Decentralized exchanges (DEXs) are rising in recognition amongst crypto customers. Up to now yr, DEXs have generated vital competitors for centralized exchanges (CEXs) that at present management buying and selling.

In a dialog with BeInCrypto, trade specialists from CoinGecko, Gate.io, and PancakeSwap mentioned they count on DEXs to develop in 2025 but additionally urged that CEXs will nonetheless be prime contenders for newcomers.

The Success of CEXs and DEXs

Because the starting of crypto buying and selling, CEXs like Coinbase and Binance have dominated the crypto market. These exchanges at present amass over 300 million customers mixed, providing excessive liquidity, and serving as easy-to-use platforms for junior merchants.

Up to now yr, DEXs have additionally gained momentum, offering customers with a decentralized different to buying and selling. With a better layer of safety to stop fraud and fewer publicity to overregulation, DEXs problem CEXs’ management over the crypto market.

However regardless of the rising adoption of decentralized exchanges, CEXs are nowhere close to fading out.

“Whereas DEXs are set to proceed rising and evolving in 2025, CEXs will nonetheless play a pivotal function in the ecosystem, significantly in onboarding new customers. Each sorts of exchanges have complementary roles, and collectively, they will contribute to the general progress and adoption of crypto within the coming years,” mentioned Chef Children, Head Chef at PancakeSwap.

By leveraging these benefits, CEXs will proceed to be in charge of the sector.

The Preliminary Grip of CEXs

Centralized cryptocurrency exchanges are platforms that retailer digital property on behalf of purchasers and allow them to commerce, deposit, and withdraw their cryptocurrencies.

A central entity controls these exchanges and acts as an middleman between patrons and sellers. This entity can also be answerable for making certain that person funds stay safe.

CEXs are the principle avenue for cryptocurrency buying and selling as a result of they’re simply accessible for first-time crypto traders. Binance, Coinbase, and Kraken are among the many most-used centralized exchanges.

In accordance with Shaun Lee, a analysis analyst at CoinGecko, 2024 was a really profitable yr for CEXs.

“General, CEXs have carried out extraordinarily effectively, with the prime 10 showcasing volumes of over $2 trillion, over a number of months in the yr. In 2023, the prime 10 CEXs solely managed to break above the $1 trillion mark as soon as, in December,” he mentioned.

CEXs additionally have a tendency to draw sure traders as a result of they’re topic to rigorous regulatory oversight. This may increasingly act as a safeguard for merchants seeking to take step one away from conventional finance sectors.

The Rise of DEXs

DEXs operate as a peer-to-peer market and don’t depend on intermediaries for crypto buying and selling or custody over funds. In contrast to CEXs, that are regulated by a central entity and require customers to bear Know Your Buyer (KYC) processes, DEXs provide customers the likelihood to commerce anonymously.

Their recognition has just lately surged, offering merchants and traders with a decentralized different to centralized exchanges. Constructed on blockchain know-how, DEXs remove the necessity for intermediaries. In the meantime, immutable good contracts facilitate buying and selling.

