Cango Inc. pivoted from vehicle buying and selling to Bitcoin mining and is now concentrating on 50 EH/s in early 2025. With a rising BTC treasury, Tencent as an institutional investor, and Bitmain hyperlinks, is that this the mining sector’s subsequent darkish horse?

A Cango Deep Dive

The next visitor publish comes from Bitcoinminingstock.io, the one-stop hub for all issues bitcoin mining shares, academic instruments, and trade insights. Initially printed on Mar. 25, 2025, it was penned by Bitcoinminingstock.io creator Cindy Feng.

It’s been a couple of weeks since our final deep dive into lesser-known names within the Bitcoin mining house. I’ve been a bit quiet—partly as a result of the sector’s been in a hunch, but additionally as a result of I’ve been recovering from a lower-back harm (a reminder to take heed to your physique and never push it too arduous with bodily actions).

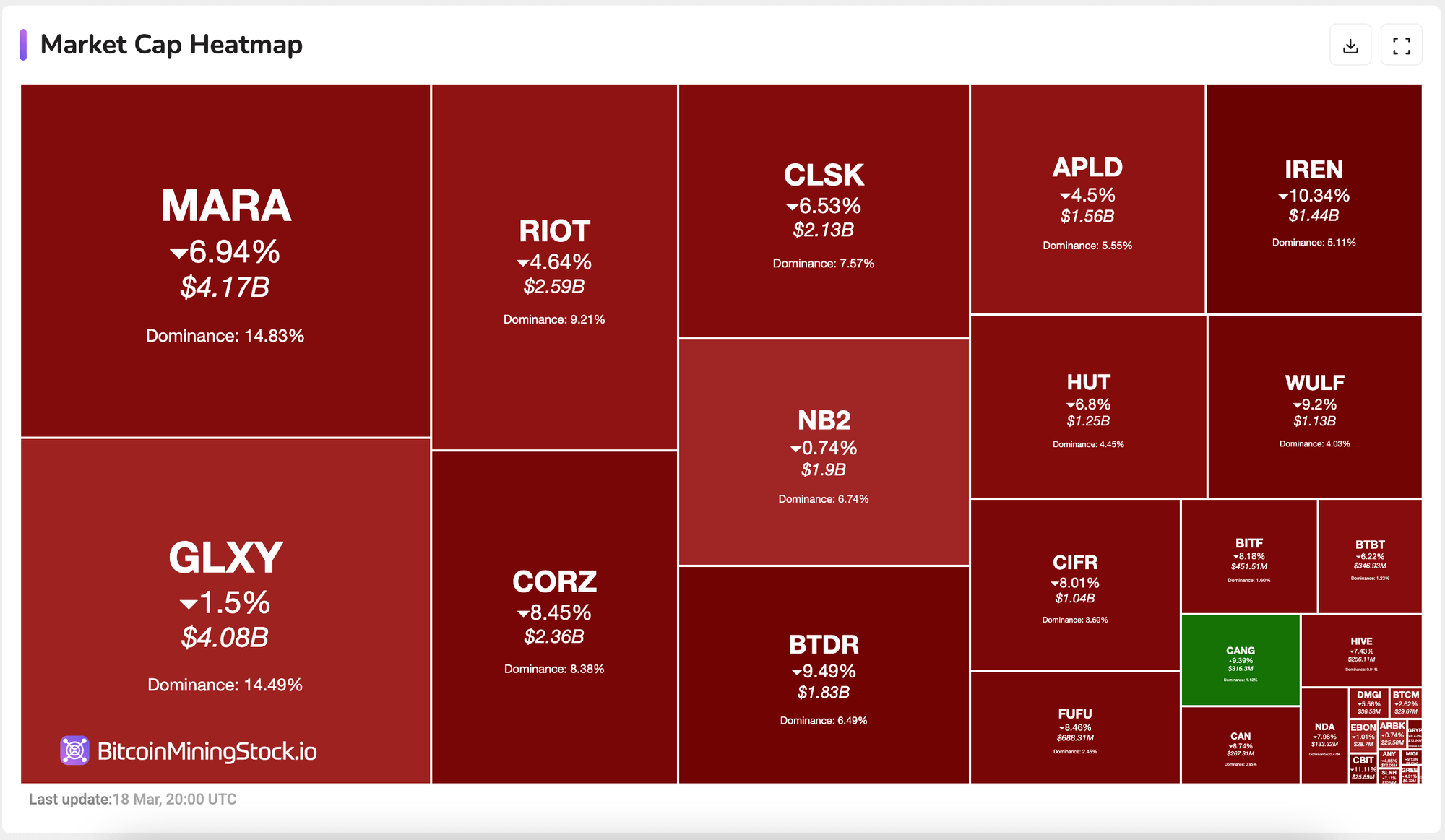

For the second instalment of this sequence, I wish to speak about Cango Inc. (NYSE: CANG). Why? Whereas the entire mining sector has been taking a beating recently, Cango has had a couple of robust days, boosted by its share buyback announcement and a non-binding buyout supply.

