CleanSpark delivered an excellent monetary quarter, however its market efficiency didn’t replicate the identical energy. This evaluation breaks down key financials, operational insights, and strategic instructions to know the complete image.

CleanSpark Government Overview: Robust Execution Amid Market Ambivalence

The next visitor submit comes from Bitcoinminingstock.io, the one-stop hub for all issues bitcoin mining shares, instructional instruments, and trade insights. Initially printed on Feb. 20, 2025, it was penned by Bitcoinminingstock.io creator Cindy Feng.

Whereas doing analysis for my Bitcoin Mining Annual Report again to Dec 2024, CleanSpark stood out with a number of key metrics, comparable to gross margin, hash fee growth, M&A actions, and fleet upgrades. At the moment, I believed the corporate was positioned for a powerful 12 months forward—assuming Bitcoin’s value continued its upward momentum.

Screenshot from the annual report (co-authored with Nico Smid from Digital Mining Options)

Nevertheless, following CleanSpark’s fiscal Q1 2025 earnings name on February 6, 2025, the corporate’s inventory value remained flat and even declined. This market response raised some questions for me: What numbers stunned traders? Did the corporate present steerage that involved traders? Let’s take a more in-depth take a look at the numbers and break down what is likely to be taking place.

Monetary Highlights: Income & Profitability Surged

CleanSpark’s fiscal Q1 2025 (Oct 1 – Dec 31, 2024) was an excellent quarter financially, demonstrating sturdy income development and robust profitability, pushed by Bitcoin’s value improve and improved operational effectivity.

Key Revenue Assertion Metrics:

- Income: $162.3 million (+120% YoY) vs. $73.8 million in Q1 2024. This was primarily pushed by a rise in Bitcoin value, offset by a decrease variety of Bitcoin mined as a result of halving occasion in April 2024

- Web Revenue: $246.8 million (+854% YoY) vs. $25.9 million in Q1 2024, largely dues to honest worth Bitcoin revaluation.

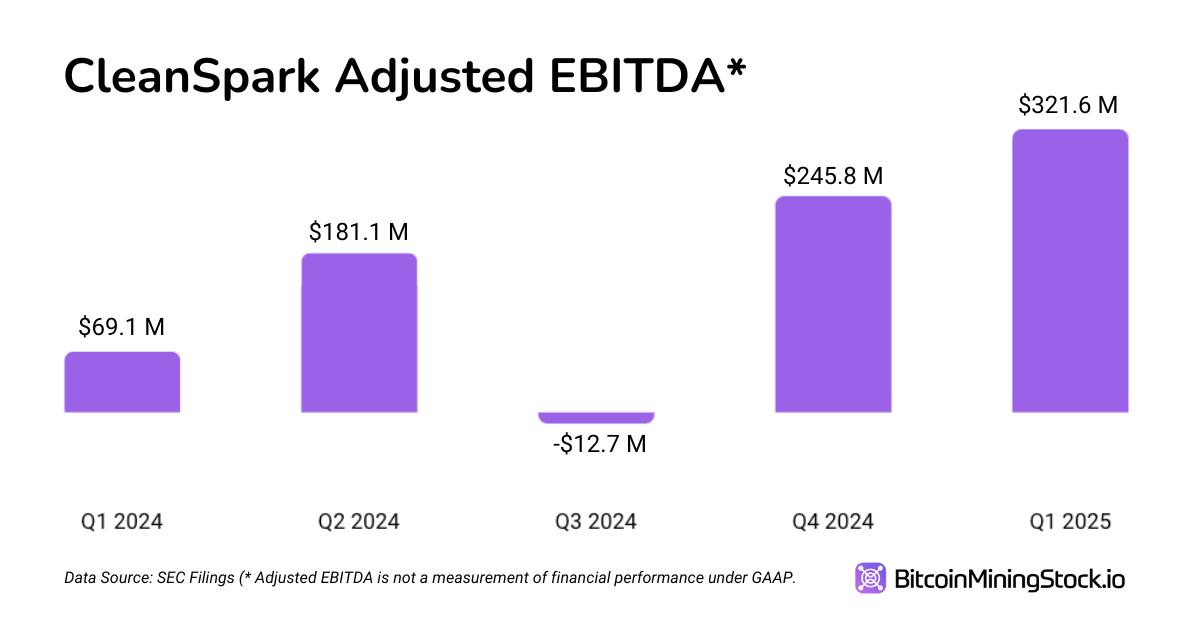

- Adjusted EBITDA: $321.6 million from $69.1 million, setting a brand new document. (*This reported quantity embody $218.2 million honest worth achieve)

