Disclosure: The views and opinions expressed right here belong solely to the creator and don’t symbolize the views and opinions of crypto.information’ editorial.

United States President Donald Trump signed an govt order to create a sovereign wealth fund. Whereas the media speculates whether or not the US authorities will spend money on crypto, let’s take a broader have a look at the previous and the potential way forward for Bitcoin (BTC).

You may additionally like: The main focus is on strengthening US management in crypto tech | Opinion

What fashioned Bitcoin’s tendencies?

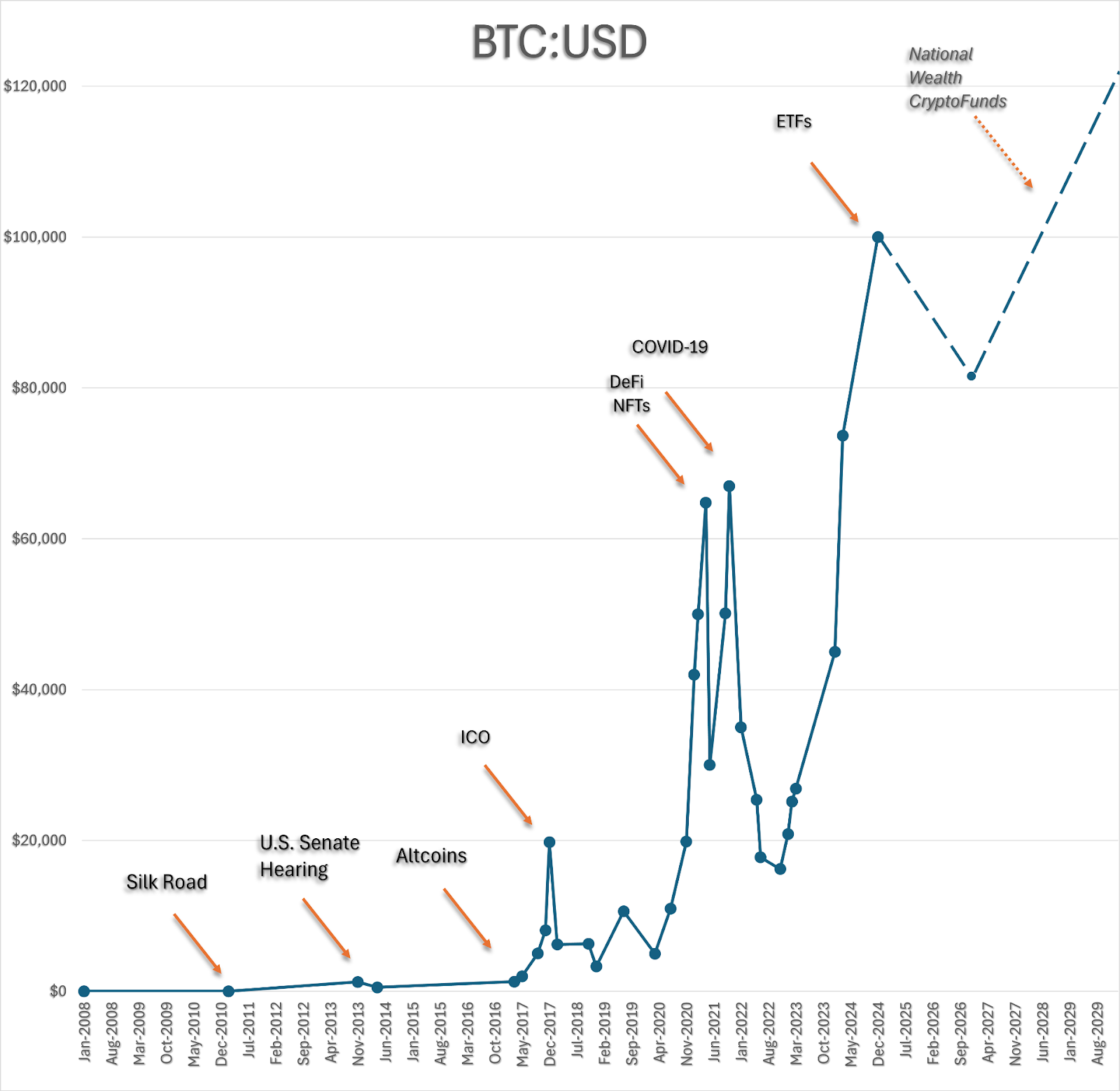

Over the past 17 years, Bitcoin’s value climbed from $0 to a historic excessive of $110,000, but its trajectory has been something however linear. In 2010, as an illustration, you wanted 5 thousand BTC simply to purchase a pizza. The daybreak of the notorious Silk Street market in 2011 contributed to an early value spike. When the US authorities took down {the marketplace}, the following US Senate public listening to unexpectedly propelled Bitcoin’s value from a number of hundred {dollars} to over $1,200 per coin.