Bitcoin Mining Shares Heatmap (dwell updates)

However right here’s what actually caught my eye: only a few months in the past, this was nonetheless an vehicle buying and selling platform with restricted progress potential. Now, it concentrating on 50 EH/s early this 12 months, with 32 EH/s already on-line.

So how is that this daring pivot enjoying out? And will Cango quietly turn out to be a serious participant within the house? Let’s dive in.

Firm Overview

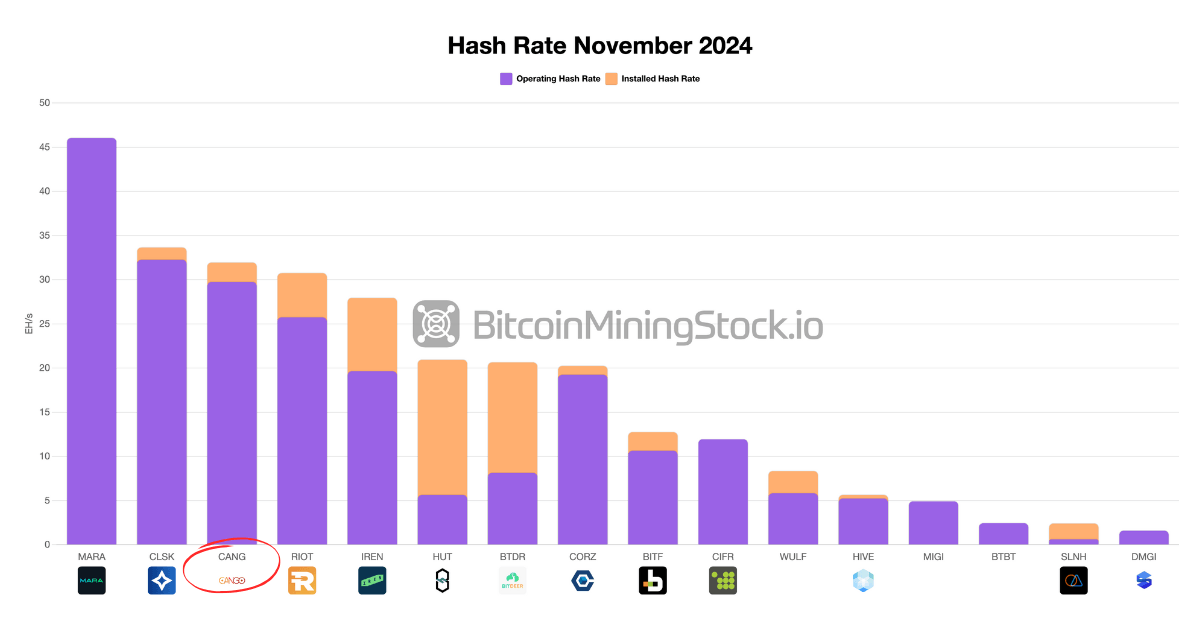

Cango Inc. (NYSE: CANG) started as an Shanghai-based auto financier and later positioned itself as a key participant in China’s vehicle buying and selling providers. By late 2023, the corporate has shifted its focus from the home market to facilitating used automobile gross sales from China to creating markets. Then in November 2024, Cango introduced its entry into Bitcoin mining, launching operations with 32 EH/s of on-line hash price. The dimensions and immediacy of this transfer shocked many traders—putting Cango simply behind MARA and CleanSpark, and making it the third-largest public Bitcoin miner by deployed capability on the time.

