The stablecoin market, at present valued at $206 billion in line with defillama.com, has skilled notable shifts, together with development within the first six days of 2025.

Practically $4 Billion Vanishes as Tether and Ethena Decline in Early 2025

Among the many high ten stablecoins, tether (USDT) and ethena usd (USDE) recorded vital outflows, collectively amounting to just about $4 billion, or exactly $3.98 billion. Tether confronted probably the most substantial decline, dropping $3.79 billion from its peak valuation of simply over $141 billion. As of Jan. 6, 2025, USDT’s market capitalization stands at $137.21 billion.

Ethena’s USDE, a yield-bearing stablecoin, equally peaked on Dec. 19, 2024, the identical day as USDT, with a market cap exceeding $6 billion. It has since decreased by $190 million, leaving the present market valuation of USDE at $5.81 billion. In the meantime, two different stablecoins, USD0 and USDX, are climbing the rankings as their provides develop.

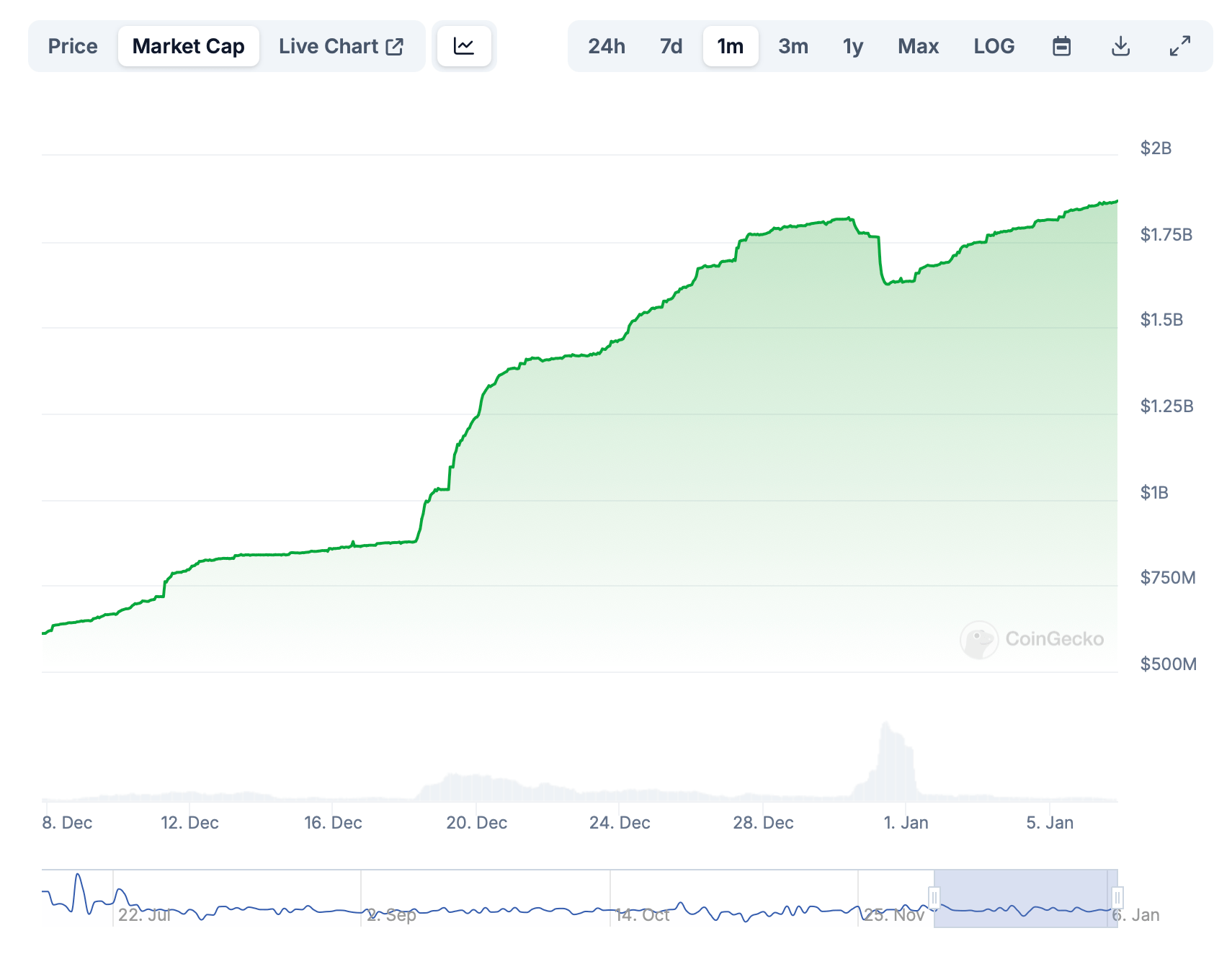

Regular USD0’s market cap development during the last 30 days.

Regular’s USD0 now ranks because the fifth-largest stablecoin by market capitalization, at present valued at $1.864 billion. On Dec. 31, 2024, USD0’s market cap stood at $1.62 billion, reflecting an influx of $244 million. Issued by Regular Cash, USD0 is totally backed 1:1 by real-world property (RWAs), primarily ultra-short-maturity U.S. Treasury Payments. It’s actively traded on decentralized alternate (dex) platforms resembling Curve and Uniswap.

Equally, Usdx Cash’s USDX has demonstrated appreciable development. Now the ninth-largest stablecoin, it holds a market valuation of $585.23 million. Only a month in the past, USDX’s market cap was $184 million, with $70 million of that development occurring in 2025. Essentially the most lively exchanges swapping USDX at this time embody Uniswap and Pancakeswap’s Stableswap app.

The stablecoin sector has seen a reshuffling of rankings over the previous 12 months, with gamers rising and falling. Regardless of tether shedding $3.79 billion, its dominance nonetheless stays unmatched, with a market valuation almost thrice that of its closest competitor, USDC. However, the $3.79 billion contraction marked some of the vital provide reductions for USDT in over a 12 months inside such a condensed timeframe.