- Gross Margin: 57%, barely decrease than 60% YoY on account of elevated operational prices (significantly power prices and mining infrastructure growth)

- Bitcoin Manufacturing: 1,945 BTC, down barely from 2,020 BTC in Q1 2024 as a result of Bitcoin halving occasion in April 2024.

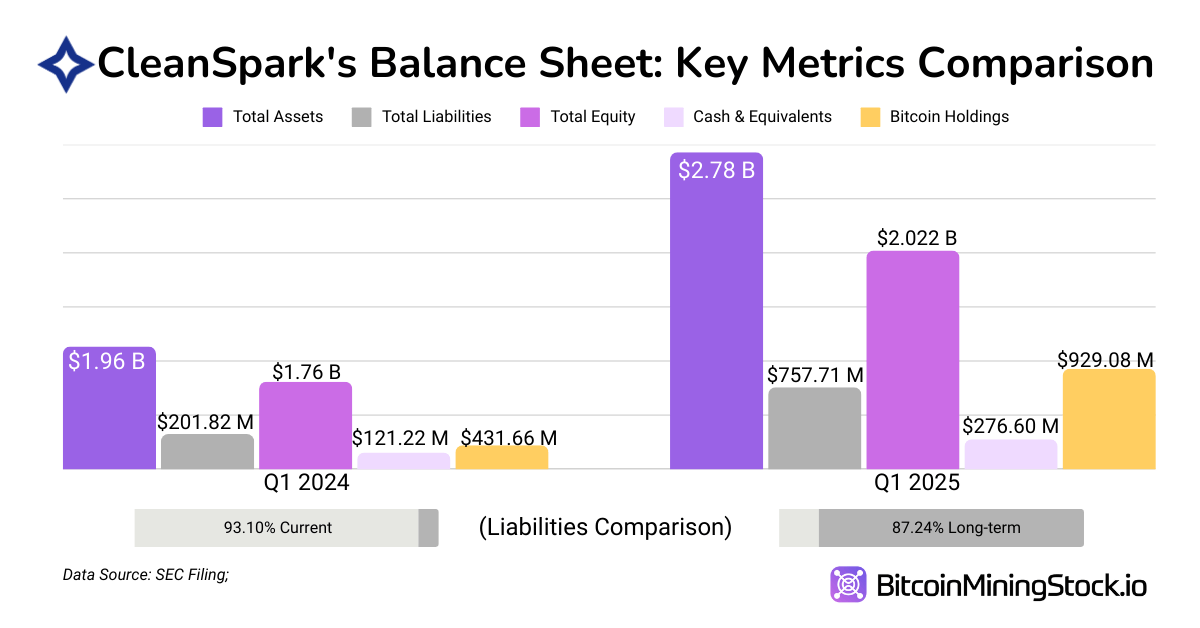

Key Steadiness Sheet Metrics

- Complete Property: $2.78 billion (+41.6% YoY), vs $1.96 billion in Q1 2024. Largely pushed by improve in Bitcoin holdings and knowledge heart expansions & new mining infrastructure.

- Complete Present Liabilities: $96.7 million dropped from $187.9 million, primarily on account of mortgage repayments ($52.2M paid off)

- Lengthy-term Liabilities: $641.4 million (vs $7.2M), primarily on account of new convertible debt issuance

- Stockholders’ Fairness: $2.02 billion (+14.8% YoY), vs $1.76 billion in Q1 2024

- D/E ratio: 0.32 (vs 0.08), indicating that CleanSpark has considerably elevated its leverage over the previous 12 months, by taking over extra debt to fund development.

