Digital asset inflows hit over $2 billion final week, fueled by Trump inauguration enthusiasm, with whole property underneath administration reaching greater than $170 billion.

Crypto funding merchandise noticed inflows of $2.2 billion final week, based on information from European various asset supervisor CoinShares. In a weblog submit on Jan. 20, James Butterfill, head of analysis at CoinShares mentioned the newest growth marks the biggest weekly inflows up to now in 2025, attributing the surge to the Trump inauguration euphoria.

Complete property underneath administration hit $171 billion, reaching an all-time excessive, Butterfill revealed, including that buying and selling volumes on exchange-traded merchandise had been additionally excessive, hitting $21 billion final week, accounting for 34% of bitcoin buying and selling volumes on trusted exchanges.

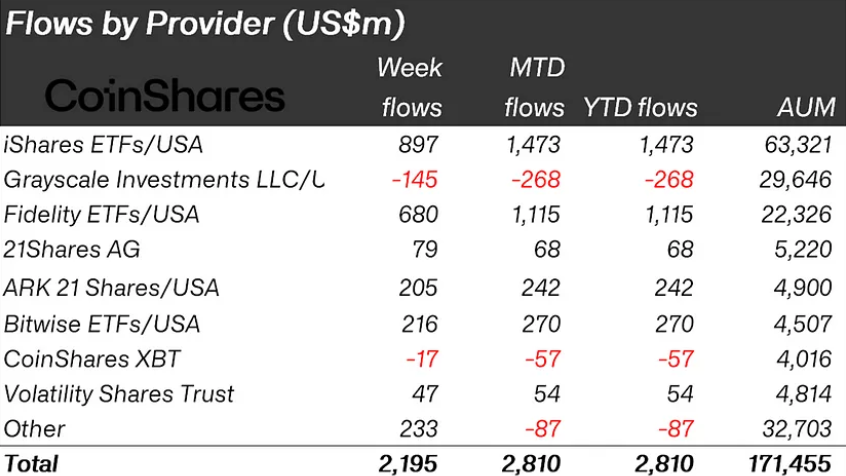

Crypto asset flows by ETF supplier | Supply: CoinShares

You may additionally like: Digital asset funding merchandise attain document $44.2b in 2024, CoinShares says

Bitcoin (BTC), as with earlier instances, led the inflows, bringing in $1.9 billion. Yr-to-date inflows for BTC now stand at $2.7 billion, CoinShares says, noting that “unusually, regardless of the current worth rises, we now have seen minor outflows from short-positions.”

Ethereum (ETH) had inflows of $246 million, reversing earlier outflows this yr. XRP (XRP) additionally noticed $31 million in inflows final week, pushing its whole since mid-November to $484 million. Smaller inflows had been recorded for Stellar (XLM), with $2.1 million, whereas different altcoins noticed little exercise.

The U.S. dominated inflows regionally, pulling in $2 billion. Switzerland and Canada additionally contributed with $89 million and $13 million, respectively. CoinShares notes that Ethereum stays the “poorest performer from a circulation perspective up to now this yr,” regardless of final week’s positive factors, whereas Solana’s (SOL) inflows had been a modest $2.5 million.

Learn extra: Macroeconomic information as soon as once more ‘key driver’ of crypto costs, CoinShares says