Regardless of the general market losses, demand for on-chain options stays sturdy. A number of EVM-compatible L1 and L2 chains are noting a rise in new wallets.

New lively wallets are shifting to a number of EVM-compatible chains, reflecting demand for on-chain actions. Regardless of the general market drawdown, Web3 exercise and apps are lively, constructing wider adoption.

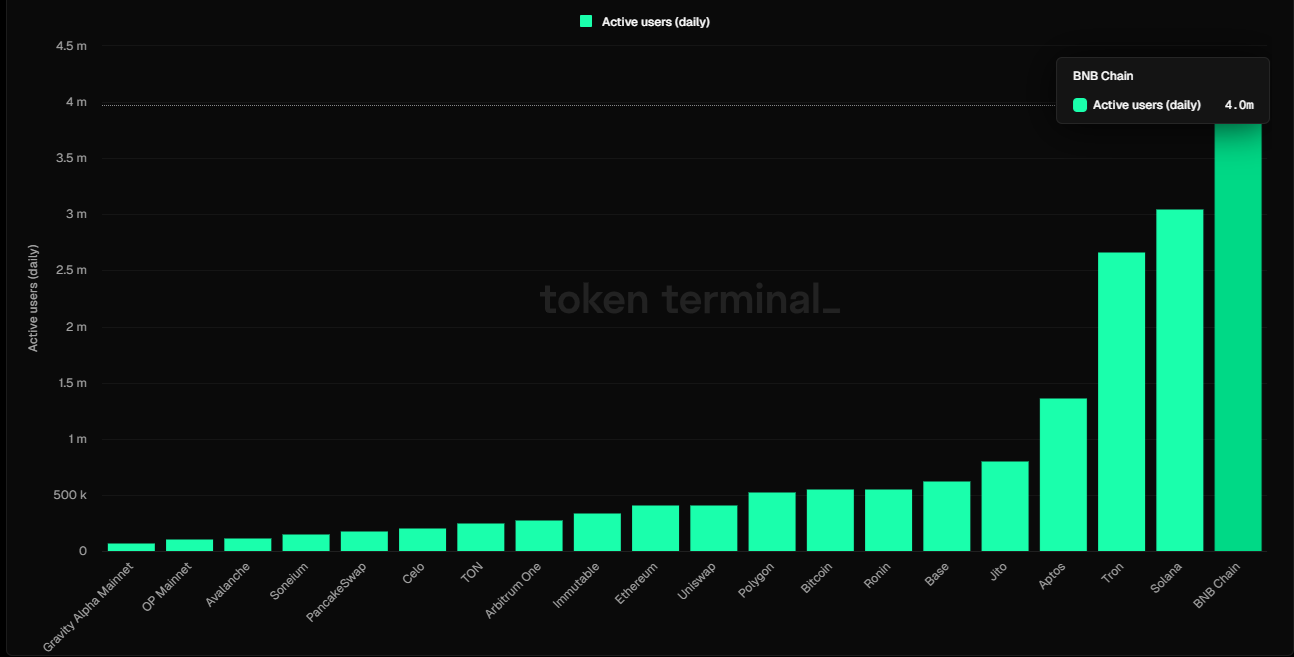

Exercise continued to circulate into BNB Sensible Chain and Base, as a response to a slowing Solana meme market. BNB Sensible Chain grew to become the chief with 4M lively every day customers, with simply 2.7M for Solana. Based mostly on distinctive tackle knowledge, prior to now week, Binance added one other 2M wallets.

BNB Sensible Chain surpasses Solana in every day lively addresses, principally linked to PancakeSwap exercise. | Supply: TokenTerminal

Base was the chief in new pockets inflows, with an extra 2.8M addresses becoming a member of the community prior to now week. Base distinctive addresses went vertical prior to now few weeks, including as much as 30M new addresses in the entire month of February. The continued shift to Base confirmed rising demand for affordable on-chain actions, together with excessive obtainable liquidity for DeFi investments and passive earnings.

All the L2 chains had a weekly engagement with over 9M weekly lively wallets, rising for the second week in a row. The L2 ecosystem stays close to peak exercise, with over $10.5B in stablecoin liquidity to drive buying and selling. Decentralized buying and selling nonetheless reaches 18.5% of trade exercise, displaying the robustness of decentralized on-chain actions even at lowered ETH costs and worsened sentiment.

Probably the most lively chains with new person development attempt to keep away from the destiny of ‘lifeless networks’, the place exercise has solely adopted airdrop campaigns. A few of the prime development networks began constructing their app assortment through the 2021 bull market, and have been making an attempt to make a return.

Ethereum ecosystem stays related

Different extremely lively chains with an influx of customers present former stars from the 2021 Web3 bull cycle are nonetheless related. Customers flowed into Polygon and Ronin, in addition to the EVM-compatible L1 chain Avalanche.

Polygon lately expanded its utilization, carrying a number of the main apps based mostly on DappRadar knowledge. Polygon exercise hinges on the Moonveil gaming ecosystem, the Polymarket prediction app, and legacy video games retaining reputation.

The previous week additionally noticed a shift into Sonic (previously Fantom), because the community was talked about broadly on social media. Sonic additionally grew because it provided its personal model of meme tokens, a contemporary begin from the slowing exercise of Pump.enjoyable.

The latest growth in customers follows the sturdy demand for DEX buying and selling. The highest DEX is boosting all EVM chains, particularly Uniswap. PancakeSwap elevated the site visitors and new person flows to BNB Sensible Chain, whereas Base benefitted from its main DEX, Aerodrome.

One of many causes for the exercise of EVM-compatible chains is the comparatively low fuel worth of Ethereum. Fuel charges are as little as $0.04, whereas common transactions on Ethereum are underneath $1. This led to a rise in new Ethereum customers, including 752K new addresses prior to now week.

Smaller chains acquire token-based site visitors

On-chain analysts have famous that exercise on smaller chains displays new token launches and DEX exercise. Based mostly on DEX exercise, Solana continues to be the highest-rank community for tokenization, however Base has ranked at a detailed second.

Based mostly on DexScreener reputation, Sonic is now within the prime 5 of chains serving as a token platform with excessive DEX exercise. | Supply: DexScreener

Based mostly on DexScreener, the at present lively chains replicate their trending tokens. Sonic now ranks within the prime 5 tokenization chains, whereas Arbitrum is again within the prime 15. PulseChain and TON are simply behind Sonic, drawing in their very own model of token creators.

Buying and selling bot utilization can also be altering the panorama for essentially the most lively networks. Solana takes up 82% of bot customers, however BNBChain and Base lately elevated their share. Base continues to be the smallest bot-driven chain, the place nonetheless underneath 10K customers are buying and selling with bots. The comparatively decrease competitors could also be a consider driving Base DEX exercise.