Japanese monetary companies agency Monex Group Inc. reported a third-quarter internet lack of ¥9.9 billion ($67 million), primarily as a consequence of one-time bills associated to its cryptocurrency subsidiary Coincheck’s Nasdaq itemizing, at the same time as its core companies confirmed sturdy efficiency.

The corporate recorded ¥17.1 billion in one-time bills associated to Coincheck Group N.V.’s December itemizing, together with ¥13.7 billion in share-based compensation bills and ¥3.4 billion in skilled charges. Excluding these prices, the corporate’s operational efficiency remained strong, pushed by sturdy crypto buying and selling volumes and regular brokerage revenues.

Coincheck’s market buying and selling quantity greater than doubled to ¥245.6 billion within the quarter, reflecting broader crypto market momentum. The U.S. phase maintained regular efficiency with quarterly revenue of ¥1.5 billion, whereas the Japanese operations benefited from the strategic alliance with NTT DOCOMO.

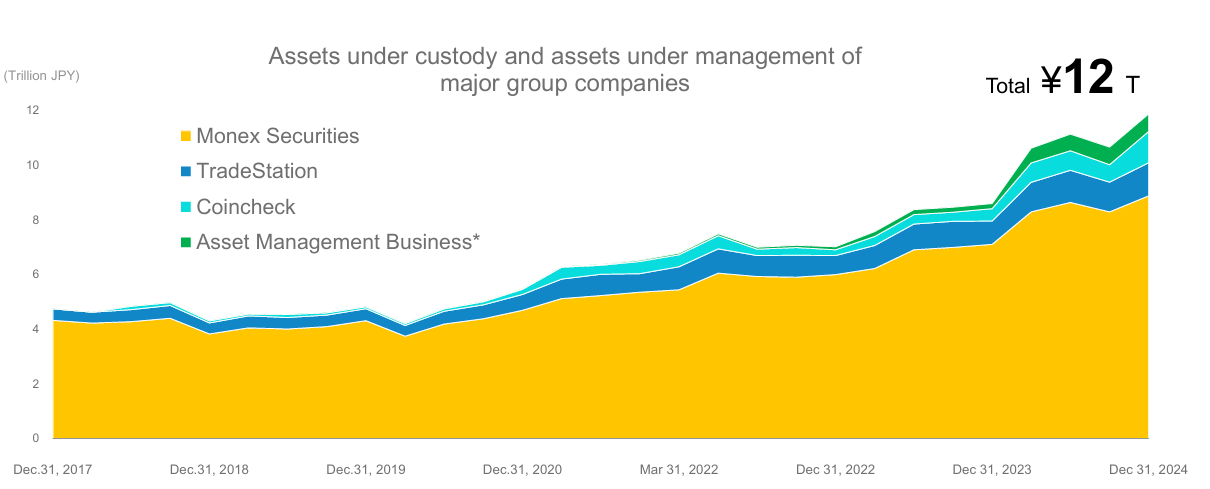

The corporate’s complete property underneath custody and administration reached ¥12 trillion, marking important enlargement of its enterprise base. Monex Securities, now an equity-method affiliate following its partnership with NTT DOCOMO, noticed its mutual fund stability develop to ¥1.96 trillion, up 8% from the earlier quarter.

Trying forward, Monex Group maintains its concentrate on attaining a 15% ROE whereas balancing progress investments with shareholder returns.

Dividend and Buyback

In a separate announcement, Monex declared a particular year-end dividend of ¥10 per share, funded by proceeds from the sale of its Hong Kong subsidiary, Monex Increase Securities. This comes along with the odd dividend of ¥15.1 per share, bringing the entire year-end dividend to ¥25.1.

The corporate continues to execute its ¥5 billion share buyback program introduced in July 2024, having repurchased ¥2.7 billion price of shares as of January 31, 2025. Monex maintains its goal of attaining a 15% ROE whereas balancing progress investments with shareholder returns.

The Crypto Guess

Almost a 12 months in the past, Monex accomplished the acquisition of a majority stake in 3iQ Digital Holdings, a Canadian crypto asset administration agency. This deal, first introduced in December 2023, introduced 3iQ and its subsidiaries underneath Monex’s possession.

To assist 3iQ’s progress, Monex invested $7.5 million in its Managed Account Platform (QMAP). This platform offers institutional traders with entry to quite a lot of crypto hedge funds, specializing in methods designed to satisfy the wants of worldwide establishments. The funding reinforces 3iQ’s place in institutional digital asset administration.

Moreover, Monex has launched a brand new service in partnership with Tokyo-based NTT Docomo, permitting prospects to buy mutual funds utilizing bank cards. By integrating NTT Docomo’s d CARD, customers can earn as much as 1.1% again in d POINTs on their month-to-month mutual fund contributions. Monex expects this rewards system to encourage common investments by providing added monetary incentives.