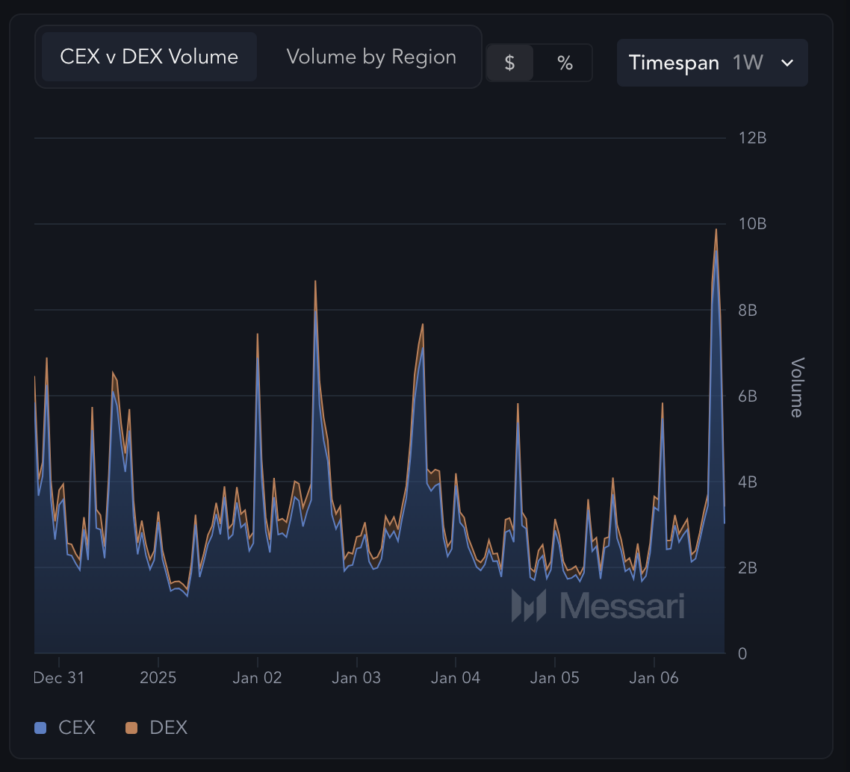

DEX and CEX Buying and selling Volumes within the Previous Week. Supply: Messari.

These qualities have develop into more and more interesting for merchants seeking to prioritize safety and autonomy when exchanging property.

DeFi platforms have develop into aggressive rivals for CEXs. Hyperliquid, for instance, is a layer-one blockchain for decentralized buying and selling that allows high-performance, expeditive buying and selling with lowered charges. The change has develop into broadly adopted prior to now yr.

“Decentralized exchanges (DEXs) at present seize about 40% of the market share, and they’re steadily gaining floor on centralized exchanges (CEXs). Trying forward to 2025, DEXs will have even extra alternatives to develop. As DeFi matures and adoption rises, decentralized exchanges will play an more and more central function within the broader monetary ecosystem,” mentioned Chef Children.

Whereas CEXs and DEXs function inside completely different frameworks, each platforms reveal indicators of rising person adoption and success within the discipline.

Safety and Overregulation Considerations in CEXs

CEXs are typically scrutinized relating to safety. Because the platform itself holds the personal keys to its purchasers’ wallets, it’s totally answerable for the custody of person property. Customers develop into weak to a possible lack of funds in case of hacks or sudden change closures.

Kevin Lee, chief enterprise officer at Gate.io, defined that given their centralized nature, CEXs must proceed creating mechanisms that improve safety and keep away from potential safety breaches.

“Centralized exchanges (CEXs) should prioritize safety by using complete measures that defend each customers and their property. This entails using superior applied sciences such as multi-signature wallets, chilly storage options for the majority of funds, and sturdy encryption to stop breaches. Moreover, common third-party audits of safety techniques and good contracts are essential to figuring out vulnerabilities proactively. Exchanges ought to additionally combine real-time monitoring instruments powered by AI to detect and reply to potential threats instantly,” he mentioned.

Most centralized exchanges use KYC procedures to adjust to regulatory necessities geared toward stopping illicit actions resembling cash laundering and terrorist financing. Customers should present id info, submit supporting documentation, and await verification to fund their accounts and start buying and selling on the platform.

Because of this, these platforms are topic to intensive oversight. This may increasingly contain stringent licensing necessities and compliance rules imposed by authorities, which may doubtlessly restrict CEXs’ means to help sure tokens or serve customers in particular jurisdictions.

The Fall of FTX

As a result of their centralized nature, a number of distinguished CEXs, together with FTX, Mt. Gox, and WazirX, have skilled vital safety breaches, leading to substantial monetary losses for his or her customers.

One of the vital infamous instances is FTX, a distinguished cryptocurrency change that ranked third globally by buying and selling quantity in 2022. FTX went bankrupt in November of that yr amid allegations that its house owners had embezzled and misused buyer funds.

On the time, studies emerged that Alameda Analysis, an affiliated buying and selling agency, derived a good portion of its worth from speculative cryptocurrency investments. This prompted considerations amongst FTX clients, who later withdrew their funds from the change en masse, sending FTX straight into chapter 11.

A Cautionary Story

The next collapse of FTX had a major impression on the cryptocurrency market and resulted in a 25-year jail sentence for then-CEO Sam Bankman-Fried.

“These instances serve as reminders of the significance of proactive regulatory compliance and sound threat administration. Exchanges should guarantee their management adheres to moral practices,with sturdy inside controls to stop systemic failures,” mentioned Lee of Gate.io.