Overview of Public Miners’ Hash Fee

The mining acquisition deal was for 50 EH/s in whole, with the remaining 18 EH/s anticipated to return on-line in Q1 2025, topic to the efficiency standards outlined within the settlement. Notably, the infrastructure was not constructed from scratch: Cango acquired operational ASIC fleets immediately from Bitmain, and a Bitmain affiliate continues to handle the machines’ operations and upkeep inside third-party internet hosting amenities.

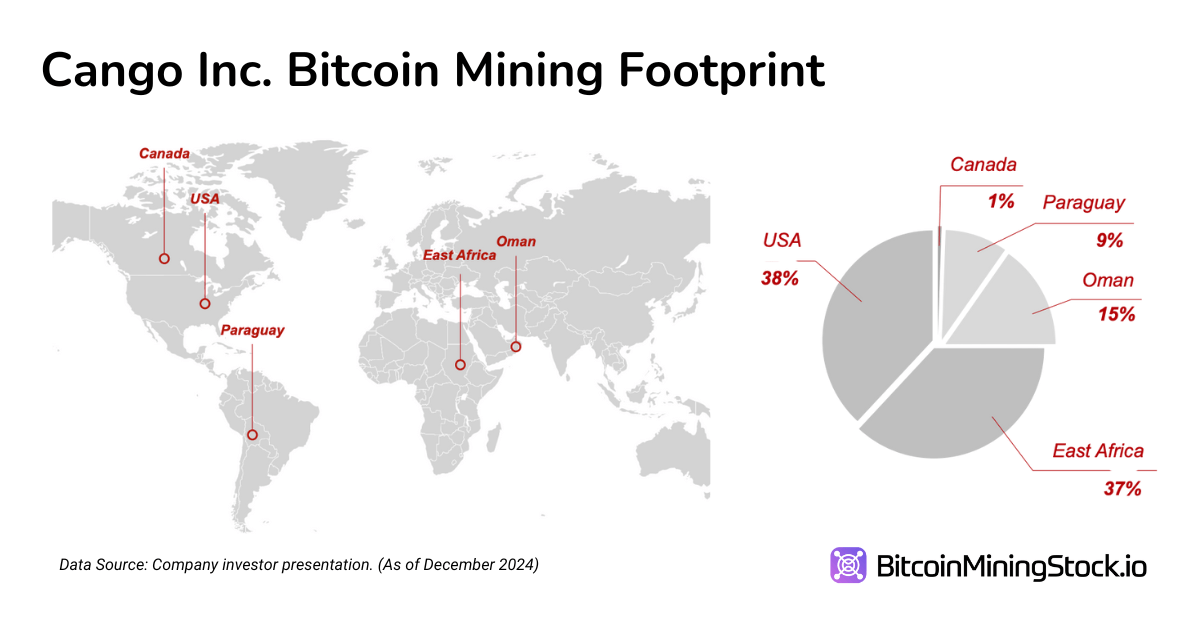

Based on firm disclosures, Cango has its fleet primarily hosted within the U.S.,East Africa, Oman and Paraguay – which retains it clear from China’s ongoing crypto restrictions.

Monetary Highlights

Income & Profitability Transformation

The impression of Cango’s pivot to Bitcoin mining is clearly mirrored in its newest monetary outcomes. In This autumn 2024, the corporate reported income of RMB 668 million ($91.5 million), a 414% YoY improve. This progress was virtually solely pushed by Bitcoin mining, which accounted for 98% of whole income. In distinction, the auto buying and selling section, as soon as Cango’s core enterprise, simply contributed RMB 15 million ($2.1 million) – a sign that this legacy section is successfully being phased out.

