Crypto whales offered MOG, PEPE, and TURBO all through early February, following a broader development of enormous holders lowering their publicity to meme cash. Whereas MOG has seen essentially the most aggressive promoting, PEPE and TURBO have additionally skilled a gradual decline in whale addresses, signaling weaker confidence amongst main buyers.

Though the variety of massive holders has barely recovered, the general development stays bearish, with distribution outweighing accumulation. If this sample continues, these tokens may face extra promoting stress, making it more durable for them to regain sturdy bullish momentum.

MOG Coin (MOG)

Whales offered the MOG meme coin persistently for a number of months, with this promoting stress accelerating firstly of February. Massive holders lowering their positions can sign a shift in sentiment, as whale exercise usually impacts value motion and liquidity.

When whales promote in massive portions, they improve the availability available in the market, doubtlessly making it more durable for MOG to maintain upward momentum.

The continuing decline in whale addresses means that confidence amongst main buyers has weakened, elevating issues about continued promoting stress.

Variety of Addresses Holding at Least 100,000,000 MOG. Supply: Santiment.

Though the variety of whales holding at the least 100,000,000 MOG just lately recovered – rising from 10,089 on February 6 to 10,127 – this quantity stays traditionally low.

It’s nonetheless effectively under the ten,457 recorded on January 30, which means that regardless of the slight rebound, whales offered a major quantity of MOG over the previous few weeks.

This means that the broader development stays one in every of distribution somewhat than accumulation. Except whale exercise shifts towards sustained shopping for, MOG could proceed going through challenges in constructing sturdy bullish momentum.

PEPE

Like MOG, whales offered PEPE all through early February, although the promoting stress has been much less intense. Whereas massive holders lowering their positions can point out weakening confidence, PEPE whales haven’t offloaded their holdings on the similar tempo as MOG whales.

Nonetheless, when whales promote, it will increase provide available in the market, doubtlessly limiting upward value motion. The decline in whale addresses means that some massive buyers have been taking earnings or lowering publicity, which may contribute to short-term volatility.

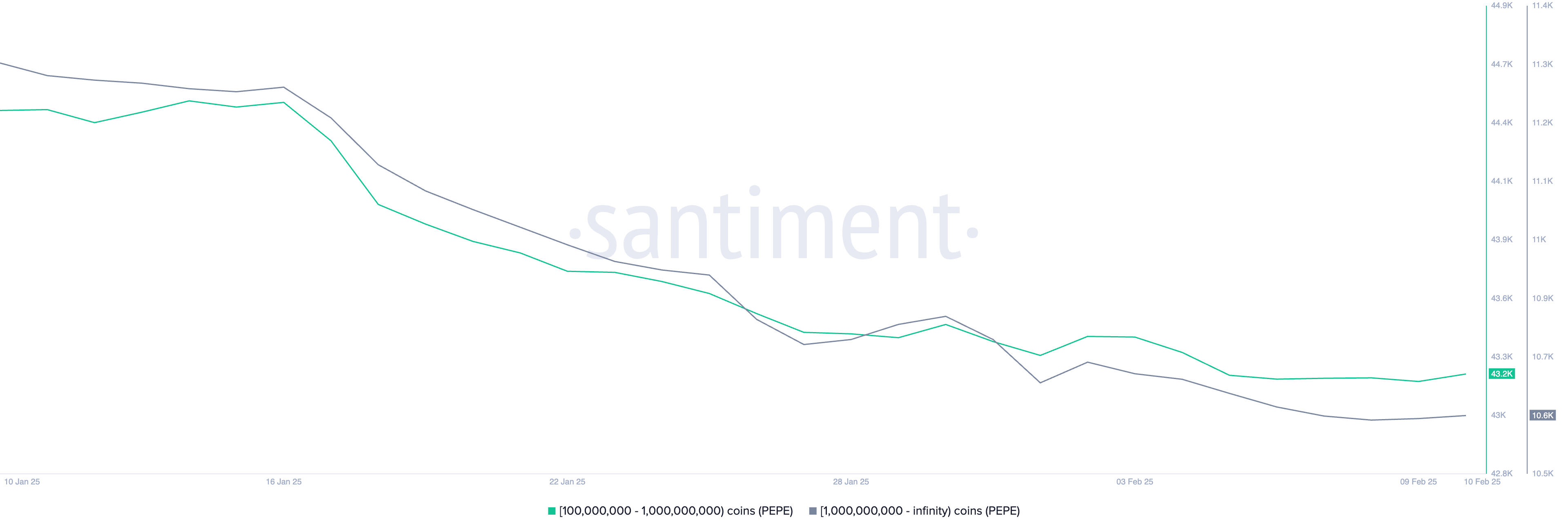

Variety of Addresses Holding at Least 100,000,000 PEPE. Supply: Santiment.

