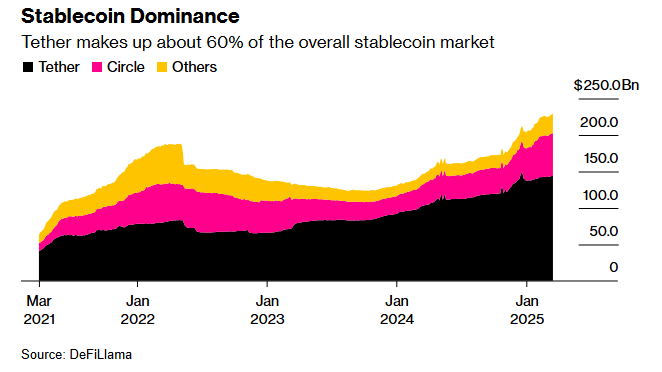

Stablecoin market capitalization has elevated by 90% since late 2023, exceeding $230 billion. These digital tokens keep a gradual worth by being backed by reserves.

Whereas their rising use in worldwide transactions strengthens the US greenback’s place because the dominant world foreign money, critics warn that stablecoins may additionally introduce systemic dangers paying homage to previous monetary crises.

Stablecoins and the Danger of a New Monetary Disaster

Throughout market turmoil, stablecoin holders might rush to redeem their tokens for money, forcing issuers to promote quickly off their reserve belongings. This might create instability in monetary markets.

The identical occurred in 2008. Then, the Reserve Main Fund, a significant money-market fund (MMF), broke its greenback peg resulting from publicity to Lehman Brothers’ collapsed debt. That occasion triggered widespread panic and a broader run on MMFs, disrupting the worldwide monetary system.

In line with Federal Reserve Governor Lisa D. Cook dinner, the identical dangers may apply to stablecoins.

“If a run on a big stablecoin have been to happen, liquidation of the belongings backing the stablecoin could possibly be disruptive, particularly if these belongings have been linked to different funding markets,” she stated at a current monetary convention.

Lawmakers are actually pushing to manage stablecoins by means of legislative efforts just like the GENIUS Act and the STABLE Act. These payments intention to combine stablecoins into the monetary system. Issuers have to be licensed and again their tokens with accepted belongings corresponding to money, US Treasury payments, and MMFs to do that.

Nonetheless, critics argue that the GENIUS Act lacks key safeguards to forestall monetary instability. Senator Elizabeth Warren has been notably vocal, warning that the invoice would enable stablecoin issuers to put money into dangerous belongings.

“Below this invoice, stablecoin issuers can put money into the very belongings that have been bailed out in 2008. Anybody who thinks the US taxpayer gained’t be referred to as on to bail these guys out is kidding themselves,” Bloomberg reported, citing Warren’s speech throughout a current Senate listening to.

China, EU Push Again In opposition to US Greenback Dominance in Stablecoins

Whereas the dangers are clear, stablecoins have additionally been instrumental in reinforcing the US greenback’s dominance. Vital world stablecoin transactions happen in dollar-backed tokens like Tether (USDT) and USD Coin (USDC).

This widespread adoption enhances the greenback’s position in worldwide commerce, rising demand for US belongings. China, nonetheless, has expressed issues that the US’s rising affect in digital currencies may undermine its monetary sovereignty.

“As soon as the US greenback stablecoin hyperlinks the worldwide credit score of the US greenback with the appliance situations of the digital world extra intently, it could tremendously consolidate the hegemony of the US greenback,” stated Zhang Ming, a Chinese language economist.

In opposition to this backdrop, Beijing has accelerated its growth of the digital yuan. That is meant to scale back dependence on dollar-based stablecoins in cross-border transactions. The European Union shares the identical sentiment.

The stablecoin trade can be dealing with disruption from conventional monetary establishments. Main banks, together with Financial institution of America, are reportedly exploring their stablecoin choices. This follows current regulatory developments that enable US banks to offer crypto and stablecoin companies.

This new competitors may erode the market dominance of personal issuers like Tether and Circle. Nonetheless, it may additionally combine stablecoins extra deeply into the mainstream monetary system.

USDT and USDC Stablecoin Dominance. Supply: DefiLlama

As stablecoins increase, their impression on the monetary system grows extra important. On the one hand, they provide advantages corresponding to elevated cost effectivity and cross-border transactions. However, their potential to set off monetary instability can’t be ignored.

Policymakers and monetary establishments should tread fastidiously, making certain regulatory frameworks promote innovation whereas mitigating dangers.

The teachings of 2008 are a stark reminder that even seemingly steady monetary devices can unravel with alarming pace.