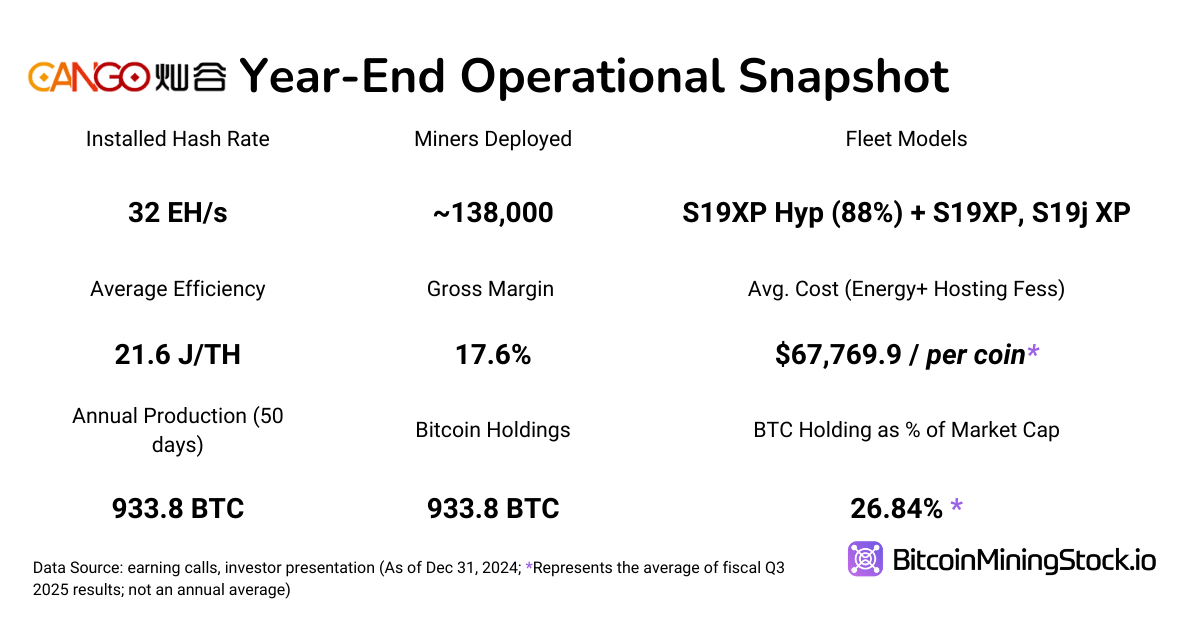

Regardless of the income surge, profitability stays a key difficulty. Cango posted a gross margin of 17.6% in This autumn—considerably under friends with comparable operational scale. For comparability, CleanSpark, which operates in a comparable hash price vary, reported a 57% gross margin throughout the identical interval. This implies that Cango’s price construction is way from optimized. Reliance on third-party internet hostingand publicity to increased power prices are two main attributors.

The corporate’s common Bitcoin manufacturing price stood at $67,769 per BTC(money price consists of power and internet hosting charges). This determine locations Cango towards the increased finish of the price curve amongst massive public miners we observe – a lot of whom report all-in prices within the $50K vary. Till Cango secures lower-cost infrastructure or negotiates extra favorable internet hosting phrases, its margin profile is more likely to stay below stress, even when income progress continues.

Stability Sheet & Liquidity

Cango entered 2025 in a robust liquidity place, reporting RMB 2.5 billion ($345 million) in money and short-term investments as of December 31, 2024 – up from RMB 1.7 billion ($232.9 million) the earlier 12 months. This substantial reserve offers a significant buffer for continued growth and cushions in opposition to potential volatility in Bitcoin markets. Nevertheless, the corporate’s whole liabilities additionally rose sharply, growing 126% YoY to RMB 1.88 billion ($258 million). This rise was primarily pushed by accrued bills and different present liabilities tied to its mining acquisition and associated operations.

Whereas Cango presently has sufficient liquidity to fund near-term progress, the stress now shifts to enhancing operational margins. With out stronger money circulate technology, the corporate could ultimately want to hunt exterior capital, risking fairness dilution or elevated leverage.

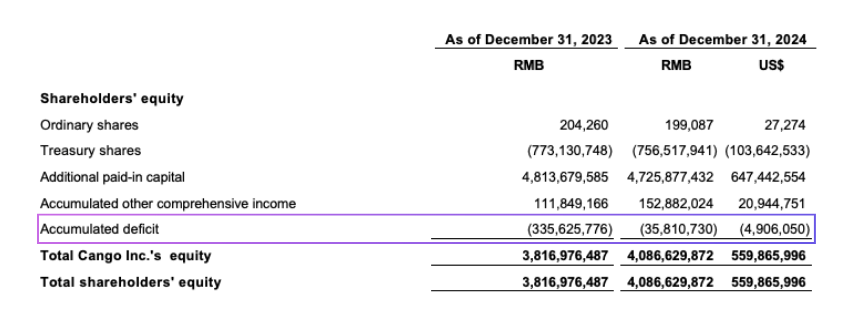

A more in-depth have a look at the fairness construction highlights these trade-offs. Shareholders’ fairness elevated 7.1% YoY to RMB 4.09 billion ($559.9 million), largely because of the firm’s RMB 299.8 million ($41.1 million) internet revenue in 2024. This return to profitability helped cut back the gathered deficit from RMB (335.6) million to RMB (35.8) million, strengthening the stability sheet and partially restoring retained earnings.

