Over the previous 30 days, information reveals the stablecoin market added $7.719 billion to its valuation in February, marking a gentle but vital growth. Dominating this development was USDS, which noticed its circulating provide leap by 63.68% from the month’s inception—a determine eclipsing all friends.

February’s Stablecoin Development Sees a $7.719 Billion Rise

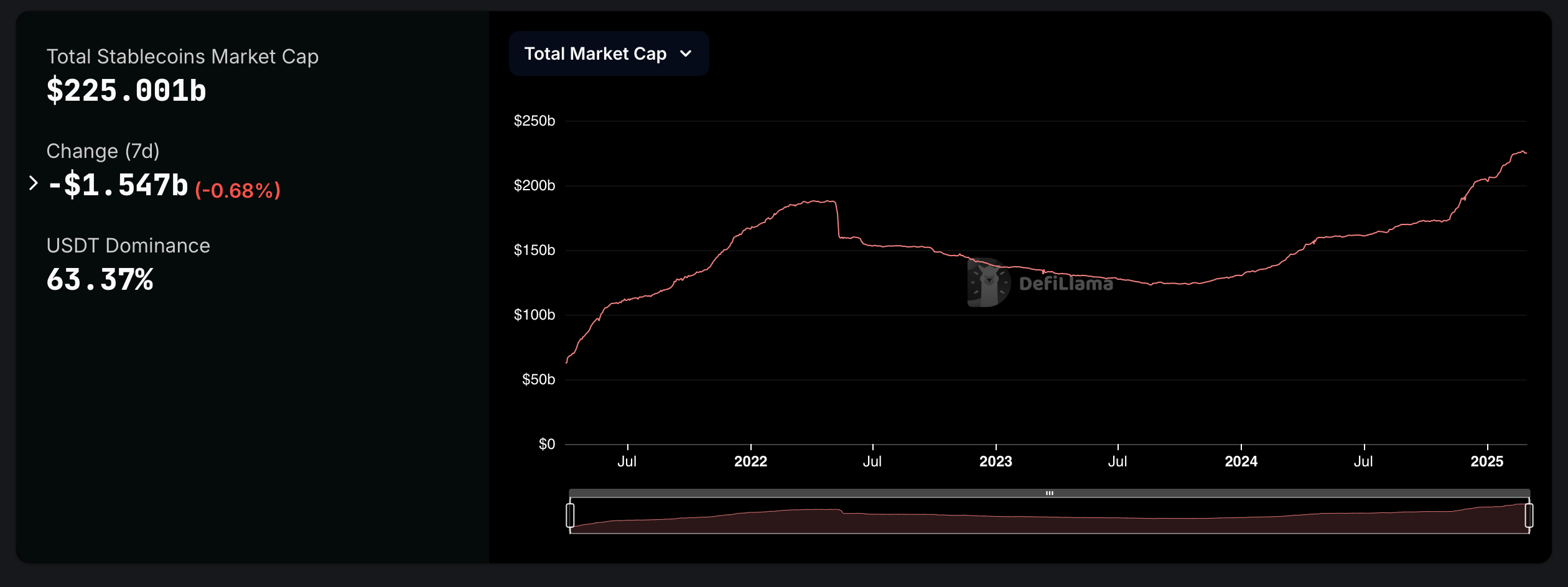

Amid a widespread contraction in cryptocurrency valuations this month, defillama.com information reveals the fiat-anchored digital asset financial system persists in its upward trajectory. Tether (USDT) stays the main entity inside this sphere, commanding a valuation of $142.579 billion—a determine representing 63.37% of the mixture $225 billion stablecoin area. USDT’s provide expanded by $2.5 billion since Jan. 31, demonstrating its sustained momentum within the digital foreign money area.

Supply: Defillama stablecoin overview.

Circle’s USDC mirrored this development, attaining a 7.33% escalation over the previous 30 days—translating to a $3.85 billion amplification. Conversely, Ethena’s USDe, the third-largest stablecoin, skilled a $154.87 million contraction, eroding 2.63% of its circulating reserves. USDC instructions a market valuation of $56.422 billion, whereas USDe claims a valuation of $5.72 billion.

DAI confronted amplified outflows, shedding $356 million this month, with its market capitalization resting at $4.34 billion. Contrastingly, Sky’s USDS accrued a $1.653 billion enhance, hovering by 63.68% since Jan. 31. USDS’s valuation now settles at $4.248 billion. Notably, Paypal’s PYUSD expanded by 49.32% over the previous 30 days, with its market capitalization stabilized close to $753.61 million following an inflow of $248.9 million.

February’s stablecoin dynamics reveal a market outlined by divergent methods. Established giants anchor confidence, whereas newer entrants vie for relevance via volatility-driven alternatives. This friction between stability and speculative ambition reveals an evolving ecosystem the place the crypto market tides change the sport. Such shifts trace at broader recalibrations in digital finance, as individuals navigate liquidity preferences and aggressive differentiation in a maturing sector.