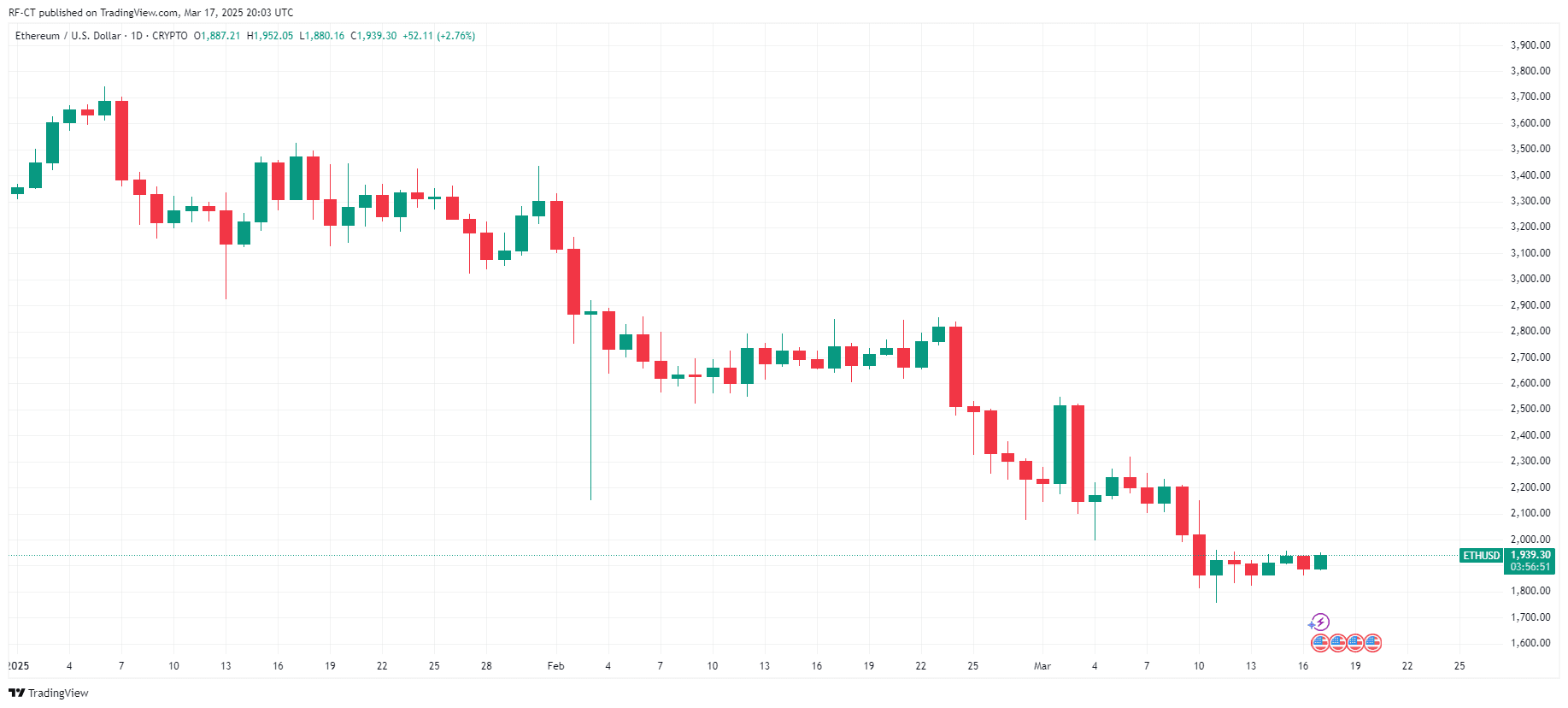

As of immediately, Ethereum value is buying and selling at roughly $1,900, reflecting a slight improve over the previous 24 hours. With the extremely anticipated FOMC assembly taking place in 2 days, Ethereum’s value might expertise important volatility. Will the Federal Reserve’s choice push ETH under $1,000, or will it maintain present ranges? Here is an Ethereum value prediction on what to anticipate.

Ethereum Worth Prediction Forward of the FOMC Assembly

1- Present Ethereum Worth Traits

Ethereum’s community exercise has been on a decline, with every day lively addresses and new pockets creations hitting yearly lows. This lower in on-chain engagement has led to diminished transaction charges and elevated inflationary pressures, including to bearish sentiment out there.

Analysts warn that if Ethereum’s value dips under the $1,900 help degree, it might set off liquidation from long-term holders, accelerating additional value declines. The crucial help vary between $1,900 and $1,843 is below shut watch, particularly because the FOMC assembly looms. The end result of this assembly might dictate whether or not Ethereum maintains its place or faces a steep decline.

By TradingView – ETHUSD_2025-03-17 (YTD)

2- FOMC Assembly’s Potential Impression on Ethereum Worth

The Federal Open Market Committee (FOMC) assembly is predicted to ship key insights into U.S. financial coverage, significantly regarding rates of interest and inflation management. A hawkish stance might strengthen the U.S. greenback, resulting in downward stress on threat belongings like Ethereum. Conversely, a dovish strategy would possibly ease market fears, permitting ETH to carry and even get better.

Market contributors are intently watching the Federal Reserve’s tone, as stricter insurance policies might result in broader crypto market corrections. Ethereum’s value motion within the coming days will closely rely upon these macroeconomic indicators.

3- Revised Ethereum Worth Prediction

Normal Chartered lately revised its Ethereum value goal for 2025 from $10,000 to $4,000, citing elevated competitors from Layer-2 options like Coinbase’s Base. Nonetheless, these predictions might shift dramatically primarily based on the upcoming FOMC choice. If stricter insurance policies are introduced, bearish situations might dominate, doubtlessly pushing ETH towards decrease help ranges.

Will ETH Worth Crash under $1K?

Ethereum’s value is at a pivotal level. The upcoming FOMC assembly might decide whether or not ETH sustains its value above the $1,900 mark or dangers a deeper fall. If bearish sentiment prevails post-meeting, Ethereum might check decrease helps, elevating considerations of a possible drop under $1,000. Nonetheless, a good end result might strengthen investor confidence and maintain ETH above crucial ranges.

Traders are suggested to remain cautious and intently monitor the FOMC’s bulletins and Ethereum’s subsequent value reactions. Technical ranges and macroeconomic indicators will likely be key in figuring out ETH’s short-term trajectory.