Nevertheless, the $144 million stock-based part of the $400 million mining machine acquisition considerably impacted fairness construction. It expanded whole fairness but additionally diluted present shareholders as the sellers, now fairness holders, collectively personal roughly 40% of the corporate post-transaction. This possession shift is mirrored within the decline of further paid-in capital from RMB 4.81 billion to RMB 4.73 billion, pointing to a redistribution of fairness somewhat than recent capital influx.

Lastly, whereas the corporate repurchased 996,640 ADSs for $1.7 million, the buyback’s impression on whole fairness was negligible. It does, nonetheless, counsel that administration sees the inventory is undervalued, although present capital allocation stays firmly targeted on scaling the mining operation.

Valuation Modelling

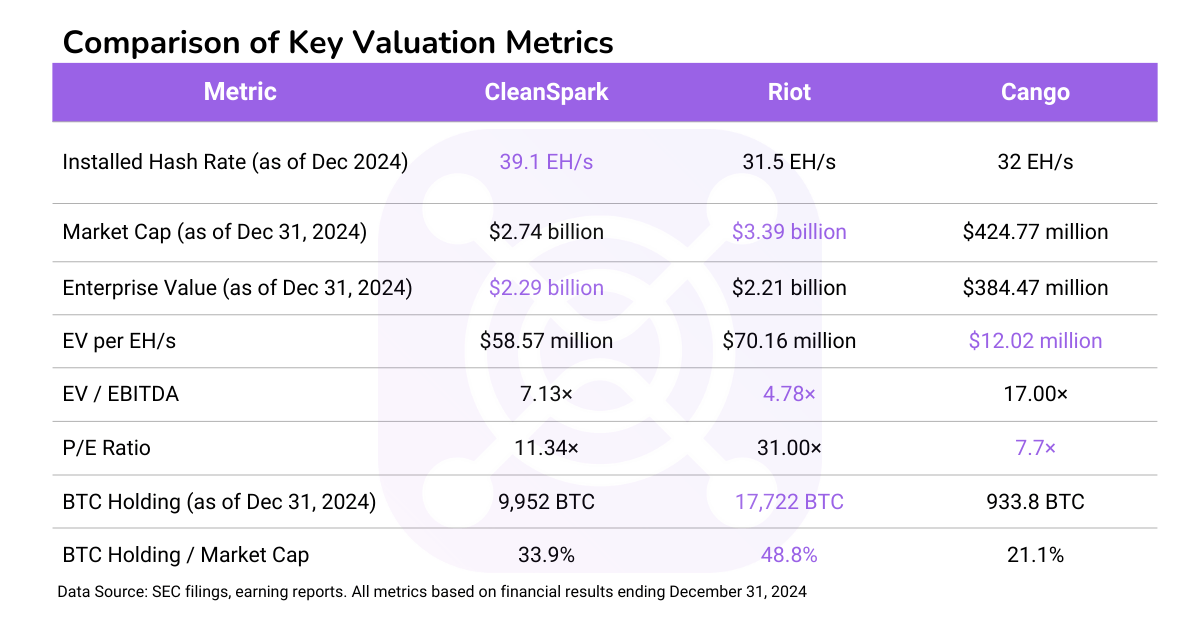

A vital step in understanding Cango’s price is to benchmark it in opposition to comparable scale Bitcoin miners (e.g.,CleanSpark, Riot). As of Dec 31, 2024, Cango’s market cap stands at $424.77 million).

- Enterprise Worth (EV): $229.2 million (Market Cap + Debt – Money & Money Equal- BTC Holdings).

- EV/EBITDA Ratio: 17x ($384.47M/$22.8M)

- P/E: 7.7x

- P/S: 2.87x (very reasonable market optimism about income)

- BTC Holding / Market Cap: 21.1%

Mining Operations & Effectivity

Cango deployed 32 EH/s by December 2024 and is predicted to broaden to 50 EH/s in Q1 2025. Projection of Bitcoin manufacturing in 2025:

- Manufacturing price in This autumn 2024: 933.8 BTC in simply 50 days (November-December 2024).

