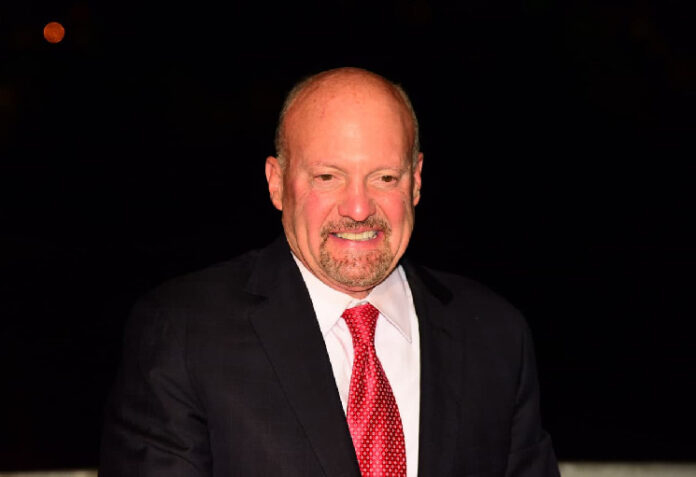

Out of the various memes that emerged within the inventory market in recent times, the notion that Jim Cramer – the host of Mad Cash and former hedge fund supervisor – is mostly mistaken is among the most persistent.

Such an concept has led to the creation of two exchange-traded funds (ETFs) launched by Tuttle Capital. The primary, the Lengthy Cramer Tracker (LJIM), was shut down comparatively shortly on account of a scarcity of curiosity.

The second, arguably because of the reputation of the meme that whichever asset Jim Cramer recommends is certain to crash, drew a lot consideration.

Nonetheless, because it turned out, the Inverse Cramer Tracker ETF (SJIM) – the fund that took a brief place on whichever inventory the well-known host endorsed – didn’t succeed as a lot as many possible hoped.

Right here’s how a lot an ‘inverse Cramer’ funding could be price now

Particularly, the reply to the query of how a lot a $1,000 funding into the ‘inverse Cramer’ ETF made in the beginning of the yr would have yielded by press time is each simpler and tougher to gauge than might be anticipated.

Certainly, early this yr, Tuttle Capital was compelled to close SJIA down on account of losses.

Moreover, regardless of many buying and selling bots and automatic methods that search to take a position reverse to Cramer’s suggestions, the efficiency of these tracked publicly reveals why the ETF didn’t survive – they are typically considerably down regardless of 2024 that includes an exceptionally sturdy inventory market.

Taking a look at a few of Jim Cramer’s suggestions, the dearth of success for ‘inverse’ methods turns into fairly obvious.

Why the ‘inverse Cramer’ technique was at all times prone to fail

Regardless that the previous hedge fund supervisor actually made a justifiable share of blunders of the variability that earned him the fame – for instance, in late 2023, Cramer estimated 2024 could be Boeing’s (NYSE: BA) yr – his most cussed suggestion is concurrently among the best performers within the final 24 months.

Jim Cramer has been so bullish in regards to the semiconductor big Nvidia (NASDAQ: NVDA) that he even named his canine Mr. Everest Nvidia.

Mr. Everest Nvidia meet the world! pic.twitter.com/5GvTecuNyz

— Jim Cramer (@jimcramer) June 20, 2017

Concurrently, the timing of this furry affirmation of bullishness does a lot to reveal why the Mad Cash host remains to be, regardless of the web jokes, in enterprise.

Although investing $1,000 in an ‘inverse Cramer’ ETF in the beginning of the yr would have led nowhere, the same funding made to have fun Mr. Everest Nvidia’s introduction on June 20, 2017, would have appreciated to roughly $21,000 as NVDA shares are buying and selling near $140.

Featured picture by way of Shutterstock