Key Money Circulation Metrics

- Working Money Circulation: $119.5 million internet money utilized in operations

- Investing Money Circulation: $255.9 million used (together with $126.9 million for brand spanking new miners and $57.4 million for mounted property)

- Financing Money Circulation: $531.1 million inflows (together with $186.8 million in fairness choices +$635.7 million in mortgage proceeds-$145 million treasury inventory repurchases)

- Firm expects money, BTC holdings, and operational money move to be ample for 12+ months, however financing could also be wanted for additional growth

Valuation Metrics & Enterprise Worth

CleanSpark’s market cap at the moment stands at $2.61 billion (Advertising and marketing closing on Dec 31, 2024). To raised perceive its valuation, I compiled a number of key monetary metrics:

- Enterprise Worth (EV): $2.16 billion (Market Cap + Debt – Money & Bitcoin Holdings).

- EV/EBITDA Ratio: 6.71x ($2.16B / $321.6M), which is comparatively low for a high-growth Bitcoin miner.

- P/E Ratio: 10.57x ($2.61B / $246.8M), suggesting the corporate is buying and selling at a reduction in comparison with tech development shares.

- BTC Holding as % of Market Cap: 35.6%, which means greater than one-third of its valuation is backed by Bitcoin holdings alone.

I’ll come again and examine with different miners, who’ve the same operational scale, as soon as knowledge turns into accessible.

Operational Metrics: Hash Fee Development & Effectivity Enchancment

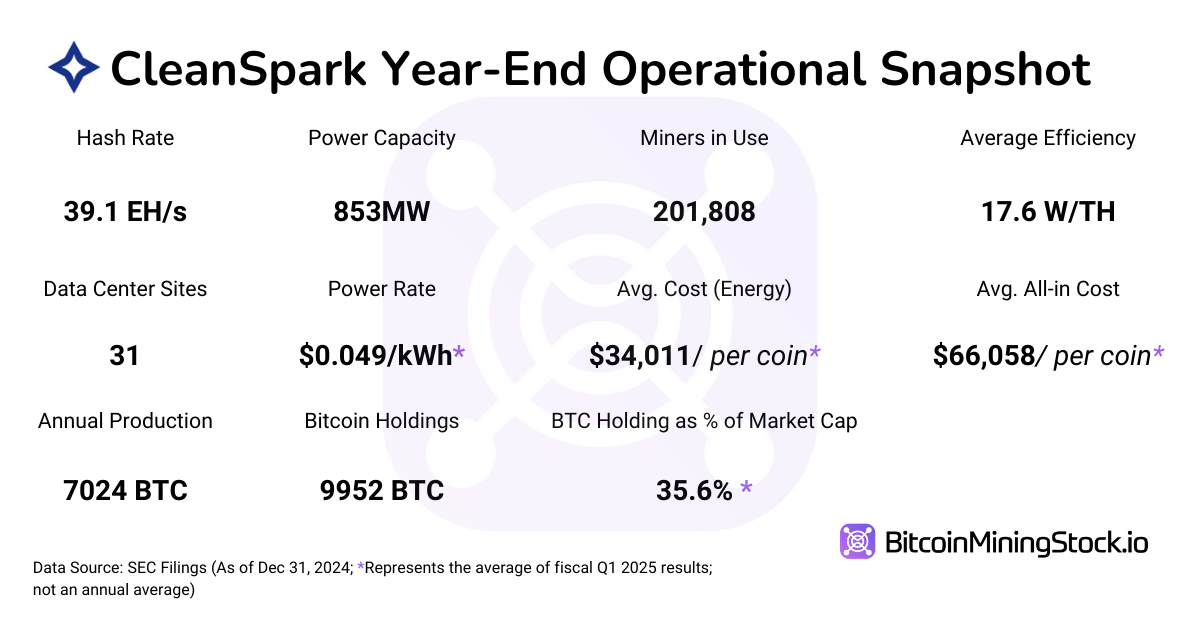

Key Hash Fee & Effectivity Metrics:

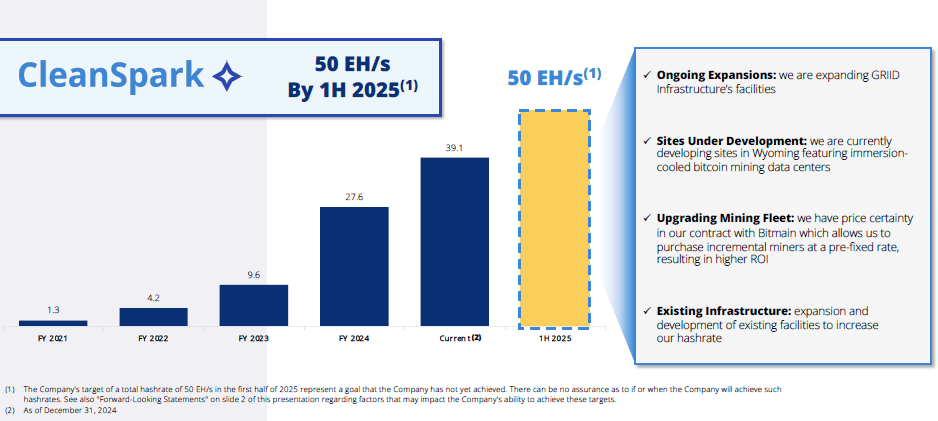

- Hash Fee: 39.1 EH/s (4.87% of world hashrate), a 4x improve YoY (10.0 EH/s in Q1 2024).

- Working miners: 201,808 in operation, up from 88,559 YoY.

- Common Effectivity: 17.6 W/TH, improved from 26.4 W/TH YoY.

- Bitcoin Manufacturing Price (Direct Vitality Price Per BTC at owned Facility):$34,011, up from $12,808 YoY.

- Complete Price Per BTC (Together with Depreciation & Financing): $66,058, up from $24,429 YoY.

Vitality Price Evaluation & Mitigation Methods

- Energy fee: $0.049/KWh (vs. $0.044/KWh YoY).

- 40.4% of Bitcoin income is used for power prices, up from 35% YoY.

- Hurricane Helene led to short-term operational curtailments, lowering effectivity.

- Vitality Mitigation Methods:

- Diversified Geographic Growth: New websites in Wyoming, Tennessee, and Georgia with decrease energy charges.

- Excessive-Effectivity Mining Rigs: Deployment of S21 XT immersion items for decrease energy draw.

- Versatile Energy Contracts: Agreements to optimize power utilization and value however stays uncovered to cost volatility