- January-February 2025 replace: 1,010.9 BTC mined, confirming an approximate 500 BTC/month tempo at 32 EH/s.

- Scaling projection: If 32 EH/s produces ~6,000 BTC yearly, then 50 EH/s ought to yield ~8,500 BTC, assuming a linear scaling mannequin.

This projection is a best-case state of affairs, excluding all variables- particularly the community issue. In actuality, rising world hash price and elevated mining competitors could push community issue increased, which would scale back Cango’s BTC output and have an effect on income forecasts. The corporate’s publicity to such fluctuations is materials, given that almost all of its income is now tied to mining.

Fleet effectivity is one other space of concern. Cango reported an common of 21.6 J/TH, consisting of:

- 90% S19XP Hyd. fashions (water-cooled, environment friendly).

- 10% older fashions (increased energy consumption, much less aggressive).

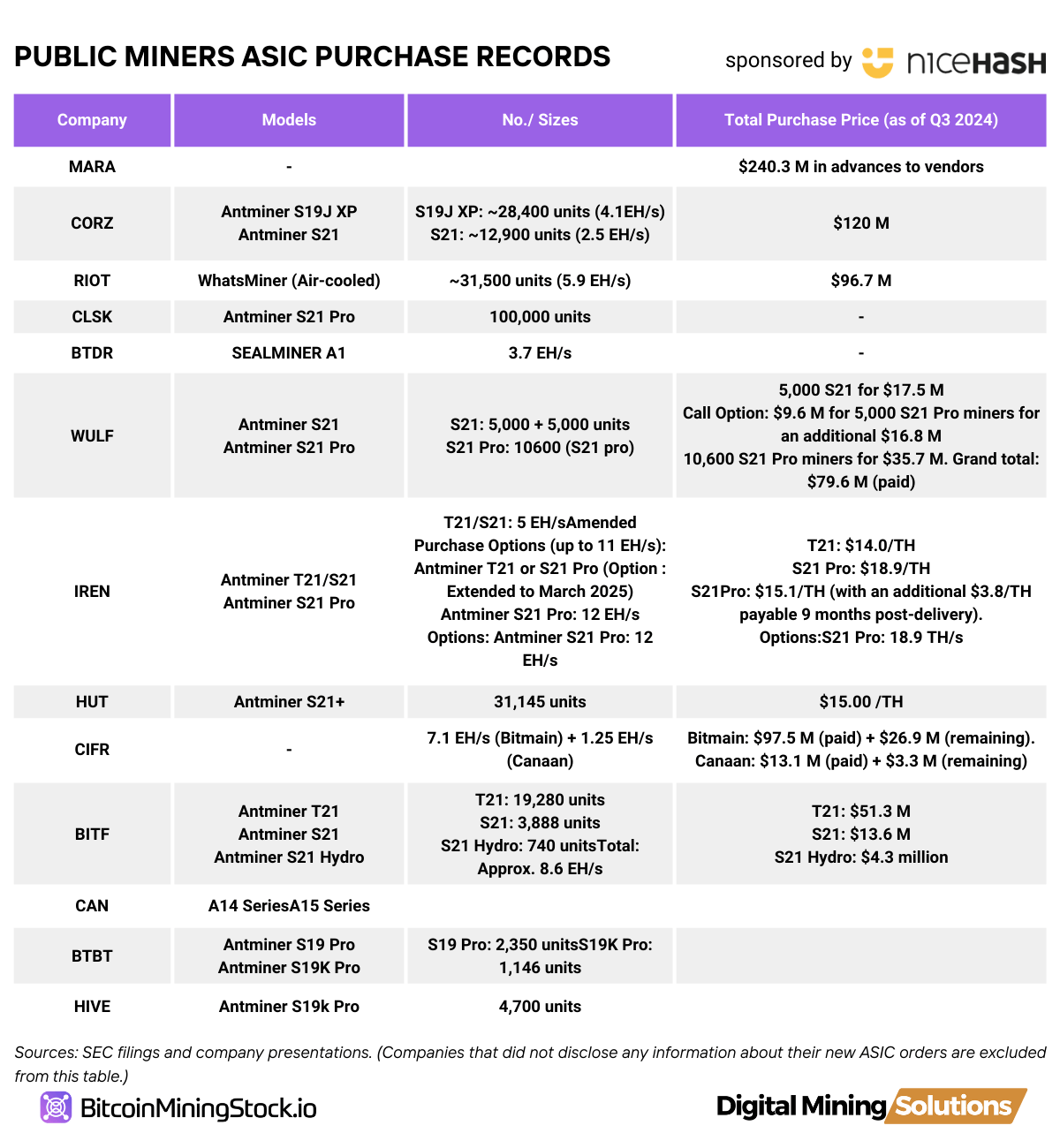

In distinction, prime miners have already begun transitioning to S21 sequence {hardware}, which affords considerably higher efficiency and power effectivity.

