The cryptocurrency market was pretty steady regardless of the worldwide macroeconomic headwind that rocked the normal markets through the previous week. The Ethereum value didn’t get pleasure from the identical reduction as different large-cap property, starting the month of April nearly because it ended the primary quarter of 2025.

The second-largest cryptocurrency is on the verge of dropping the $1,800 stage, having declined in worth by nearly 5% up to now week. Nevertheless, the newest on-chain information means that the Ethereum value could be near a backside and could be readying for a rebound within the coming weeks.

Rising Metric Says Ethereum Value May Be Prepared For A Comeback

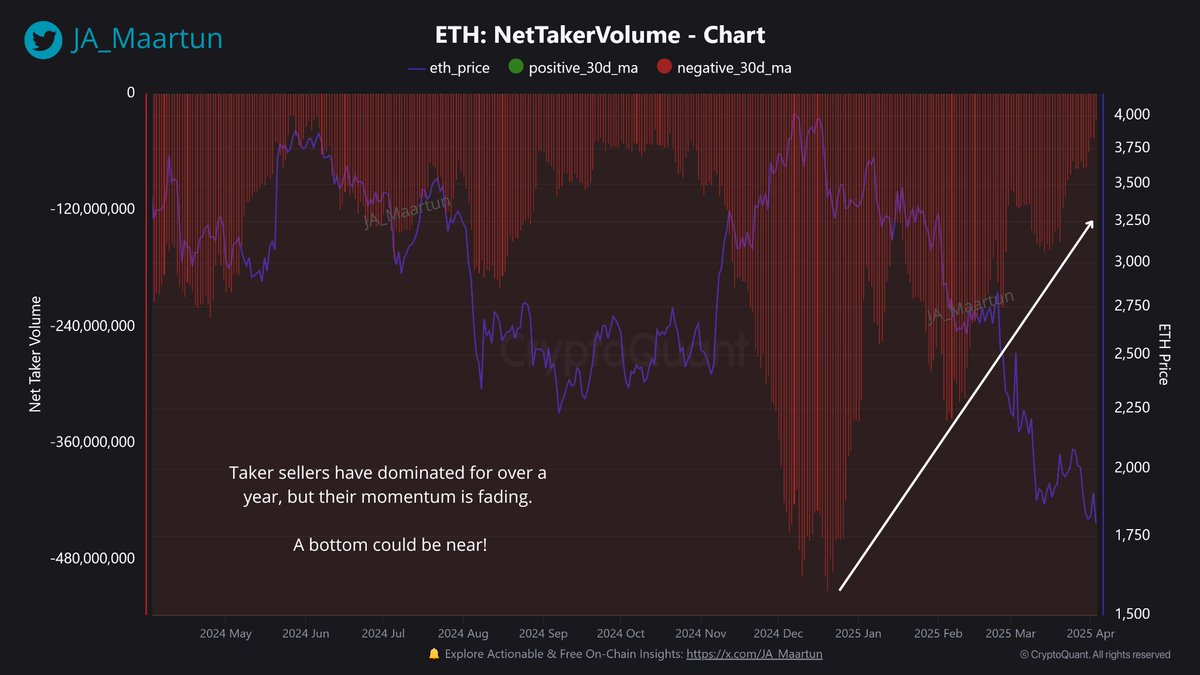

In a current publish on the X platform, on-chain analyst Maartunn shared a recent perception into the exercise of Ethereum traders on centralized exchanges. In response to the crypto pundit, this newest on-chain shift suggests {that a} new backside might be brewing for the Ethereum value.

The related indicator right here is the Web Taker Quantity metric, which tracks the distinction between taker purchase quantity and taker promote quantity in a specific asset market (Ethereum, on this case). This on-chain indicator can be utilized to gauge the power of the promoting or shopping for stress available in the market.

When the Web Taker Quantity is optimistic, it signifies that aggressive shopping for exercise (taker buys) is overwhelming promoting exercise (taker sells), suggesting a rising bullish sentiment. A unfavourable metric implies that the taker promote quantity is larger than the taker purchase quantity, which is usually a bearish sign.

Maartunn famous in his publish that aggressive promoting exercise has been outweighing the shopping for exercise within the Ethereum marketplace for over a 12 months. Nevertheless, the on-chain analyst highlighted that the taker promote quantity seems to be waning and dropping some steam up to now few weeks.

Supply: @JA_Maartun on XAs proven within the chart above, the Web Taker Quantity is forming larger lows, even because the Ethereum value is making new decrease lows. This basic bullish divergence means that the altcoin might be making ready to backside out and expertise a bullish reversal.

As of this writing, the ETH token is valued at round $1,806, reflecting a roughly 1% value soar up to now 24 hours.

ETH Whales Trimming Their Holdings

Curiously, a conflicting piece of on-chain information has additionally emerged, displaying that an necessary class of traders generally known as whales has been offloading their property. This investor cohort is influential available on the market dynamics as a consequence of their important holdings and, as such, is usually monitored by different traders.

Supply: @ali_charts on X

In a April 4 publish on X, crypto analyst Ali Martinez revealed that whales (holding between 10,000 and 100,000 cash) have offered over 500,000 ETH tokens up to now 48 hours. Contemplating the dimensions of this sell-off and the affect of the traders, this exercise might be a bearish roadblock for a potential Ethereum value restoration.

The value of ETH on the every day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.