SoSoValue has turn into the primary undertaking to reveal information through a trial spot itemizing function on Bybit in a bid to offer traders with extra readability relating to its improvement standing and positively affect their decision-making.

The act of revealing such crucial information has simply been launched on Bybit and remains to be within the trial section. It’s just like Binance’s proof-of-reserve, which turned a factor after the eventual chapter of the defunct FTX cryptocurrency change and the crash of different related platforms.

Bybit believes the brand new function communicates its dedication to selling transparency in undertaking information and hopes the data interprets into knowledgeable selections.

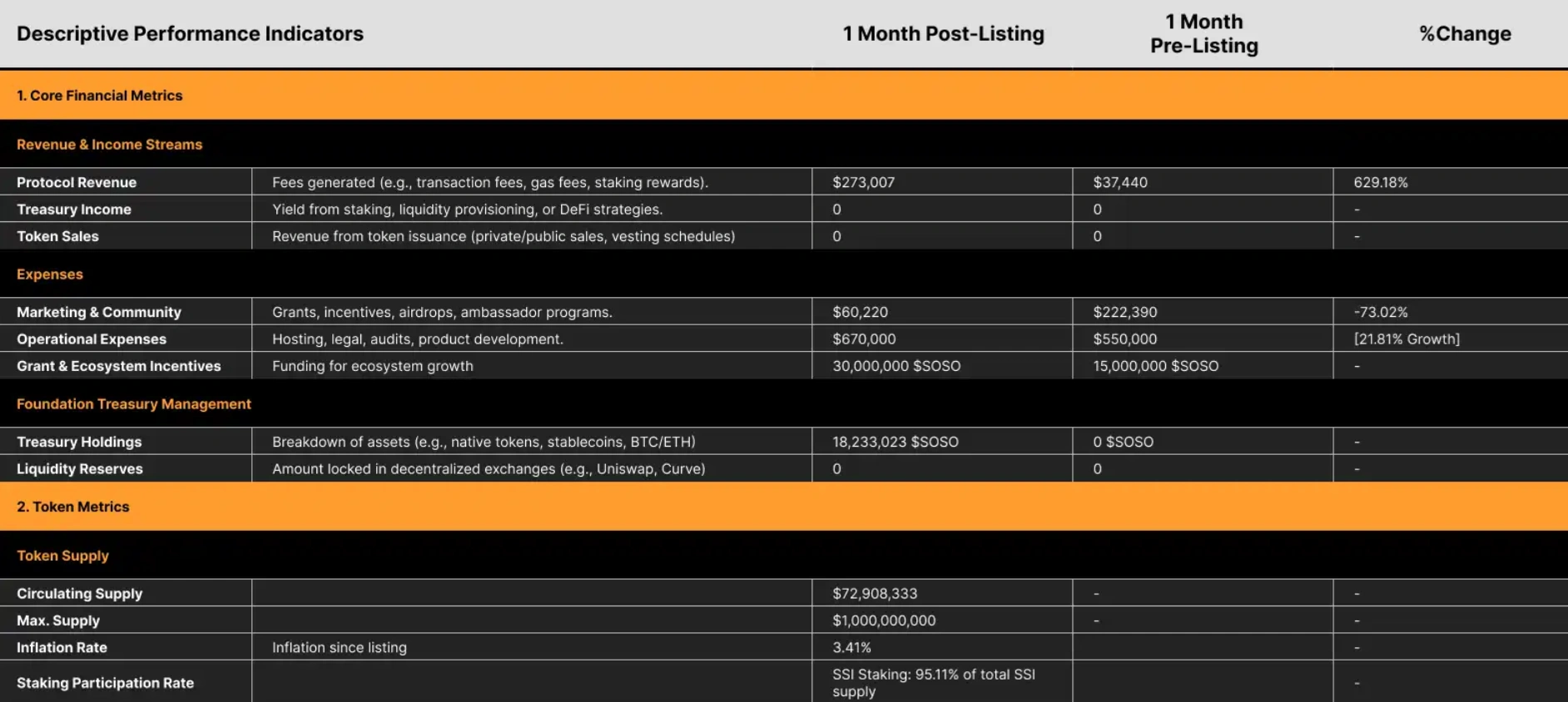

Among the information included within the disclosure

As earlier acknowledged, the info SOSO disclosed goals to offer potential traders with a clearer view of its improvement standing and is predicted to assist knowledgeable decision-making.

In response to the info, one month after itemizing, SOSO’s circulating provide is $72,908,333, with an inflation price of three.41% since itemizing. So far as SSI staking goes, it exhibits that 95.11% of the entire provide is staked.

SoSoValue’s information publication on Bybit. Supply: Bybit

33% of the entire tokens are reserved for the crew and none has been launched to them up to now. No tokens have additionally been unlocked for traders and the subsequent main token unlock will not be anticipated till 2026 when there can be one other airdrop for individuals who staked.