My Annual Mining Report reveals that majority of huge public miners positioned orders for the S21 sequence throughout the first 9 months of 2024.

If Cango needs to stay aggressive, it might must substitute older machinesand take into account migrating from third-party internet hosting to self-operated infrastructure, which might enhance margins over time by decreasing internet hosting charges and power prices. With out such enhancements, its increased manufacturing price—already round $67,769 per BTC—might erode profitability in a tightening market.

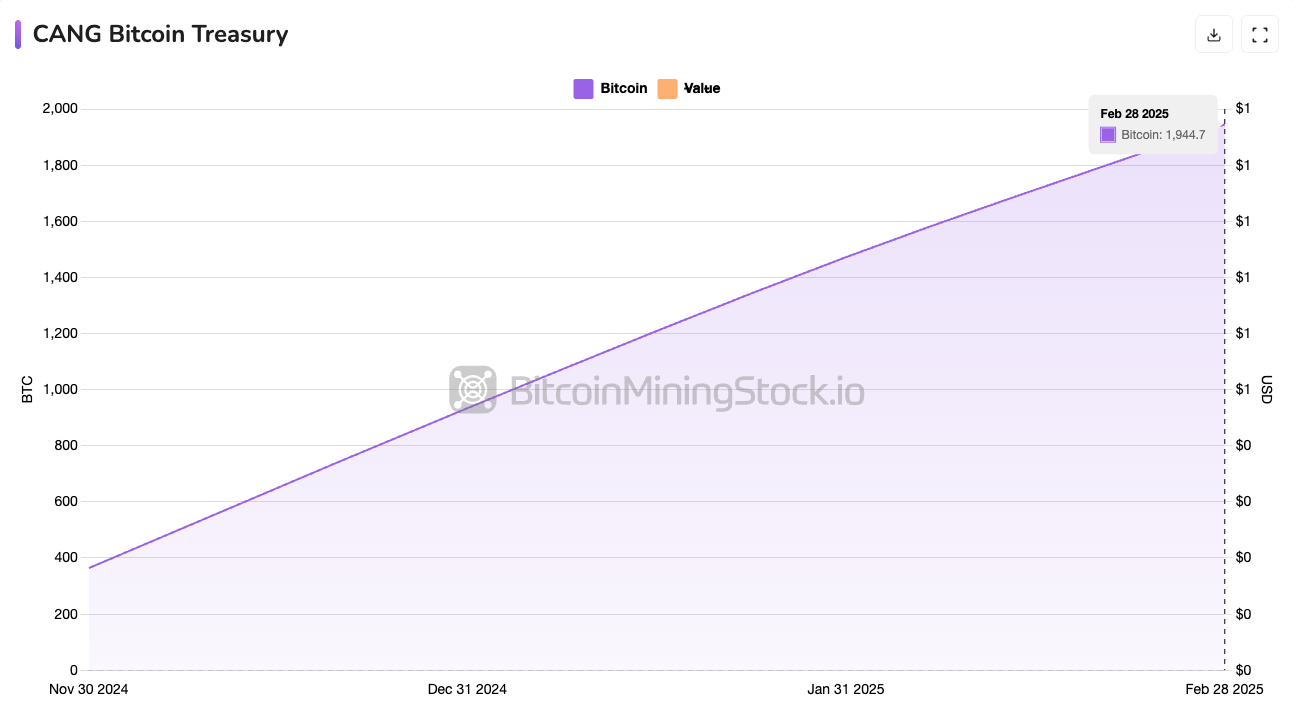

Bitcoin Treasuries

Cango has clearly adopted a “Mine & Maintain” technique, opting to retain its Bitcoin somewhat than liquidate for near-term money. As of December 2024, the corporate held 933.8 BTC (~$85 million at year-end costs). By February 2025, that determine had greater than doubled to 1,944.7 BTC, confirming energetic accumulation.

