Bitcoin’s future value has been a subject of debate amongst crypto fans and monetary specialists alike. Whereas value fluctuations will be unpredictable within the brief time period, many view Bitcoin as a long-term retailer of worth, very like gold. Many traders are betting on Bitcoin’s future worth as a hedge in opposition to inflation, with a concentrate on the rising demand for Bitcoin reserves.

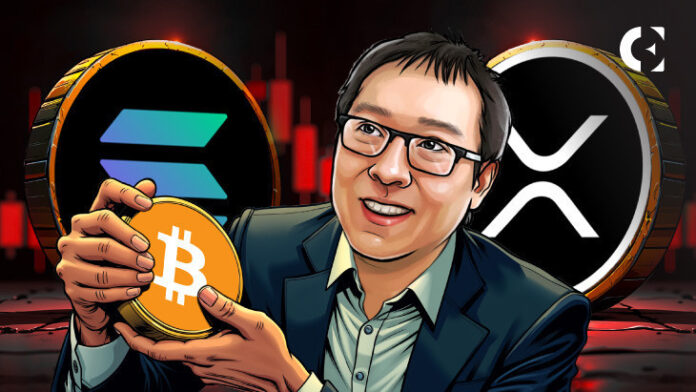

CEO of Jan3 and founding father of Pixelmatic, Samson Mow is confidently predicting that Bitcoin may attain a exceptional $1 million per coin, and he believes it may occur as quickly as this yr. “It’s going to be this yr,” Mow stated, pointing to Bitcoin’s previous efficiency. Whereas some argue that Bitcoin may face diminishing returns, Mow dismisses this concept, explaining that Bitcoin is not like conventional property—there’s no higher certain to its potential.

Associated: Bitcoin Money-Out, Ethereum Inflows: What ETF Actions Reveal Concerning the Crypto Market

Analyst Cites Shortage and Institutional Demand

With huge demand coming from establishments, nation-states, and even peculiar individuals, Mow believes Bitcoin’s shortage continues to be undervalued, particularly with solely 21 million cash in existence.

Mow additionally addressed Bitcoin’s value, which is presently round $96,000. Regardless of sturdy demand from organizations like Technique and nations like El Salvador, there are debates about why the worth hasn’t skyrocketed.

Mow speculates that the current value fluctuations are a part of a market correction, particularly with altcoins like Ripple, Solana, and others, which he claims are nonetheless overpriced.

Altcoins “Overpriced,” Bitcoin Dominance to Rise

He stated, “I’ve been predicting 1 million for some time and hopefully I’ll hit someday however I imagine this pullback may be very regular as a result of the altcoin market was overheated. Should you take a look at XRP (Ripple), it was $3, that’s ridiculous with Bitcoin at $97,000. After which you’ve got Solana. Every part is overpriced proper now for the altcoins, so I believe it’s regular we come down, they shake off.“

Bitcoin’s dominance wants to extend, significantly because the market shakes off extra hypothesis in altcoins. Nevertheless, Mow continues to be optimistic about Bitcoin’s future, insisting that even with costs at $100K or $200K, Bitcoin continues to be undervalued.

Associated: Jim Cramer Says No Bitcoin Rebound Earlier than Monday, Cites “Too A lot Worry” Amid $1.5B Hack

As Bitcoin’s journey continues, Mow and others are protecting their eyes on key developments, together with the strategic Bitcoin reserves and the continued rise of Bitcoin ETFs, that are making it simpler for institutional traders to become involved.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.