The tokenization narrative remained some of the profitable classes of tokens, retaining its earnings in an in any other case bearish interval. Led by Ondo (ONDO), the sector posted positive factors the place all different token courses had a unfavorable efficiency.

RWA tokens have been the one asset class to finish the final month with a constructive efficiency, in addition to Bitcoin (BTC). RWA tokens surpassed all different narratives, particularly the AI brokers sector, which erased over 70% of its worth.

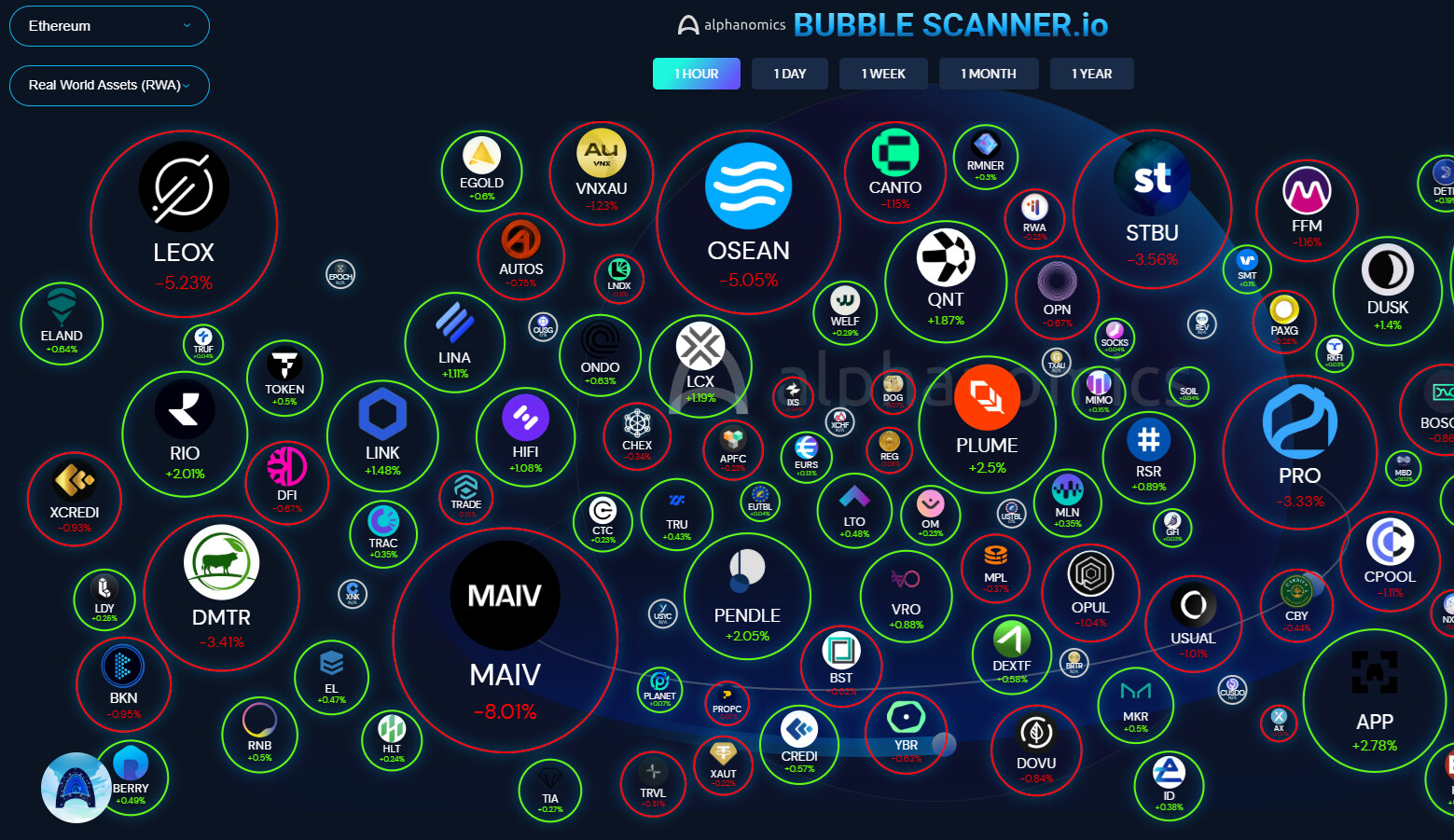

Previously 24 hours, 46% of tracked RWA tokens have been within the inexperienced, with 54% within the pink. Buying and selling volumes for the entire sector additionally expanded by over 142%.

