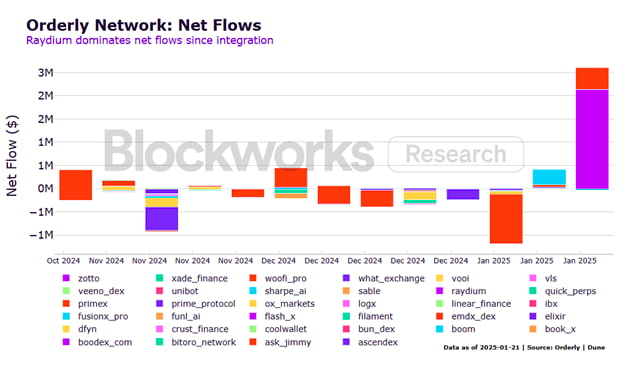

Raydium (RAY), Solana’s (SOL) main decentralized trade (DEX), has built-in Orderly’s (ORDER) perpetuals, boosting its one-month buying and selling quantity by 157%. As issues develop, Orderly may seize a share of Raydium’s $100 billion buying and selling quantity, making a promising outlook for ORDER.

This data comes from a current report by Blockworks Analysis, shared on X on January 23, 2025. As highlighted by the analysis staff, Raydium is the main DEX, with a 30-day buying and selling quantity of almost $100 billion.

Nonetheless, Orderly’s quantity nonetheless represents solely a small share of Raydium’s quantity, leaving related room for development. In accordance with knowledge from DefiLlama, shared by Orderly’s official account, the protocol noticed a 157% one-month quantity, being the best improve within the final 30 days amongst all protocols.

1 month buying and selling quantity development up 157%.

That is the best on the market. ORDER will prevail. pic.twitter.com/qk8Sr46zDt

— Orderly (@OrderlyNetwork) January 23, 2025

What’s Orderly (ORDER)?

Orderly is a cloud liquidity infrastructure that consolidates all orders right into a single shared order e-book throughout a number of chains.

With that, Orderly creates a unified liquidity panorama that improves buying and selling effectivity, delivers deeper liquidity, and supplies tighter spreads. Orderly’s omnichain spine empowers builders to innovate, by eradicating the dangers related to cross-chain bridging and wrapped asset motion, permitting builders to create a complete vary of monetary merchandise for each retail {and professional} merchants.

Furthermore, the Orderly Chain, constructed on the OP Stack, leverages Celestia’s (TIA) knowledge availability and LayerZero’s (ZRO) cross-chain messaging protocol to function the settlement layer and ledger for all transactions.

Its rising presence on Solana is an instance of what’s potential to attain with the right infrastructure and setting the suitable partnerships and integrations, leveraging the most effective instruments with the best liquidity ecosystems.

Featured picture from Shutterstock