Bitcoin’s worth has did not proceed its upward momentum, since dropping under the $100K resistance degree. This has led to numerous uncertainty surrounding the longer term worth motion.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

On the day by day chart, the worth has been consolidating under $100K, after briefly breaking it to the upside a few weeks in the past and recording a brand new all-time excessive. A couple of days in the past, the market failed to interrupt the $100K degree and was rejected to the draw back.

Consequently, the $90K help degree is probably going the goal within the brief time period. The response to this space will decide the short-term worth motion for BTC.

The 4-Hour Chart

The 4-hour timeframe demonstrates a clearer image of the sideways worth motion. The market was initially making increased highs and lows inside an ascending channel.

But, it has since damaged the sample to the draw back and retested it twice. With the RSI additionally exhibiting values under 50%, indicating bearish momentum, the market is prone to drop towards the $90K degree earlier than a possible bullish continuation.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

Open Curiosity

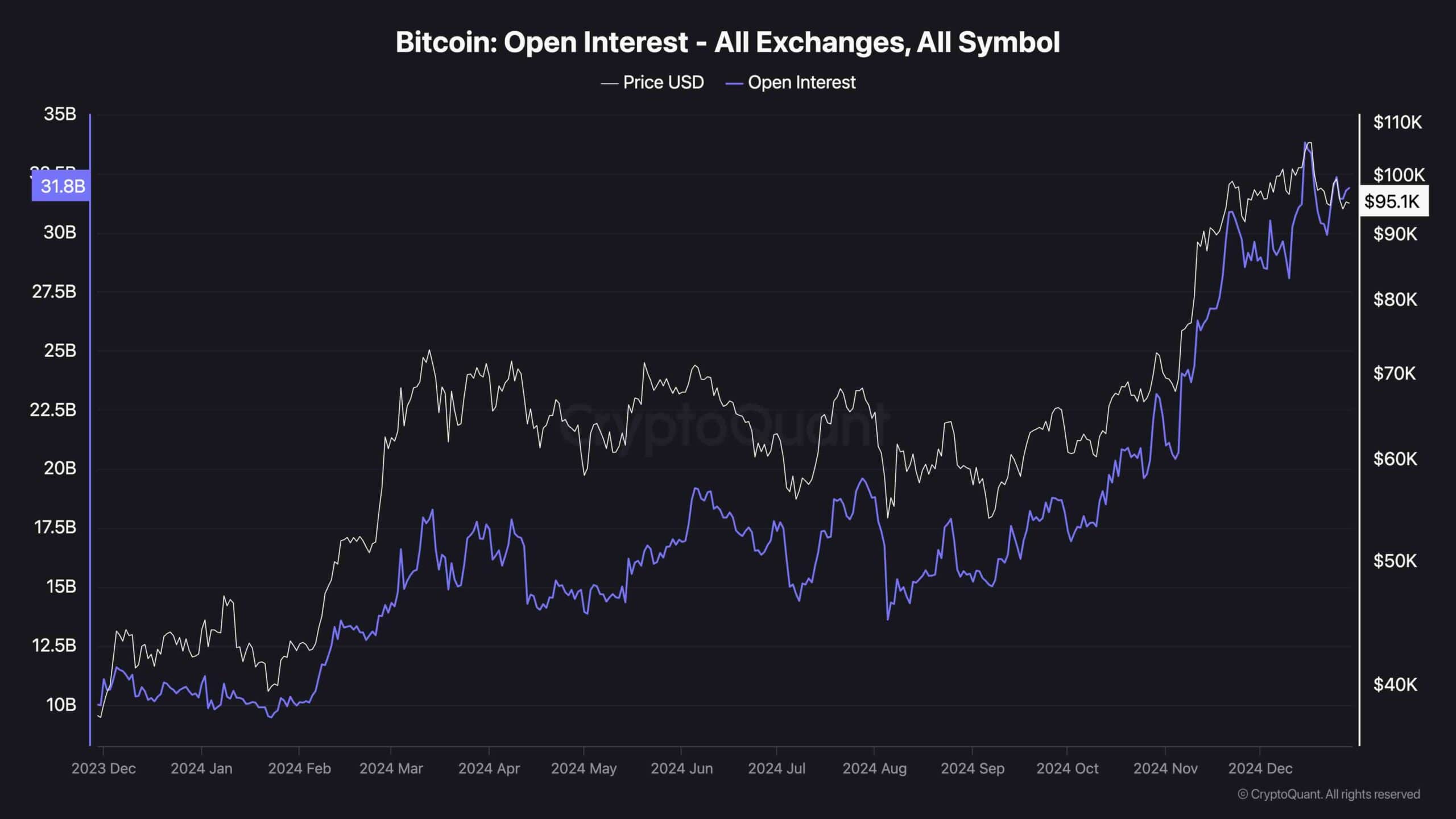

The Bitcoin futures market sentiment has been providing priceless perception over the previous couple of years, serving to analysts predict potential volatility within the brief time period. This chart presents the open curiosity metric, which measures the full variety of open perpetual futures contracts on derivatives exchanges.

Because the chart demonstrates, the open curiosity values have been at all-time highs, despite the fact that the market has dropped under the $100K degree and stopped trending. This may point out potential volatility within the short-term, attributable to liquidation cascades. Consequently, buyers must be cautious when investing in Bitcoin in the meanwhile.