ONDO, OM prepared the ground for RWA

The RWA token sector holds a complete valuation of $35B, with over 60% of the worth held by Chainlink (LINK), MANTRA (OM), and Ondo (ONDO). Virtually all of the main tokens have sparked predictions of an eventual rally, along with long-term expectations for the sector as an entire.

ONDO drew consideration for its presence within the pockets of World Liberty Monetary, along with the current Ondo summit. Ondo additionally launched Ondo Chain, an L1 particularly created for institutional tokenization. Ondo Finance has not introduced an official partnership with World Liberty Fi, regardless of the current sequence of purchases.

All these components added to the RWA narrative, boosting publicity prior to now week. The efficiency of RWA hinges on the hype affecting a number of tokens within the sector. At this level, RWA liquidity is fragmented and there’s no normal of settlement or compatibility. Tokenization by mainstream corporations like BlackRock is sort of totally different from small-scale tokenization efforts from purely crypto startups.

RWA tokenization tasks nonetheless rely totally on Ethereum, with fewer launches on Base or Solana. The sector turned to inexperienced prior to now day. RWA tokens usually are not restricted to blue chips or the creators of stablecoins. As a substitute, a number of area of interest tasks have launched throughout Ethereum, all vying for consideration as the subsequent platform that may remodel RWA token issuance, buying and selling, and settlement.

A number of new RWA tokenization tasks rallied prior to now days, every promising to faucet all belongings on the planet of TradFi. | Supply: Alphanomics

RWA tokens usually are not assured a rally, and the previous week noticed a 2% slide for the sector. Nevertheless, the tokens are seen as one of many potential sources for a brand new altcoin season, in case the meme token hype slows down. RWA can also be down 28% prior to now three months, although knowledge could fluctuate based mostly on the collection of particular tokens.

The RWA token narrative consists of meme-like tasks that share the hype. Not all tasks are equal, and a few could also be extraordinarily risky. New tasks promise to tokenize all belongings and shift settlement on-chain, once more with no certainty on requirements and adoption.

Ethereum stays the main chain for tokenization

A minimum of 112 entities have issued tokens based mostly on real-world belongings, coming from conventional finance. Of these issuers, 67 have chosen Ethereum, 28 have moved to ZK Sync Period, and there are solely 3 issuers on Solana.

The issuers usually are not the identical set of tasks because the newly trending small RWA tokenization tasks. Among the issuers are older, surviving from earlier bull markets.

In complete, RWA tokens carry $17.18B in worth, whereas excluding stablecoins. The most typical kind of asset to be tokenized is personal debt. Round $3.59B of tokenized worth comes from US authorities debt.

Shares and commodities, in addition to the promised actual property tokenization, are among the uncommon use circumstances for tokenization. RWA belongings additionally vary between these used for enterprise and people used for speculative casual buying and selling on crypto markets.

Gold-backed tokens get a buying and selling increase

One of many use circumstances for RWA is tokenized commodities. The current rally of gold to an all-time excessive was additionally mirrored in gold-backed tokens.

In crypto, all gold-backed tokens are valued at solely $1.7B, a comparatively small subset of crypto belongings. RWA is predicted to faucet conventional belongings within the trillions, transferring past its early stage.

PAX Gold and Tether Gold have been among the many most generally traded tokenized gold belongings, each reflecting gold’s rally above $2,900 per ounce. For now, gold tokenization is comparatively uncommon, on account of regulatory and storage necessities.