Coinbase, the biggest Ethereum staking custodian, has persistently averted disclosing data on its staked ETH holdings for the previous 5 quarters. And now, estimates counsel Coinbase manages roughly 21% of all staked ETH, making its lack of transparency a major concern.

Regardless of calling itself a clear entity, Coinbase has not offered particulars on its staked ETH, cbETH backing, or cbBTC reserves. This has raised doubts concerning the integrity of its staking operations, notably as its deal with rotation and custody construction make monitoring tougher.

1/ it is the fifth quarter the place @coinbase, the biggest staked ETH custodian, refuses to share any information on their staked ETH 🙃

estimates point out they handle ~21% of all staked ETH pic.twitter.com/6a28StGrOH

— hildobby (@hildobby_) February 18, 2025

Coinbase’s Transparency Points & Staking

Monitoring Coinbase’s staked ETH has confirmed tough as a result of its frequent deal with rotations. Whereas impartial analysts have estimated a relentless 15% of staked ETH beneath Coinbase in earlier quarters, current knowledge suggests this quantity may very well be round 8.4%.

Nevertheless, this determine solely accounts for labeled addresses, with a good portion unaccounted for. As Coinbase continues to switch its staking construction, precisely figuring out its true holdings stays a problem.

Associated: Ethereum Charges at $0.41 – A 2-12 months Low: ETH Value Affect Analyzed

Base Community and cbETH

Base, Coinbase’s Ethereum Layer-2 community, aligns carefully with Ethereum’s ecosystem, but the alternate refuses to reveal its function in Ethereum’s safety layer. A extra clear strategy may improve belief in its staking merchandise.

Moreover, cbETH may need gained broader adoption if its backing was verifiable. As an alternative, Coinbase expanded cbETH’s provide with out proving the corresponding staked ETH, creating uncertainty about its precise worth.

8/ Coinbase is all about transparency however has by no means shared any information on their staked ETH quantity, cbETH backing or cbBTC backinghttps://t.co/Lb4EyxRAIa

— hildobby (@hildobby_) February 18, 2025

Ethereum Value Evaluation

Key Assist and Resistance Ranges

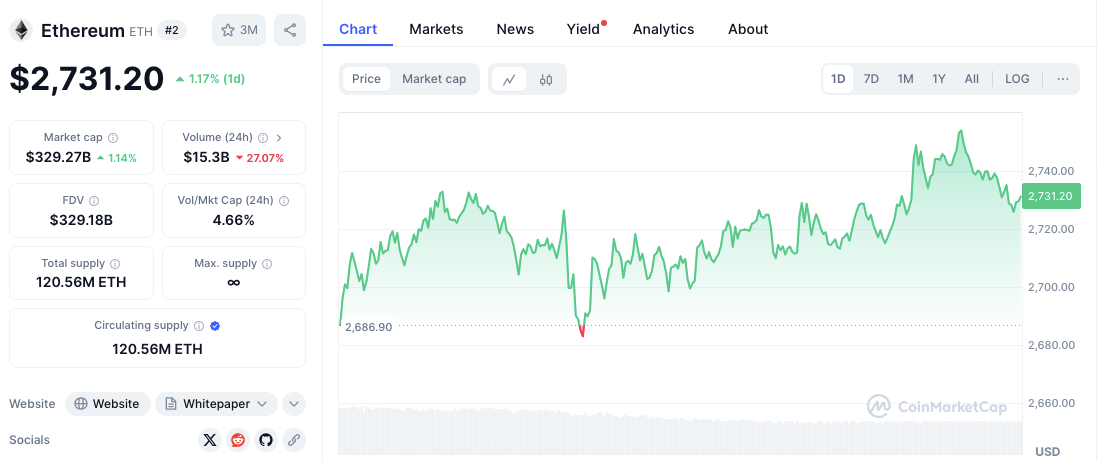

Ethereum has been displaying indicators of stability, buying and selling at $2,728.67 with a 1.55% achieve up to now 24 hours.

A essential assist zone lies between $2,685 and $2,690, the place earlier worth motion suggests robust shopping for curiosity. If ETH fails to carry above this degree, the following key assist could kind round $2,650.

Supply: CoinMarketCap

On the upside, resistance is seen between $2,740 and $2,750. A breakout above this degree may push Ethereum towards $2,780 and even $2,800 within the close to time period. Given the present worth actions, ETH is sustaining an upward development with minor corrections, suggesting a bullish outlook.

Ethereum’s Technical Indicators

ETH/USD day by day worth chart, Supply: TradingView

The Relative Power Index (RSI) at the moment stands at 43.14, barely above the oversold territory. This implies ETH stays in a neutral-to-bearish zone, with potential for restoration if shopping for stress will increase.

Associated: Ethereum Group Intrigued by $1.37 Million Burn & “Mind-Weapon” Declare

In the meantime, the MACD indicator reveals a bearish development, with the MACD line at -113.4 beneath the sign line at -138.3.

Nevertheless, the histogram is displaying indicators of turning constructive, signaling a doable bullish reversal. If momentum shifts, ETH may see an upward breakout past present resistance ranges.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.