The danger-courting dealer who brought about outsized losses for one in all Hyperliquid’s swimming pools is again once more with one other Ethereum (ETH) lengthy place. This time, the dealer used 25X leverage, as soon as once more posing a danger for the trade.

The whale dealer, who brought about over $4M in misplaced liquidity for Hyperliquid’s pool, is again once more with one other lengthy place on Ethereum (ETH). This time, the dealer switched shortly between dangerous quick and lengthy positions on ETH, as soon as once more exposing the trade to potential liquidations. Following the information, the HYPE native token of Hyperliquid fell additional, sliding to $12.35.

The brand new batch of positions is smaller, because the whale deposited $2.3M into Hyperliquid. Nonetheless, at 25X leverage, the place might have an outsized impact. The positions on the whale’s Hyperliquid account have been nonetheless lively because the crypto market entered one other interval of volatility.

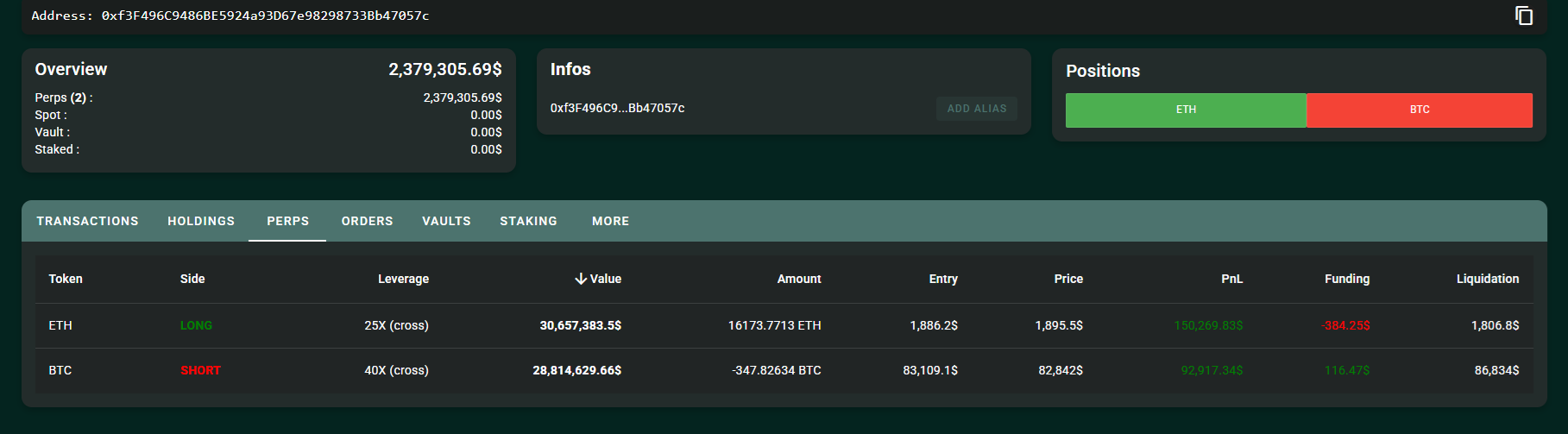

The dealer’s positions have been within the inexperienced, as he guess on a bounce for ETH and an extra slide for BTC. | Supply: Hyperliquid

On-chain information reveals the whale additionally moved via GMX, making a 4.08M USDC deposit. Initially, the whale shorted ETH, however then closed the place and moved on to lengthy the asset. The whale secured $177K positive factors via that place, earlier than shifting to Hyperliquid once more.