FTX’s sudden dissolution additionally raised considerations in regards to the stability and resilience of the broader cryptocurrency ecosystem, shaking investor confidence. Lee added that central exchanges ought to use FTX as a reference level for measures to keep away from customers’ monetary losses.

“The high-profile incidents at platforms like FTX and WazirX have taught the trade that transparency and robust governance are important for the survival of centralized exchanges. These occasions underscored the significance of sustaining strict separation between person funds and operational funds to stop misuse and mismanagement. They additionally highlighted the essential want for common proof-of-reserves audits and public disclosures to foster person belief and accountability,” he mentioned.

Conditions like these elevate questions in regards to the centralized nature of an change’s operations. Skilled merchants are inclined to undertake decentralized exchanges to have full management over their crypto pockets keys.

DEXs and Liquidity Points

One vital drawback of DEXs in comparison with CEXs is decrease liquidity. This decrease liquidity can lead to substantial worth slippage, that means that the precise worth at which a commerce is executed might deviate significantly from the anticipated market worth.

As a result of most DEXs have a usually smaller person base and decrease buying and selling volumes, it’s typically harder to search out instant counterparties for trades.

“Liquidity is essential for any DEX, large or small, as it immediately impacts buying and selling effectivity, slippage, and the total person expertise. For smaller DEXs, the lack of liquidity can be significantly difficult, as it limits energetic merchants and accessible buying and selling pairs,” mentioned PancakeSwaps’ Chef Children.

Since CEXs have entry to a extra intensive pool of patrons and sellers, customers are inclined to commerce on these exchanges to keep away from liquidity points. Chef Children says DEXs should deal with this challenge to develop into extra aggressive.

“For any DEX, extra liquidity advantages the complete DeFi ecosystem by enabling higher pricing, attracting extra customers, and in the end creating a extra vibrant and environment friendly market. This, in flip, strengthens the DeFi area as a entire, driving innovation and progress,” he mentioned.

Addressing liquidity points is essential for DEXs to boost their competitiveness and contribute successfully to the expansion and improvement of decentralized exchanges.

Onboarding Obstacles for DEXs

DEXs usually current a better stage of technical complexity than CEXs. Utilizing a DEX usually requires some familiarity with blockchain know-how because it entails utilizing suitable wallets and the correct administration of personal keys.

This stage of data can current limitations for crypto newcomers buying and selling on exchanges for the primary time.

“The complexity of self-custodial wallets and bridging nonetheless presents a vital barrier for the common person, making mass adoption of DEXs difficult. To attain a broader viewers, DEXs should simplify and make the person expertise extra accessible,” Chef Children mentioned.

This issue alone makes CEXs extra interesting to junior merchants.

“CEXs will stay a essential half of the crypto ecosystem, particularly when driving broader adoption. For many newcomers, centralized exchanges provide the most easy entry level, intuitive interfaces, fiat on-ramps, and straightforward onboarding processes,” he added.

By creating supportive academic assets and adoption-friendly initiatives, DEXs can facilitate adaptability for customers desirous about switching to decentralized exchanges.

Bridging Centralized and Decentralized Choices

Kevin Lee of Gate.io says CEXs can leverage this benefit to fend off competitors from more and more widespread DEXs like Hyperliquid, Uniswap, and PancakeSwap.

“CEXs can lead in person training and onboarding by simplifying entry to blockchain applied sciences and creating intuitive person experiences. Collaborations with rising initiatives and ecosystems assist develop the scope of innovation on their platforms,” Lee defined.

Centralized exchanges also needs to combine options that cater to the wants of traders who prioritize decentralized approaches to buying and selling.

“By integrating hybrid fashions, such as non-custodial wallets and decentralized buying and selling choices, CEXs can present customers with a bridge between centralized comfort and decentralized autonomy. Furthermore, providing value-added providers like fiat on-ramps, superior buying and selling instruments, staking, and institutional-grade merchandise permits CEXs to cater to a wider vary of customers,” Lee defined.

As each CEXs and DEXs acquire recognition, they’re prone to study from one another to beat their respective challenges. Addressing these gaps will guarantee cryptocurrency exchanges’ sustainable progress and long-term success.