Bitcoin value chronology: Foremost tendencies and milestones | Supply: Courtesy of the creator

Then got here the primary altcoin season, fueled by the arrival of Ethereum (ETH) in 2016 and the preliminary coin providing growth ending in 2017. This era pushed Bitcoin to an unbelievable excessive of $20,000. After its first crypto winter of 2017–2018, Bitcoin steadily rebounded. The rise of decentralized finance and the explosion of nonfungible tokens injected renewed vitality as modern tasks and enthusiastic adopters bid up costs once more. Though Bitcoin itself was not the driving drive behind DeFi—Ethereum’s sensible contracts took that function—Bitcoin remained the primary gateway for crypto investments, with its “wrapped” model showing on decentralized exchanges and automatic market makers from 2018 to 2020. NFTs additionally accompanied Bitcoin’s climb. After a modest rollback, COVID-19 struck, and governments all around the world poured out a rain of freshly printed cash to their residents, fueling one other wave of investor curiosity.

Simply because it appeared tendencies have been slowing, institutional buyers entered the scene. Conventional monetary establishments started embracing Bitcoin, launching exchange-traded funds round 2022, which peaked in recognition between 2024 and 2025. This broadened entry for each retail and institutional buyers and strengthened Bitcoin’s standing as “digital gold.”

Nationwide wealth funds

Now, with rumors swirling that the US authorities would possibly quickly maintain direct crypto investments by means of newly initiated Sovereign Wealth Funds, it’s value contemplating what would occur if this turns into actuality.

Undoubtedly, america would set a worldwide precedent for different international locations. This development may form the subsequent two to 5 years and probably ship Bitcoin’s value skyrocketing, maybe fulfilling the wildest desires by reaching $1,000,000 per coin. There’s a catch, although. Even essentially the most highly effective monetary organizations can undergo from short-sightedness.

What drives Bitcoin’s worth?

Bitcoin by no means absolutely grew to become the “digital money” envisioned in Satoshi Nakamoto’s white paper. Its Silk Street period might have been its golden age for real-world transactions. For readability, it stays the go-to possibility for shady trades worldwide. In reputable markets, Bitcoin features primarily as a retailer of worth—a speculative asset traded by buyers with little regard for its unique utility.

We’ve seen it evolve by means of a number of eras, and we now stand on the edge of probably the most important one but: nationwide investments. Many governments already personal some BTC, typically seized from legal enterprises. Nonetheless, if treasury departments leap in late, they could miss important income, whereas early movers like El Salvador may take pleasure in a bigger windfall. Every development thus far has expanded Bitcoin’s investor base, however what may surpass the participation of institutional organizations, superannuation funds (but to embark), and nationwide treasuries? Finally, you run out of patrons on Earth—there’s actually nobody on the Moon to proceed the development as soon as Bitcoin will get there.

That’s the reason I contemplate it short-sighted to count on that Bitcoin’s speculative worth will proceed to be fueled by these tendencies indefinitely. Those that may form Bitcoin’s future and make its use really sustainable, past mere hypothesis, sadly, present few indicators of getting a long-term imaginative and prescient. My prediction is that they’ll quietly exit earlier than the development turns downward.

Different (sustainable) future

Many query Bitcoin’s reliability, however such skepticism typically depends on flawed assumptions. Bitcoin is neither centralized nor weak: it has operated as a publicly accessible ledger for over 17 years with out main disruptions—an unparalleled feat.

If nationwide treasuries acknowledge Bitcoin’s resilience, it may pave the way in which for long-overlooked purposes. Bitcoin has the potential to evolve into a strong utility platform just like Ethereum. Whereas some engineers debate this, I consider their skepticism stems from a scarcity of in-depth experience on this space.

Think about leveraging Bitcoin’s blockchain for a nationwide land registry, a decentralized different to ICANN’s TLD system, or perhaps a voting system for democratic international locations. Bitcoin’s larger charges may very well be justified by its unprecedented safety—notably for mission-critical private and non-private programs that deal with beneficial belongings. Whereas cheaper, much less safe blockchains might enchantment to speculative or experimental tasks, Bitcoin is designed for situations the place reliability trumps price.

Conclusion

I’ve lengthy advocated for constructing dApps and sensible contracts on Bitcoin (and I’m deeply concerned within the technical aspect), contending that its excessive charges are a worthwhile trade-off for top-notch safety. It’s for the “huge boys”—sectors the place reliability is non-negotiable. If nationwide treasuries lastly embrace Bitcoin as the final word digital retailer of worth, it’ll open the door to its true utility because the digital fortress for essentially the most vital items of public infrastructure—its value won’t ever flip again, actually reaching the Moon and even Mars.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.

Learn extra: Will Bitcoin survive the approaching monetary collapse? | Opinion