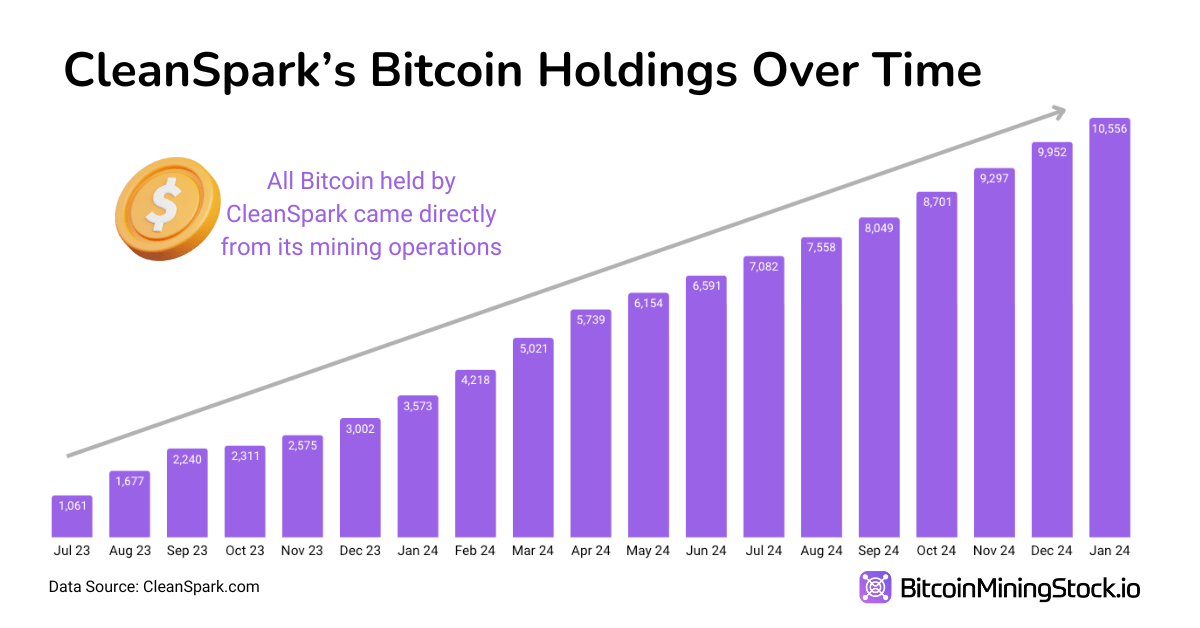

Bitcoin Holding & Treasury Technique: HODL Over Promote

BTC Treasury:

- Complete Bitcoin Held: 9,952 BTC (valued at $929 million; up from 6,819 BTC in contrast with the earlier quarter).

- 99% of BTC in chilly storage, 1% in sizzling wallets.

- BTC Offered Throughout the Quarter: 3,413 BTC ($3.4 million value) in comparison with 43,300 BTC ($43.3 million) in Q1 2024

- BTC Used as Collateral (to the Coinbase): $8.86 million transferred, $129.18 million retrieved from collateral accounts.

- Funding Operations: Relied on exterior financing ($635.7M convertible debt) as a substitute of BTC gross sales.

- No BTC Lending or Yield Methods Reported.

Growth & M&A: Scaling Up for 50 EH/s

Development & Growth Plans:

- Objective: 50 EH/s by mid-2025, with potential growth to 60 EH/s.

- New Mining Websites Acquired:

- Tennessee Web site: $29.9M funding.

- Mississippi Web site: $3M funding, plus $2.9M for infrastructure.

- Fleet Development:

- 60,000 S21 miners secured, with an choice to purchase 100,000 extra at $21.50/TH, 37% beneath market value.

- 285,098 whole miners owned, with ~83,290 pending deployment.

CleanSpark’s Hash Fee Development Roadmap (screenshot from the corporate presentation)

Ideas: The Large Image & Key Concerns

By taking a look at numbers from the monetary report, I nonetheless imagine CleanSpark holds a powerful place within the Bitcoin mining sector. The corporate positions itself as a premier American Bitcoin miner, which may grow to be much more advantageous below the present U.S. administration.

Nevertheless, my essential concern stays Bitcoin’s value motion. Traditionally, CleanSpark’s inventory value is tightly correlated with BTC efficiency. If Bitcoin surges, CleanSpark can grow to be extra engaging; but when BTC stagnates or dips, CLSK might face huge sell-offs.

One other key issue to contemplate is how CleanSpark manages income throughout completely different market cycles. Not like friends diversifying into AI/HPC, CleanSpark stays dedicated to Bitcoin mining. Its CEO stays skeptical of HPC, statingthat “ repurposing a Bitcoin mining facility for high-performance computing is much extra advanced than it could seem”, and reinforcing CleanSpark’s long-term concentrate on Bitcoin as an environment friendly, confirmed, and scalable enterprise mannequin. This means the corporate is unlikely to pivot like its friends any time quickly.

That mentioned, the corporate might discover methods to leverage its BTC holdings strategically—maybe by means of treasury methods that reduce counterparty dangers whereas enhancing monetary flexibility.

Finally, CleanSpark boasts one of many largest mining operations, high vary effectivity, disciplined capital administration and wonderful executions (exceeded their annual hash fee goal), and bold growth plans. I at the moment see no sturdy motive to be bearish on CleanSpark so long as Bitcoin mining stays a viable trade.

Even when we speak in regards to the present trending Bitcoin Treasury Technique, Cleanspark generally is a compelling funding alternative. As compared with Technique (MSTR)- essentially the most well-known advocate of this technique, CleanSpark holds a essential benefit: they will acquire Bitcoin at a considerably lower cost (all-in price: $66,058 per coin) by mining. As individuals say “If you happen to can mine at a lower cost, why purchase?”