On January 30, the variety of addresses holding at the least 100,000,000 PEPE stood at 54,383 earlier than declining as February started, reaching 53,927 on February 8—its lowest stage since March 2024. Though there was a slight restoration to 53,954, the general development stays downward, which means whales offered a notable quantity of PEPE in current weeks.

Whereas this promoting stress will not be as aggressive as MOG’s, it nonetheless signifies hesitation amongst massive buyers. If whale promoting continues, it may put additional stress on PEPE value, making it more durable for the token to maintain bullish momentum.

TURBO

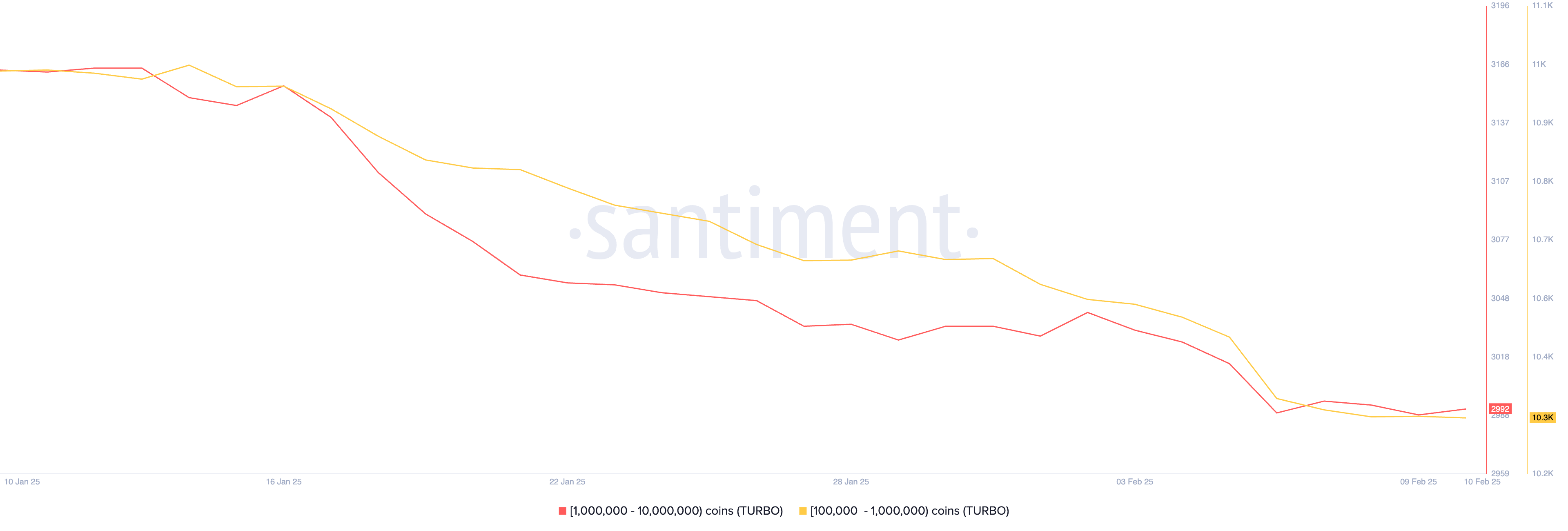

Crypto whales additionally offered TURBO within the first days of February, following the identical sample seen in different meme cash like MOG and PEPE. On January 30, the variety of addresses holding between 100,000 and 10,000,000 TURBO was at 13,706, however as February started, that quantity declined to 13,404.

Variety of Addresses Holding Between 100,000 and 10,000,000 TURBO. Supply: Santiment.

It has since dropped additional to 13,370, indicating that enormous holders proceed to scale back their positions.

The continuing decline in whale addresses factors to continued distribution somewhat than accumulation, which may result in elevated volatility for TURBO. Whereas the drop has been regular somewhat than aggressive, the truth that whales offered over the previous few weeks alerts hesitation available in the market.