Historic efficiency knowledge for miners is now out there in our premium options.

This treasury strategy gained additional visibility when Cango was added to the Bitwise Bitcoin Normal Firms ETF on March 18, 2025—an ETF that tracks public firms holding 1,000 BTC or extra. Inclusion alerts institutional recognition and will improve visibility amongst crypto-aligned traders.

Following the earlier assumption, Cango might mine ~ 8,500 BTC in 2025. Coupled with present holdings, its treasury could possibly be ~9,500 BTC by year-end. By then, its Bitcoin holdings might attain almost $1 billion if BTC hits $100K, which doubtlessly locations Cango among the many largest public BTC holders on the planet, rivalling established mining companies and doubtlessly reshaping its valuation narrative.

Whereas this technique aligns with a long-term bullish view on Bitcoin, it introduces liquidity and stability sheet dangers. If Bitcoin costs drop considerably, Cango could also be compelled to promote BTC at unfavorable costs or depend on exterior financing to fund operations – particularly for the reason that firm’s mining enterprise remains to be margin-sensitive and capital-intensive.

Non-Binding Buyout Provide: A Hidden Bitmain Play?

On March 14, 2025, Cango acquired a non-binding buyout supply from Enduring Wealth Capital Ltd. (EWCL). Little info is thought about this funding administration firm integrated within the British Virgin Islands, however key people from EWCL have hyperlinks to Bitmain, the world’s largest ASIC producer.

This raises some hypothesis:

- Is that this an try and separate Cango’s Bitcoin mining enterprise from its Chinese language company origins? Given China’s 2021 mining ban, a construction separation might cut back regulatory dangers and permit Cango to function extra freely.

- Is Cango successfully turning into a Bitmain-backed mining proxy? The corporate purchased the entire fleet from Bitmain’s present operations, with Bitmain associates persevering with to function and preserve these machines post-acquisition. Now, Bitmain-linked personnel are behind a buyout try.

If the deal goes via, Cango might have direct entry to Bitmain’s ASIC provide, decreasing {hardware} prices and boosting Cango’s aggressive edge, however may additionally see modifications in possession construction that have an effect on present shareholders. Buyers ought to carefully watch whether or not the deal materializes and what phrases it consists of, because it might essentially alter Cango’s company construction.

Ultimate Ideas

Cango’s aggressive pivot into Bitcoin mining has essentially reshaped its company id. It’s now not an vehicle platform firm with reasonable progress prospects – it now ranks among the many largest Bitcoin miners by hash price. It has a stack of BTC sitting on the stability sheet, which aligns with the rising “Bitcoin Treasury” development.

That stated, the story remains to be below growth. Core questions stay round operational effectivity , the soundness of Bitcoin costs, and the way successfully Cango can deploy its liquidity to optimize price buildings. For instance, transitioning from third-party internet hosting to self-mining infrastructure, as firms like MARA have achieved, might considerably enhance long-term margins. The latest non-binding buyout supply from the entity linked to Bitmain additionally provides intrigue. If deeper integration with Bitmain materializes, it might grant Cango entry to discounted ASIC {hardware} and speed up fleet upgrades,

But challenges persist. Regardless of holding $345.3 million in money and short-term investments, which might cowl roughly 1.13 years of operations at present burn charges, the growing old fleet, primarily composed of second-hand S19 XP Hyd. fashions, faces sooner depreciation. As friends shift to S21 sequence machines, Cango could discover itself at an effectivity drawback if it doesn’t maintain tempo. Fleet depreciation might additional erode already skinny gross margins, particularly contemplating the This autumn report didn’t account for these prices.

Notably, Cango’s management group brings a robust monetary background, and its shareholder base consists of Tencent as a top-11 holder – a truth typically missed by Western traders. Nevertheless, its headquarters in China continues to pose regulatory and geopolitical dangers, notably because the mining ban in China stays in place.

Anybody keen on CANG ought to monitor the next key elements:

- Bitcoin manufacturing price relative to friends

- Depreciation and turnover of older mining fleet

- Liquidity and volatility of BTC holdings below a “HODL” technique

- Affect of China-based operations on future strategic flexibility

- Consequence of the buyout supply and potential reference to Bitmain

Whether or not Cango can set up itself as a key participant within the sector, solely time will inform.