Because the broader cryptocurrency market grapples with vital downturns, Ethereum (ETH) and Solana (SOL) have emerged as a number of the hardest-hit belongings among the many high ten digital currencies.

On high of that, current allegations by market specialists on social media counsel potential market manipulation by main gamers within the area, elevating additional issues for traders.

Ethereum Falls Beneath $2,600: Potential Finish To Altseason

Over the previous few days, on-chain information has surfaced, indicating large-scale promoting of Ethereum and Solana tokens primarily by Binance (BNB), the world’s largest cryptocurrency change.

Market skilled Crypto Rover highlighted that these gross sales, which occurred over a span of simply 48 hours, have contributed to a staggering 7% drop in Ethereum and a 12% decline in Solana’s worth.

Ethereum has now breached its vital help stage of $2,600, some extent that analysts like Ali Martinez warning may sign the tip of the altcoin season if confirmed on larger time frames.

Martinez notes that the subsequent vital threshold for the Ethereum holders is about at $2,300; falling under this stage may jeopardize the psychologically essential $2,000 mark.

For Solana, the scenario is equally dire. The asset has retraced under its main help stage at $150, settling round $140. This decline represents a substantial 51% hole from its all-time excessive of $293 reached in January.

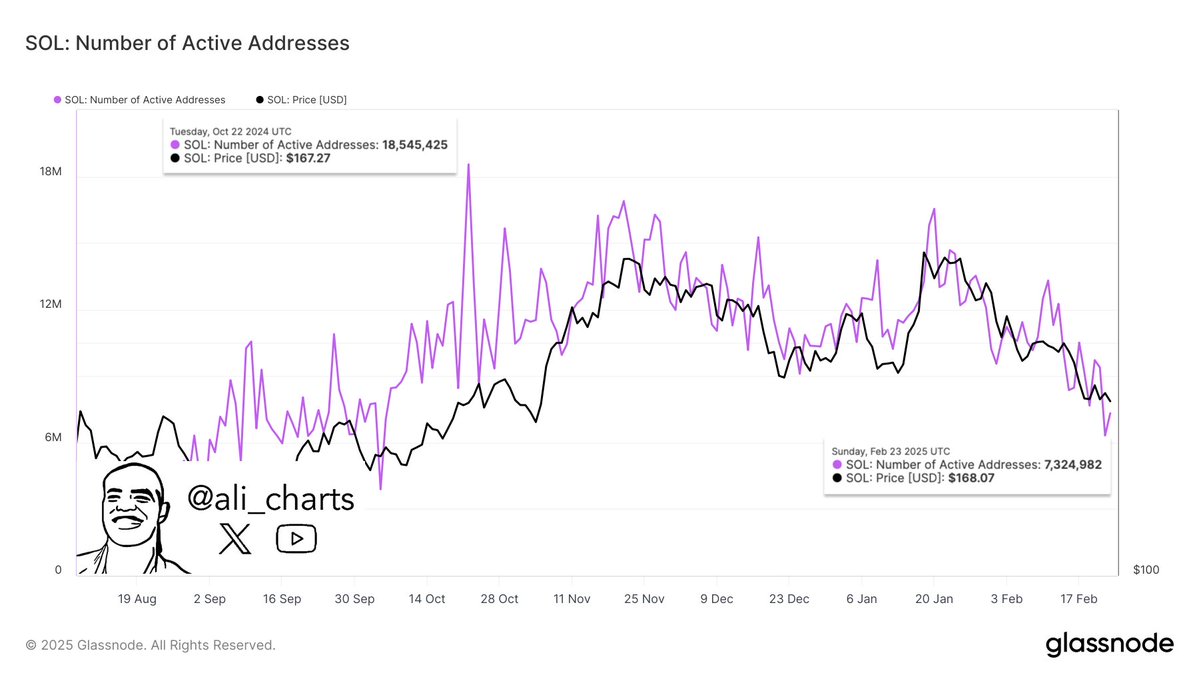

The bearish sentiment surrounding Solana is additional underscored by a stark drop in community exercise. Martinez identified that Solana’s energetic addresses have plummeted by 60%, falling from a formidable all-time excessive of 18.5 million in October to only 7.3 million.

Market Manipulation Allegations Come up

Amidst these troubling developments, voices inside the crypto group are suggesting that the market turbulence might not be coincidental.

Consultants like Marty Get together have expressed issues concerning the function of Binance, asserting that the change could have offloaded its holdings in Solana and Ethereum to cowl fines imposed by the Division of Justice (DOJ) whereas additionally taking advantage of liquidating leveraged futures positions.

Such actions have been characterised as “manipulative,” with Marty noting the timing of those gross sales. Physician Revenue, one other market skilled, additionally means that platforms like Bybit could have engaged in related practices to get better “misplaced Ethereum” after its current hack, fueling additional hypothesis concerning the integrity of those exchanges.

Critics argue that these “market maneuvers” are indicative of a broader sample of manipulation, notably geared toward triggering mass liquidations amongst lengthy positions.

Physician Revenue remarked on the obvious transparency of those manipulations, suggesting that market gamers are exploiting the naivety of common crypto traders.

Given the present local weather, there’s a rising name inside the crypto group to shift away from centralized exchanges and conventional monetary buildings.

Advocates like Physician Revenue are urging traders to embrace decentralized finance (DeFi) and monolithic networks, emphasizing the significance of self-custody and minimizing reliance on establishments that could be prone to manipulation.

For now, Ethereum has managed to stabilize at $2,390, which is sort of 50% under the document excessive of $4,878 reached in the course of the 2021 bull market.

Featured picture from DALL-E, chart from TradingView.com