency was unimpressive and, in reality, barely deteriorated,” he informed Decrypt. “Nonetheless, the high-performance computing (HPC) phase delivered sturdy outcomes, with notable shopper curiosity.”

He was referring to Core Scientific’s take care of AI hyperscaler CoreWeave, which earlier this week introduced a $1.7 billion acquisition deal. Simply final month, the 2 corporations finalized a $1.2 billion growth at a Texas information heart.

He stated he’s additionally been keeping track of Bitdeer, one other Bitcoin miner that’s dipping into the manufacturing facet of issues. Its SEALminer A2 rigs have already captured an estimated 5% of market share primarily based on projected future hashrate progress, he stated.

“We consider this might enhance additional over time,” Shannon stated. “This phase affords better operational flexibility, as the corporate can make the most of machines at value somewhat than buying at market costs, decreasing expenditure.”

Edited by Guillermo Jimenez.