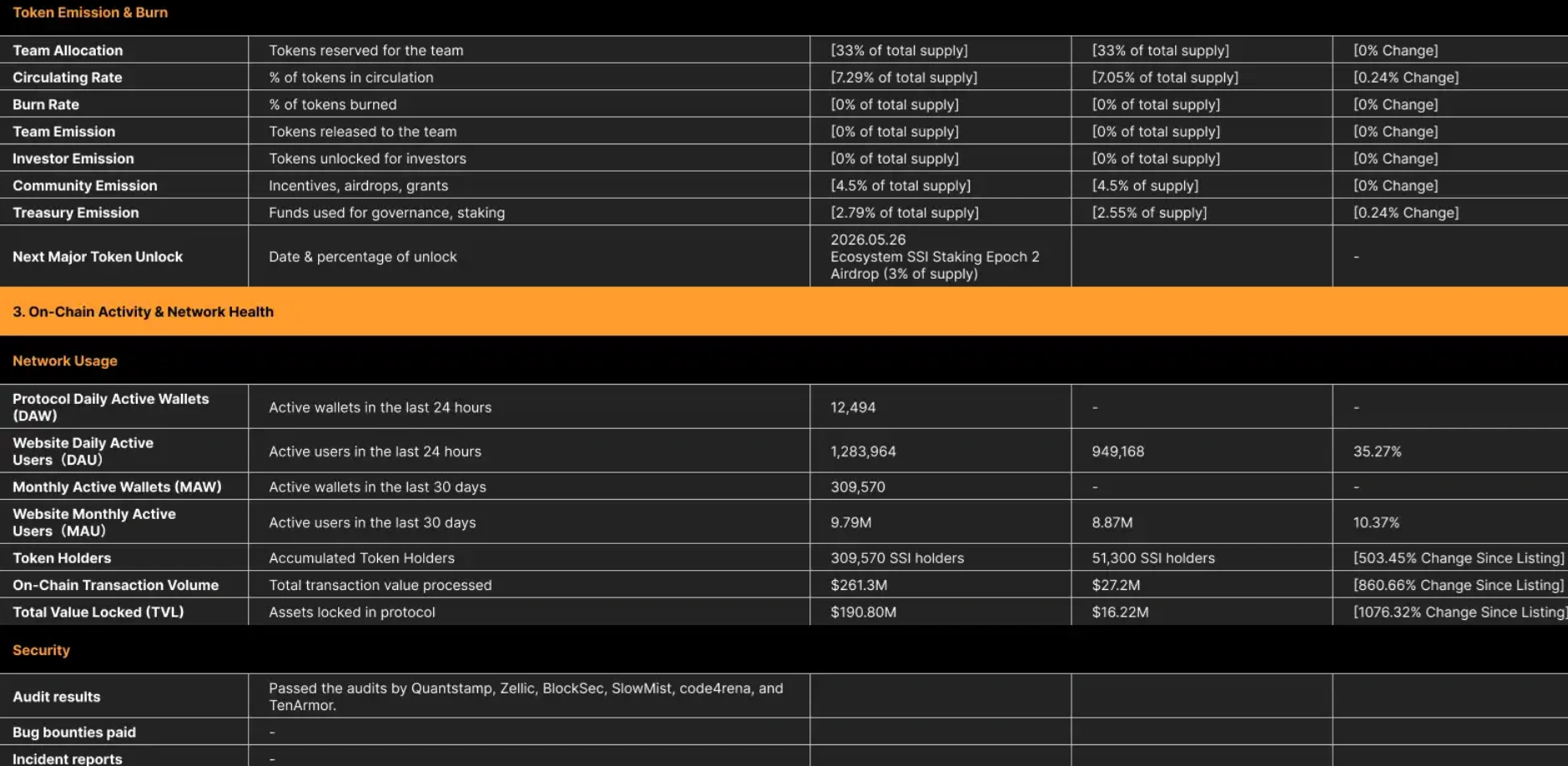

SoSoValue’s information publication on Bybit. Supply: Bybit

The info additionally exhibits that SOSO has handed audits by respected websites like QuantStamp, Zellic, BlockSec, and TenArmor.

Bybit’s new information disclosure function is just like Binance’s proof-of-reserve

Bybit’s new effort at transparency comes years after its modern, Binance, the world’s largest crypto change, introduced plans to implement a proof-of-reserve system on November 8, 2022.

As earlier acknowledged, Binance made the choice after a few exchanges, together with FTX, fell which led to a big monetary disaster, with billions vanishing. It used Merkle Bushes, a cryptographic information construction, to attain this because it ensures transparency and safety in relation to the verification of its digital asset holdings.

The proof-of-reserve system permits Binance customers to confirm that the custodian is in possession of all of the belongings it claims to have. CZ, who championed the course, hoped the mechanism would forestall exchanges from misusing shopper funds and improve the general belief folks have in centralized exchanges.

The system includes audits that verify the accuracy of any reported reserves, and it has been very helpful over time in serving to traders make knowledgeable selections.

After it was introduced, many business leaders and KOLs praised the initiative, claiming it was a step in the fitting route. Since then numerous different exchanges like OKX have achieved the identical.

Various crypt customers nonetheless assume “not your keys not your funds” in relation to centralized exchanges, however the proof-of-reserve system has turn into a option to “vibe verify” tasks, guaranteeing they’re what they are saying they’re.

Nonetheless, it’s essential to notice that whereas proof-of-reserve works to advertise transparency, there isn’t a accepted commonplace for these attestations, so not all reviews are created equal.

For instance, exchanges like Binance supply proof-of-reserves which can be, in the intervening time, merely self-attestations not accomplished by an impartial third occasion like Bybit’s. This implies customers must take Binance’s phrase {that a} undertaking is being clear not like when a 3rd occasion is concerned and is ready to certify the attest actions are on level. Different exchanges in addition to Bybit that use a 3rd occasion to audit tasks embrace Kraken, Uphold, and Bitstamp.