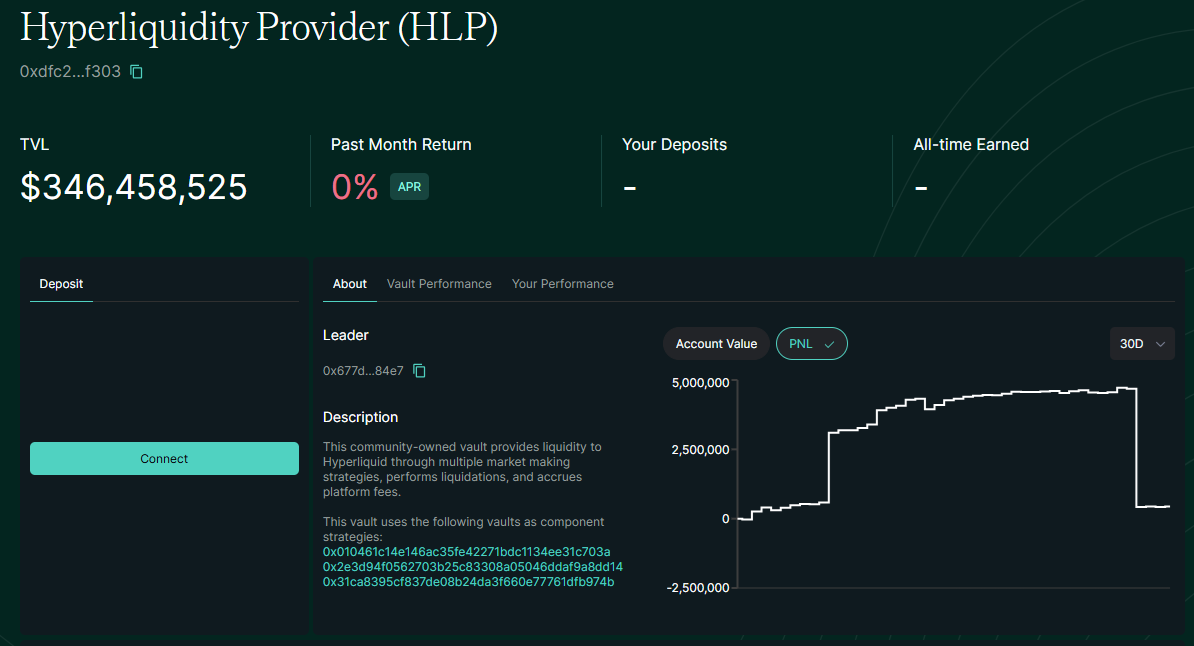

The Hyperliquid neighborhood vault nonetheless carries a lot decrease liquidity after taking on the whale’s preliminary ETH lengthy after liquidation.

The whale’s new place longed ETH at 25X leverage and shorted Bitcoin (BTC) with 40X leverage. The dealer’s new place as soon as once more makes use of the utmost out there leverage on Hyperliquid, even after the current limitation. Beforehand, the whale took riskier positions after they traded at 50X leverage.

Dealer whale remains to be within the inexperienced after BTC, ETH market strikes

Hours after organising the leveraged positions, the dealer whale was nonetheless within the cash. The positions have been in revenue after ETH recovered, whereas BTC slipped underneath $83,000.

As of March 13, ETH traded at $1,898.86, whereas BTC stepped again to $82,952.12.

The whale’s positions posted comparatively small positive factors above $100,000. Nonetheless, the ETH funding price turned crimson for the lengthy place. The whale entered at $1,886.20 per ETH, as the value hovered simply above the liquidation degree.

With out an virtually fast whale rally, the whale threatened to depart Hyperliquid with one other poisonous liquidated place.

ETH is at the moment attempting to carry the $1,887 help degree, the place merchants have posted the largest accumulation of liquidity. ETH stays extraordinarily dangerous in relation to liquidations, with $8.22M in complete liquidations.

Previously 4 hours, ETH noticed $4.8M in lengthy liquidations, and $3.42M in brief liquidations. The danger for lengthy positions stays outsized, as ETH has been going through an extended drawdown previously three months. A rebound was anticipated however at all times delayed by a deeper value slide. Underneath these circumstances, an sudden rally would profit leveraged whales essentially the most.

Bybit’s CEO suspects a deliberate technique

Ben Zhou, CEO of Bybit, believes the whale was intentional in letting a big leveraged place to be liquidated. He sees the high-leverage commerce as a possible downside for each DEX and centralized market operators.

Zhou believes the whale selected a simple approach out via liquidation.

“Primarily what occurred was a whale used Hyperliquid liquidation engine to exit. Think about you opened a 300m lengthy place on ETH with round $15m margin on 50x leverage, how do you exit fast and clear?” commented Zhou on X.

Zhou proposed an answer utilized by different exchanges, through which massive positions have their leverage lowered routinely. This could not permit whales to use the out there liquidity and saddle exchanges with poisonous debt. Zhou additionally believes the lowered leverage thresholds on Hyperliquid are nonetheless open to manipulation. The opposite potential vector is to create a number of accounts, which the trade goals to discourage via screening.

The Hyperliquid neighborhood vault remains to be carrying a a lot decrease liquidity degree. | Supply: Hyperliquid

Zhou claims that due to its massive leverage, Hyperliquid remains to be aggressive and that reducing the constraints could possibly be detrimental to the corporate. Due to this, the DEX can be fairly weak to assault.

Regardless of this, the current liquidation has additionally damage the Hyperliquid neighborhood which used the vault for passive earnings. The involvement of a high-risk dealer was a black swan occasion for the vault, which had beforehand accrued upward of $4.8M in liquidity.